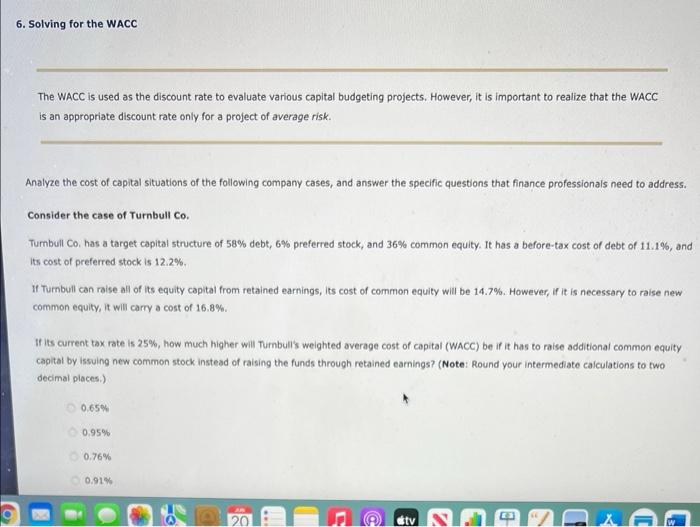

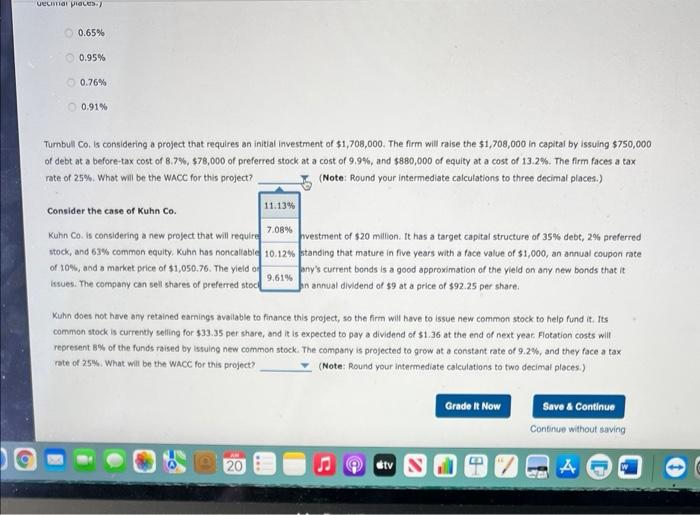

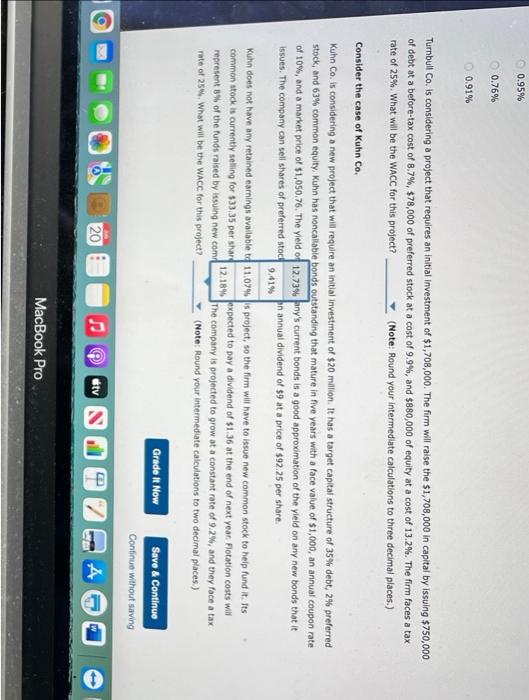

6. Solving for the WACC The WACC is used as the discount rate to evaluate various capital budgeting projects. However, it is important to realize that the WACC is an appropriate discount rate only for a project of average risk. Analyze the cost of capital situations of the following company cases, and answer the specific questions that finance professionals need to address. Consider the case of Turnbull Co. Turnbull Co. has a target capital structure of 58% debt, 6% preferred stock, and 36 % common equity. It has a before-tax cost of debt of 11.1%, and its cost of preferred stock is 12.2%. If Turnbull can raise all of its equity capital from retained earnings, its cost of common equity will be 14.7%. However, if it is necessary to raise new common equity, it will carry a cost of 16.8%. If its current tax rate is 25%, how much higher will Turnbull's weighted average cost of capital (WACC) be if it has to raise additional common equity capital by issuing new common stock instead of raising the funds through retained earnings? (Note: Round your intermediate calculations to two decimal places.) 0.65% 0.95% 0.76% 0.91% tv uecimal places./ 0.65% 0.95% 0.76% 0.91% Turnbull Co. is considering a project that requires an initial investment of $1,708,000. The firm will raise the $1,708,000 in capital by issuing $750,000 of debt at a before-tax cost of 8.7%, $78,000 of preferred stock at a cost of 9.9%, and $880,000 of equity at a cost of 13.2%. The firm faces a tax rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to three decimal places.) 11.13% Consider the case of Kuhn Co. 7.08% 10.12% Kuhn Co. is considering a new project that will require stock, and 63% common equity. Kuhn has noncallable of 10%, and a market price of $1,050.76. The yield of issues. The company can sell shares of preferred stock hvestment of $20 million. It has a target capital structure of 35% debt, 2% preferred standing that mature in five years with a face value of $1,000, an annual coupon rate any's current bonds is a good approximation of the yield on any new bonds that it an annual dividend of $9 at a price of $92.25 per share. 9.61% Kuhn does not have any retained earnings available to finance this project, so the firm will have to issue new common stock to help fund it. Its common stock is currently selling for $33.35 per share, and it is expected to pay a dividend of $1.36 at the end of next year. Flotation costs will represent 8% of the funds raised by issuing new common stock. The company is projected to grow at a constant rate of 9.2%, and they face a tax rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to two decimal places.) Grade It Now Save & Continue Continue without saving AN 20 tv S A 0.95% 0.76% 0.91% Turnbull Co. is considering a project that requires an initial investment of $1,708,000. The firm will raise the $1,708,000 in capital by issuing $750,000 of debt at a before-tax cost of 8.7%, $78,000 of preferred stock at a cost of 9.9%, and $880,000 of equity at a cost of 13.2%. The firm faces a tax rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to three decimal places.) Consider the case of Kuhn Co. Kuhn Co. is considering a new project that will require an initial investment of $20 million. It has a target capital structure of 35% debt, 2% preferred stock, and 63% common equity, Kuhn has noncallable bonds outstanding that mature in five years with a face value of $1,000, an annual coupon rate of 10%, and a market price of $1,050.76. The yield of 12.73% any's current bonds is a good approximation of the yield on any new bonds that it issues. The company can sell shares of preferred stock an annual dividend of $9 at a price of $92.25 per share. 9.41% Kuhn does not have any retained earnings available to 11.07% common stock is currently selling for $33.35 per shar represent 8% of the funds raised by issuing new com rate of 25%. What will be the WACC for this project? 12.18% is project, so the firm will have to issue new common stock to help fund it. Its expected to pay a dividend of $1.36 at the end of next year. Flotation costs will The company is projected to grow at a constant rate of 9.2%, and they face a tax (Note: Round your intermediate calculations to two decimal places.) Grade It Now Save & Continue Continue without saving 20 tv S A MacBook Pro