Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Sofie's Splendid Smoothie and Salad Shack: Sofie has spent some time planning a new smoothie and salad place in downtown lowa City. She has

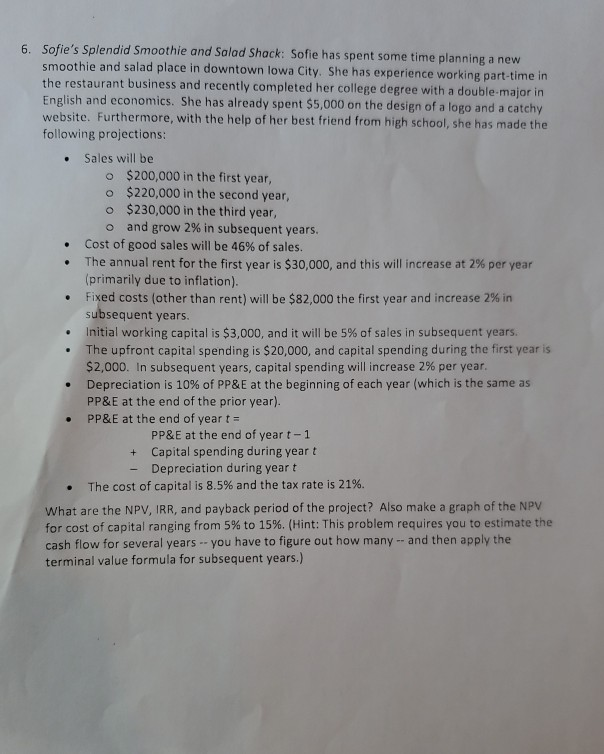

6. Sofie's Splendid Smoothie and Salad Shack: Sofie has spent some time planning a new smoothie and salad place in downtown lowa City. She has experience working part-time in the restaurant business and recently completed her college degree with a double major in English and economics. She has already spent $5,000 on the design of a logo and a catchy website. Furthermore, with the help of her best friend from high school, she has made the following projections: Sales will be o $200,000 in the first year, o $220,000 in the second year, o $230,000 in the third year, o and grow 2% in subsequent years. Cost of good sales will be 46% of sales. The annual rent for the first year is $30,000, and this will increase at 2% per year (primarily due to inflation). Fixed costs (other than rent) will be $82,000 the first year and increase 2% in subsequent years. Initial working capital is $3,000, and it will be 5% of sales in subsequent years. The upfront capital spending is $20,000, and capital spending during the first year is $2,000. In subsequent years, capital spending will increase 2% per year. Depreciation is 10% of PP&E at the beginning of each year (which is the same as PP&E at the end of the prior year). PP&E at the end of year t = PP&E at the end of yeart-1 + Capital spending during yeart - Depreciation during yeart The cost of capital is 8.5% and the tax rate is 21% What are the NPV, IRR, and payback period of the project? Also make a graph of the NPV for cost of capital ranging from 5% to 15%. (Hint: This problem requires you to estimate the cash flow for several years -- you have to figure out how many -- and then apply the terminal value formula for subsequent years.) 6. Sofie's Splendid Smoothie and Salad Shack: Sofie has spent some time planning a new smoothie and salad place in downtown lowa City. She has experience working part-time in the restaurant business and recently completed her college degree with a double major in English and economics. She has already spent $5,000 on the design of a logo and a catchy website. Furthermore, with the help of her best friend from high school, she has made the following projections: Sales will be o $200,000 in the first year, o $220,000 in the second year, o $230,000 in the third year, o and grow 2% in subsequent years. Cost of good sales will be 46% of sales. The annual rent for the first year is $30,000, and this will increase at 2% per year (primarily due to inflation). Fixed costs (other than rent) will be $82,000 the first year and increase 2% in subsequent years. Initial working capital is $3,000, and it will be 5% of sales in subsequent years. The upfront capital spending is $20,000, and capital spending during the first year is $2,000. In subsequent years, capital spending will increase 2% per year. Depreciation is 10% of PP&E at the beginning of each year (which is the same as PP&E at the end of the prior year). PP&E at the end of year t = PP&E at the end of yeart-1 + Capital spending during yeart - Depreciation during yeart The cost of capital is 8.5% and the tax rate is 21% What are the NPV, IRR, and payback period of the project? Also make a graph of the NPV for cost of capital ranging from 5% to 15%. (Hint: This problem requires you to estimate the cash flow for several years -- you have to figure out how many -- and then apply the terminal value formula for subsequent years.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started