Answered step by step

Verified Expert Solution

Question

1 Approved Answer

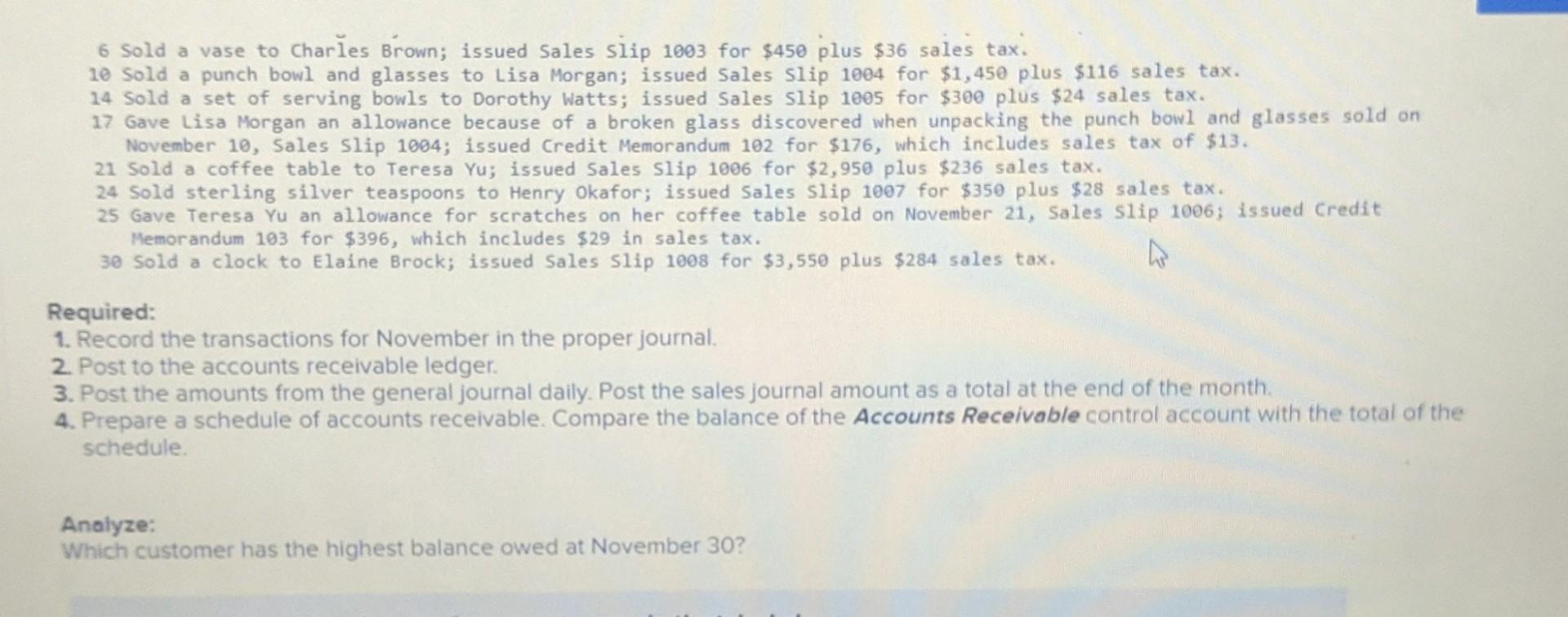

6 Sold a vase to Charles Brown; issued Sales silip 1003 for $450 plus $36 sales tax. 10 Sold a punch bowl and glasses to

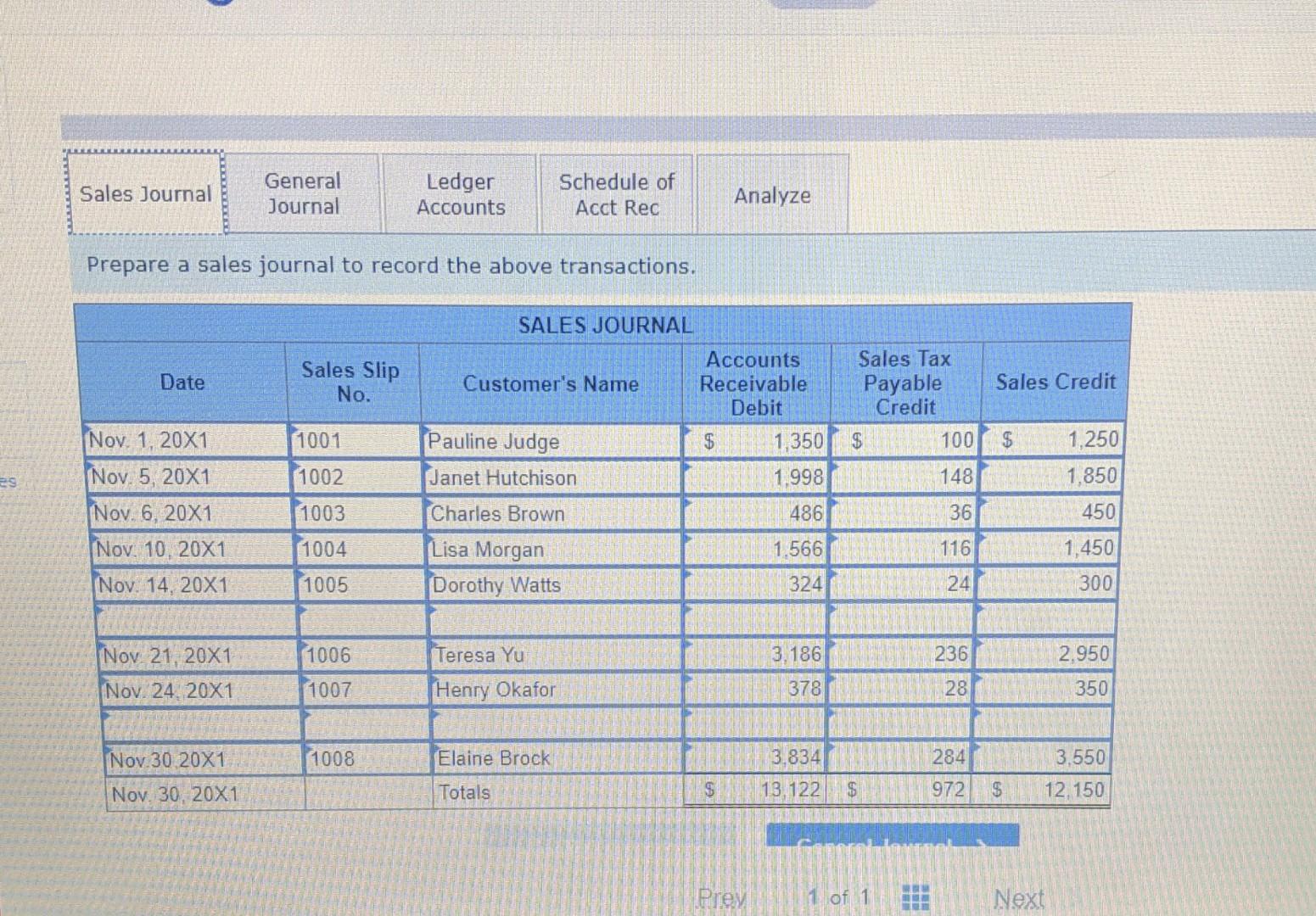

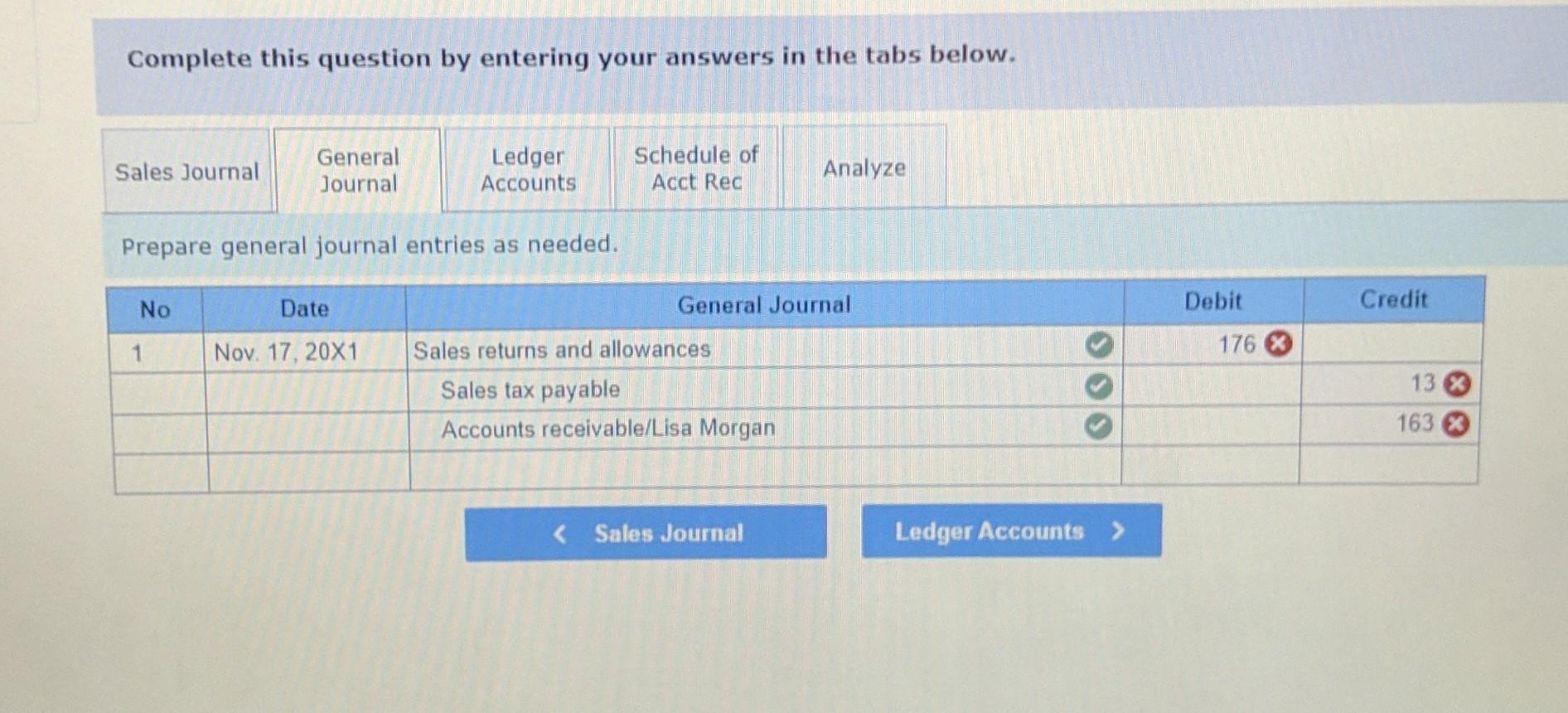

6 Sold a vase to Charles Brown; issued Sales silip 1003 for $450 plus $36 sales tax. 10 Sold a punch bowl and glasses to Lisa Morgan; issued Sales slip 1004 for $1,450 plus $116 sales tax. 14 Sold a set of serving bowls to Dorothy Watts; issued Sales Slip 1005 for $300 plus $24 sales tax. 17 Gave Lisa Morgan an allowance because of a broken glass discovered when unpacking the punch bowl and glasses sold on November 10, Sales Slip 1004; issued Credit Memorandum 102 for $176, which includes sales tax of \$13. 21 Sold a coffee table to Teresa Yu; issued Sales Slip 1006 for \$2,950 plus \$236 sales tax. 24 Sold sterling silver teaspoons to Henry Okafor; issued Sales Slip 1007 for $350 plus \$28 sales tax. 25 Gave Teresa Yu an allowance for scratches on her coffee table sold on November 21, Sales S1ip 1006; issued Credit Memorandum 103 for $396, which includes $29 in sales tax. 30 Sold a clock to Elaine Brock; issued Sales S1ip 1008 for $3,550 plus \$284 sales tax. Required: 1. Record the transactions for November in the proper journal. 2. Post to the accounts receivable ledger. 3. Post the amounts from the general journal daily. Post the sales journal amount as a total at the end of the month. 4. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable control account with the total of the schedule. Analyze: Which customer has the highest balance owed at November 30 ? Prepare a sales journal to record the above transactions. Complete this question by entering your answers in the tabs below. Prepare general journal entries as needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started