Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6 Solar World Exotic Pet Shops, Incorporated reported the following comparative balance sheets and income statement for the current year. (Click the icon to view

6

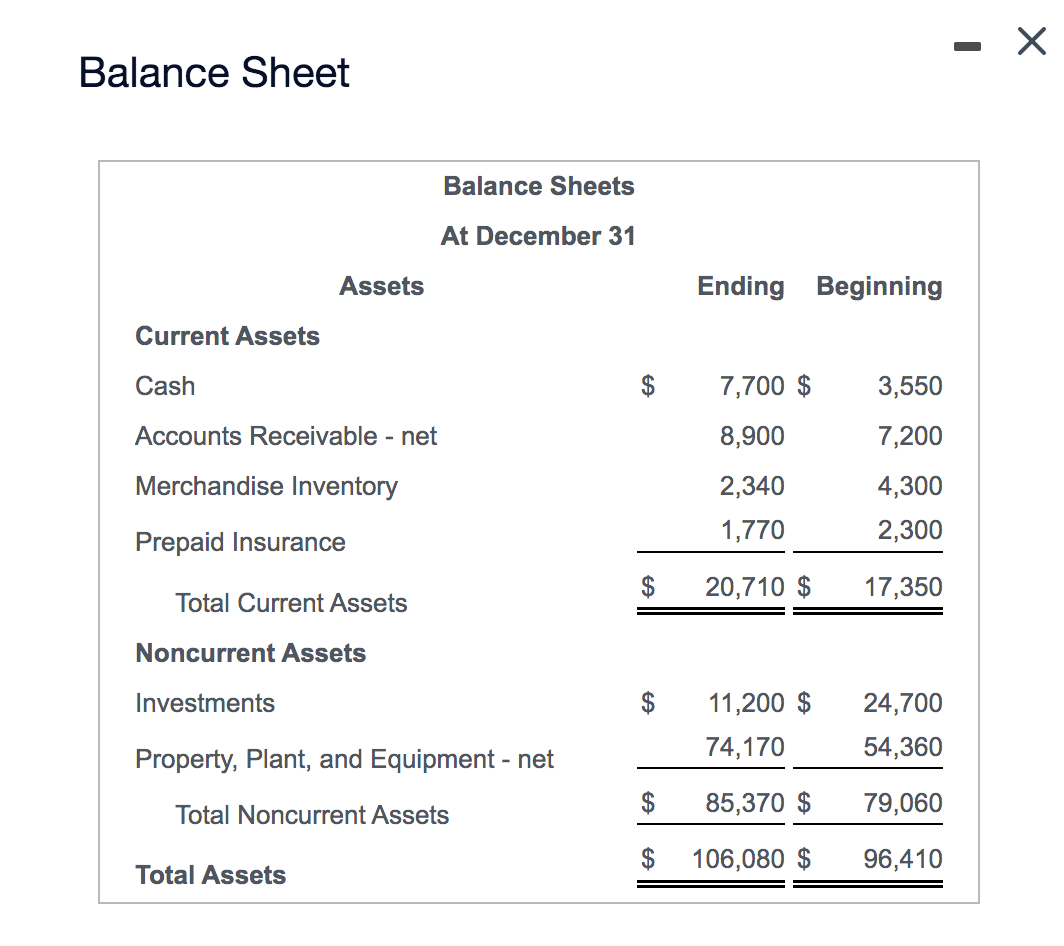

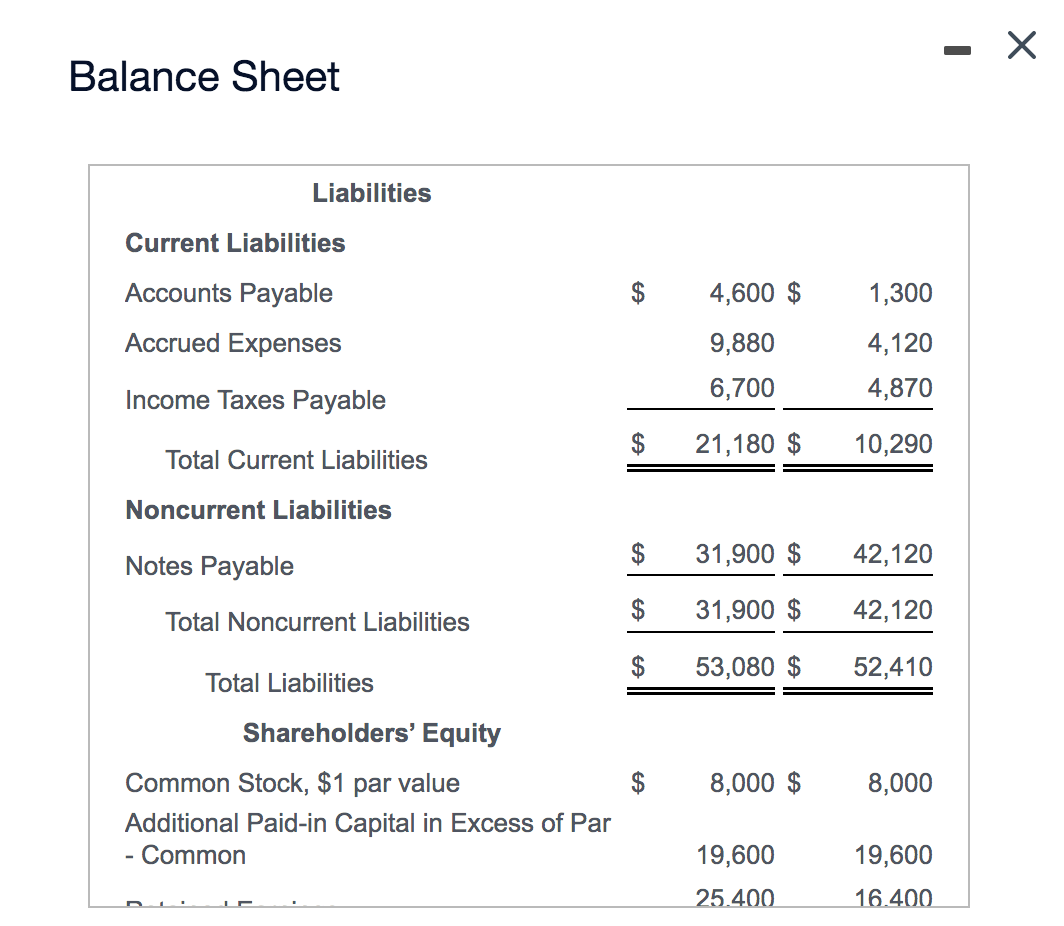

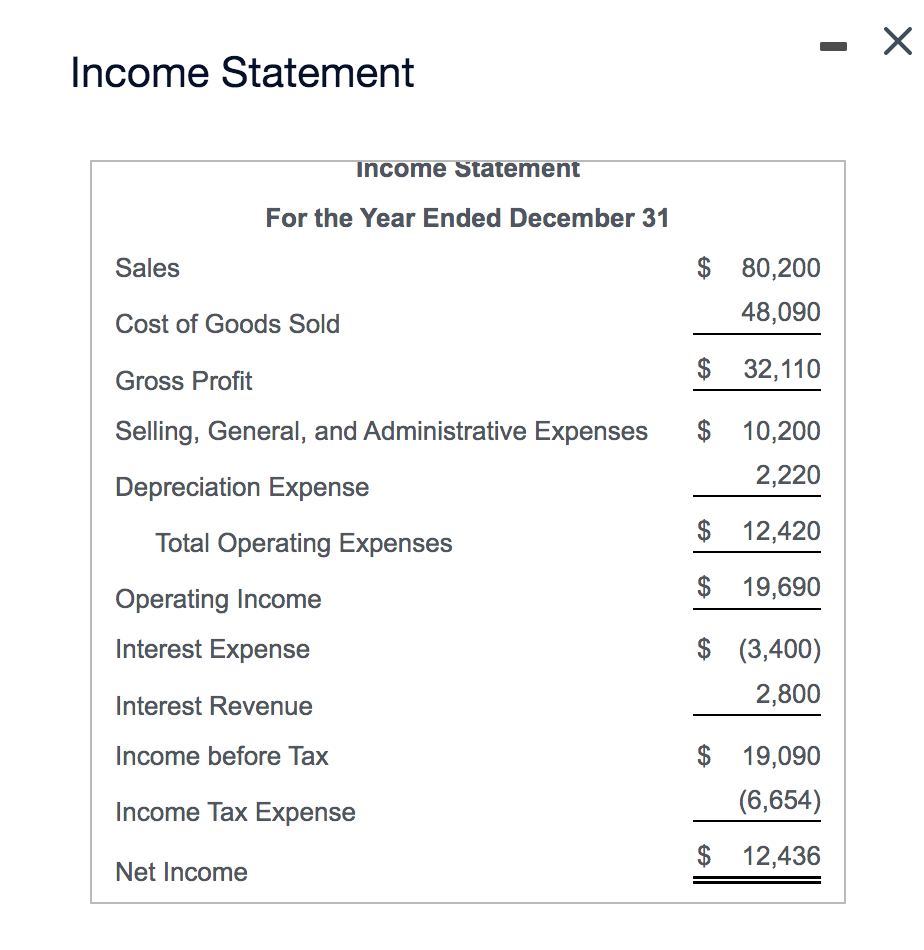

Solar World Exotic Pet Shops, Incorporated reported the following comparative balance sheets and income statement for the current year. (Click the icon to view the balance sheets.) E (Click the icon to view the income statement.) Prepare the operating activities section of the statement of cash flows using the direct method. Assume that accrued expenses relate to selling, general, and administrative expenses. (Assume that all investment income was received in cash. Use a minus sign or parentheses for any cash outflows and/or net cash used by operating activities. If an input field is not used in the statement, leave the field empty; do not select a label or enter a zero.) Partial Statement of Cash Flows (Direct Method) For the Year Ended December 31 Operating Activities: II Net Cash Provided (Used) by Operating Activities Balance Sheet Balance Sheets At December 31 Assets Ending Beginning Current Assets Cash $ 7,700 $ 3,550 Accounts Receivable - net 8,900 7,200 Merchandise Inventory 2,340 1,770 4,300 2,300 Prepaid Insurance $ 20,710 $ 17,350 Total Current Assets Noncurrent Assets Investments $ 24,700 11,200 $ 74,170 Property, Plant, and Equipment - net 54,360 $ Total Noncurrent Assets 85,370 $ 79,060 $ 106,080 $ 96,410 Total Assets - Balance Sheet Liabilities Current Liabilities $ 4,600 $ 1,300 Accounts Payable Accrued Expenses 9,880 6,700 4,120 4,870 Income Taxes Payable $ 21,180 $ 10,290 Total Current Liabilities Noncurrent Liabilities $ Notes Payable 31,900 $ 42,120 $ Total Noncurrent Liabilities 31,900 $ 42,120 $ 53,080 $ 52,410 Total Liabilities Shareholders' Equity Common Stock, $1 par value Additional Paid-in Capital in Excess of Par - Common $ 8,000 $ 8,000 19,600 19,600 25.400 16.400 $ Total Shareholders' Equity 53,000 $ 44,000 $ 106,080 $ 96,410 Total Liabilities and Shareholders' Equity Income Statement Income Statement For the Year Ended December 31 Sales $ 80,200 Cost of Goods Sold 48,090 $ 32,110 Gross Profit Selling, General, and Administrative Expenses $ 10,200 2,220 Depreciation Expense Total Operating Expenses $ 12,420 Operating Income $ 19,690 Interest Expense $ (3,400) 2,800 Interest Revenue Income before Tax $ 19,090 (6,654) Income Tax Expense $ 12,436 Net IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started