Answered step by step

Verified Expert Solution

Question

1 Approved Answer

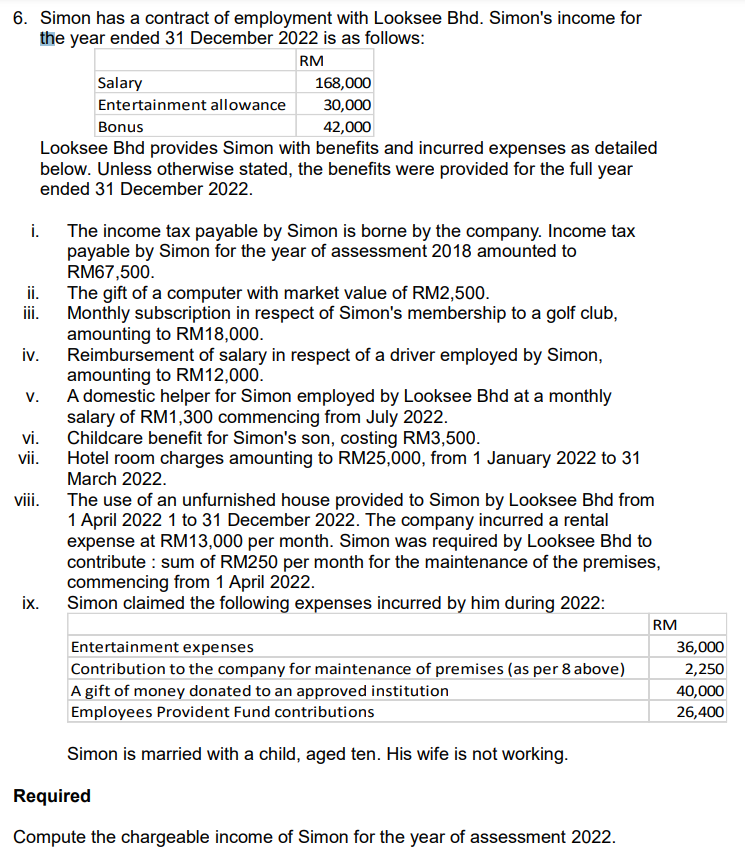

6. Simon has a contract of employment with Looksee Bhd. Simon's income for the year ended 31 December 2022 is as follows: RM Salary

6. Simon has a contract of employment with Looksee Bhd. Simon's income for the year ended 31 December 2022 is as follows: RM Salary 168,000 Entertainment allowance 30,000 42,000 i. ii. iii. iv. V. vi. vii. viii. Bonus Looksee Bhd provides Simon with benefits and incurred expenses as detailed below. Unless otherwise stated, the benefits were provided for the full year ended 31 December 2022. The income tax payable by Simon is borne by the company. Income tax payable by Simon for the year of assessment 2018 amounted to RM67,500. The gift of a computer with market value of RM2,500. Monthly subscription in respect of Simon's membership to a golf club, amounting to RM18,000. Reimbursement of salary in respect of a driver employed by Simon, amounting to RM12,000. A domestic helper for Simon employed by Looksee Bhd at a monthly salary of RM1,300 commencing from July 2022. Childcare benefit for Simon's son, costing RM3,500. Hotel room charges amounting to RM25,000, from 1 January 2022 to 31 March 2022. The use of an unfurnished house provided to Simon by Looksee Bhd from 1 April 2022 1 to 31 December 2022. The company incurred a rental expense at RM13,000 per month. Simon was required by Looksee Bhd to contribute sum of RM250 per month for the maintenance of the premises, commencing from 1 April 2022. ix. Simon claimed the following expenses incurred by him during 2022: RM Entertainment expenses 36,000 Contribution to the company for maintenance of premises (as per 8 above) A gift of money donated to an approved institution Employees Provident Fund contributions 2,250 40,000 26,400 Simon is married with a child, aged ten. His wife is not working. Required Compute the chargeable income of Simon for the year of assessment 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Chargeable Income of Simon for Year of Assessment 2022 Step 1 Calculate Employment Income Sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e796b511fd_881599.pdf

180 KBs PDF File

661e796b511fd_881599.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started