Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Ryan Company is considering whether to invest in a piece of equipment that has a cost of $500,000 today. - The equipment will provide

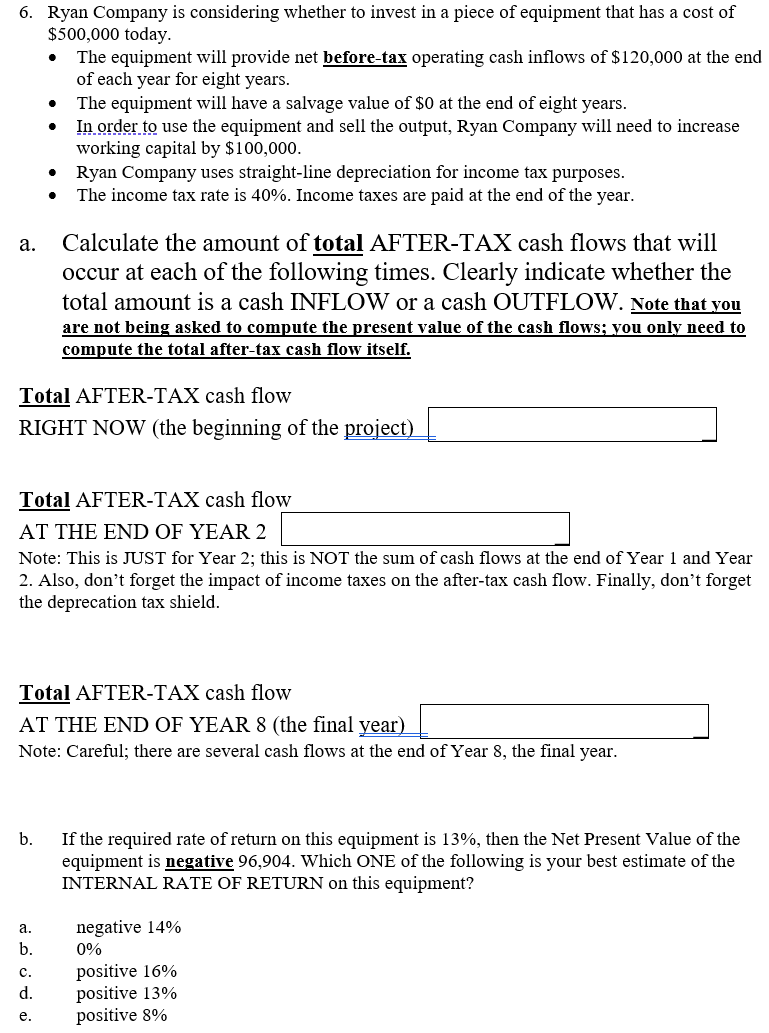

6. Ryan Company is considering whether to invest in a piece of equipment that has a cost of $500,000 today. - The equipment will provide net before-tax operating cash inflows of $120,000 at the end of each year for eight years. - The equipment will have a salvage value of $0 at the end of eight years. - In order to use the equipment and sell the output, Ryan Company will need to increase working capital by $100,000. - Ryan Company uses straight-line depreciation for income tax purposes. - The income tax rate is 40%. Income taxes are paid at the end of the year. a. Calculate the amount of total AFTER-TAX cash flows that will occur at each of the following times. Clearly indicate whether the total amount is a cash INFLOW or a cash OUTFLOW. Note that you are not being asked to compute the present value of the cash flows; you only need to compute the total after-tax cash flow itself. Total AFTER-TAX cash flow RIGHT NOW (the beginning of the project) Total AFTER-TAX cash flow AT THE END OF YEAR 2 Note: This is JUST for Year 2; this is NOT the sum of cash flows at the end of Year 1 and Year 2. Also, don't forget the impact of income taxes on the after-tax cash flow. Finally, don't forget the deprecation tax shield. Total AFTER-TAX cash flow AT THE END OF YEAR 8 (the final year) Note: Careful; there are several cash flows at the end of Year 8, the final year. b. If the required rate of return on this equipment is 13%, then the Net Present Value of the equipment is negative 96,904 . Which ONE of the following is your best estimate of the INTERNAL RATE OF RETURN on this equipment? a. negative 14% b. 0% c. positive 16% d. positive 13% e. positive 8% 6. Ryan Company is considering whether to invest in a piece of equipment that has a cost of $500,000 today. - The equipment will provide net before-tax operating cash inflows of $120,000 at the end of each year for eight years. - The equipment will have a salvage value of $0 at the end of eight years. - In order to use the equipment and sell the output, Ryan Company will need to increase working capital by $100,000. - Ryan Company uses straight-line depreciation for income tax purposes. - The income tax rate is 40%. Income taxes are paid at the end of the year. a. Calculate the amount of total AFTER-TAX cash flows that will occur at each of the following times. Clearly indicate whether the total amount is a cash INFLOW or a cash OUTFLOW. Note that you are not being asked to compute the present value of the cash flows; you only need to compute the total after-tax cash flow itself. Total AFTER-TAX cash flow RIGHT NOW (the beginning of the project) Total AFTER-TAX cash flow AT THE END OF YEAR 2 Note: This is JUST for Year 2; this is NOT the sum of cash flows at the end of Year 1 and Year 2. Also, don't forget the impact of income taxes on the after-tax cash flow. Finally, don't forget the deprecation tax shield. Total AFTER-TAX cash flow AT THE END OF YEAR 8 (the final year) Note: Careful; there are several cash flows at the end of Year 8, the final year. b. If the required rate of return on this equipment is 13%, then the Net Present Value of the equipment is negative 96,904 . Which ONE of the following is your best estimate of the INTERNAL RATE OF RETURN on this equipment? a. negative 14% b. 0% c. positive 16% d. positive 13% e. positive 8%

6. Ryan Company is considering whether to invest in a piece of equipment that has a cost of $500,000 today. - The equipment will provide net before-tax operating cash inflows of $120,000 at the end of each year for eight years. - The equipment will have a salvage value of $0 at the end of eight years. - In order to use the equipment and sell the output, Ryan Company will need to increase working capital by $100,000. - Ryan Company uses straight-line depreciation for income tax purposes. - The income tax rate is 40%. Income taxes are paid at the end of the year. a. Calculate the amount of total AFTER-TAX cash flows that will occur at each of the following times. Clearly indicate whether the total amount is a cash INFLOW or a cash OUTFLOW. Note that you are not being asked to compute the present value of the cash flows; you only need to compute the total after-tax cash flow itself. Total AFTER-TAX cash flow RIGHT NOW (the beginning of the project) Total AFTER-TAX cash flow AT THE END OF YEAR 2 Note: This is JUST for Year 2; this is NOT the sum of cash flows at the end of Year 1 and Year 2. Also, don't forget the impact of income taxes on the after-tax cash flow. Finally, don't forget the deprecation tax shield. Total AFTER-TAX cash flow AT THE END OF YEAR 8 (the final year) Note: Careful; there are several cash flows at the end of Year 8, the final year. b. If the required rate of return on this equipment is 13%, then the Net Present Value of the equipment is negative 96,904 . Which ONE of the following is your best estimate of the INTERNAL RATE OF RETURN on this equipment? a. negative 14% b. 0% c. positive 16% d. positive 13% e. positive 8% 6. Ryan Company is considering whether to invest in a piece of equipment that has a cost of $500,000 today. - The equipment will provide net before-tax operating cash inflows of $120,000 at the end of each year for eight years. - The equipment will have a salvage value of $0 at the end of eight years. - In order to use the equipment and sell the output, Ryan Company will need to increase working capital by $100,000. - Ryan Company uses straight-line depreciation for income tax purposes. - The income tax rate is 40%. Income taxes are paid at the end of the year. a. Calculate the amount of total AFTER-TAX cash flows that will occur at each of the following times. Clearly indicate whether the total amount is a cash INFLOW or a cash OUTFLOW. Note that you are not being asked to compute the present value of the cash flows; you only need to compute the total after-tax cash flow itself. Total AFTER-TAX cash flow RIGHT NOW (the beginning of the project) Total AFTER-TAX cash flow AT THE END OF YEAR 2 Note: This is JUST for Year 2; this is NOT the sum of cash flows at the end of Year 1 and Year 2. Also, don't forget the impact of income taxes on the after-tax cash flow. Finally, don't forget the deprecation tax shield. Total AFTER-TAX cash flow AT THE END OF YEAR 8 (the final year) Note: Careful; there are several cash flows at the end of Year 8, the final year. b. If the required rate of return on this equipment is 13%, then the Net Present Value of the equipment is negative 96,904 . Which ONE of the following is your best estimate of the INTERNAL RATE OF RETURN on this equipment? a. negative 14% b. 0% c. positive 16% d. positive 13% e. positive 8% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started