Question

6. Sound financial analysis involves more than just calculating numbers. The American Association of Individual Investors suggests that investors consider qualitative factors (as seen in

6. Sound financial analysis involves more than just calculating numbers. The American Association of Individual Investors suggests that investors consider qualitative factors (as seen in the following questions) when evaluating a company. Consider the following questions for the hospital. When there is insufficient information in the case to answer a question, briefly speculate about why the question might be relevant to the hospital. (5pts)

Are the companys revenues tied to one key customer?

To what extent are the companys revenues tied to one key product?

To what extent does the company rely on a single supplier? (Hint: Physicians and nurses are key suppliers of labor to a hospital.)

What about the competition?

What are the companys future prospects?

How does the legal and regulatory environment affect the company?

7. Guided by the limited information provided in the case, what are your top three or four recommendations to the board? (10 pts)

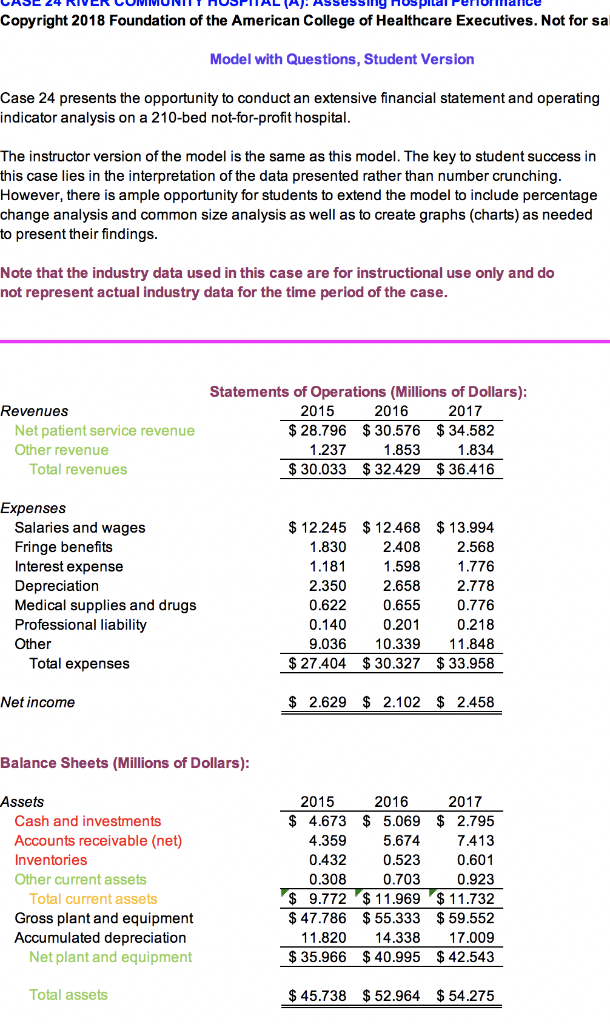

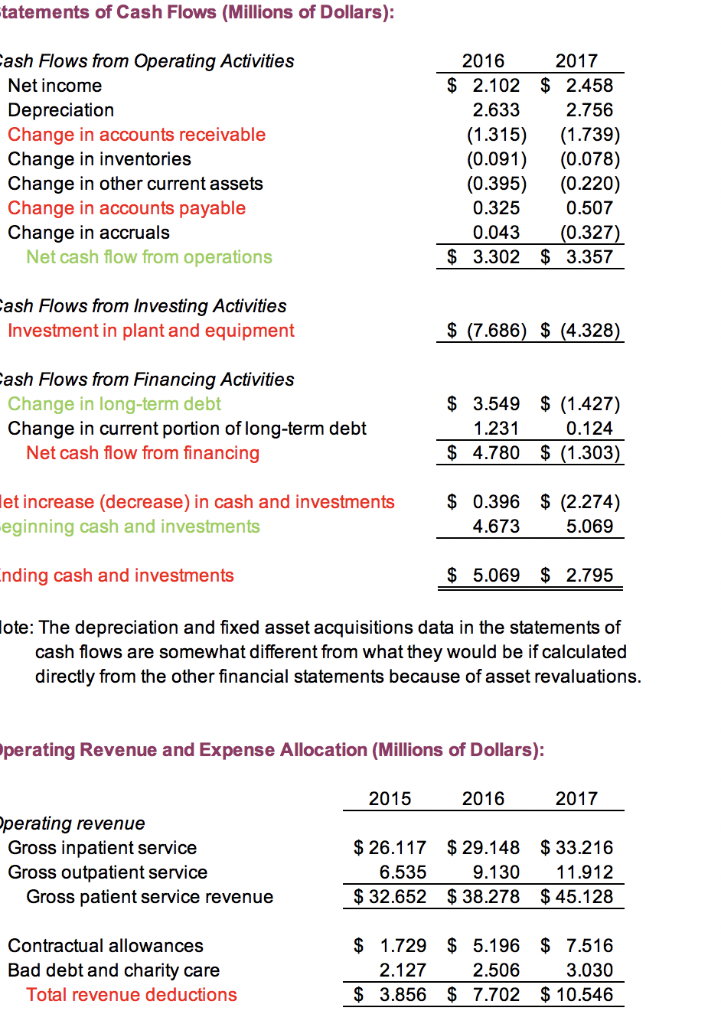

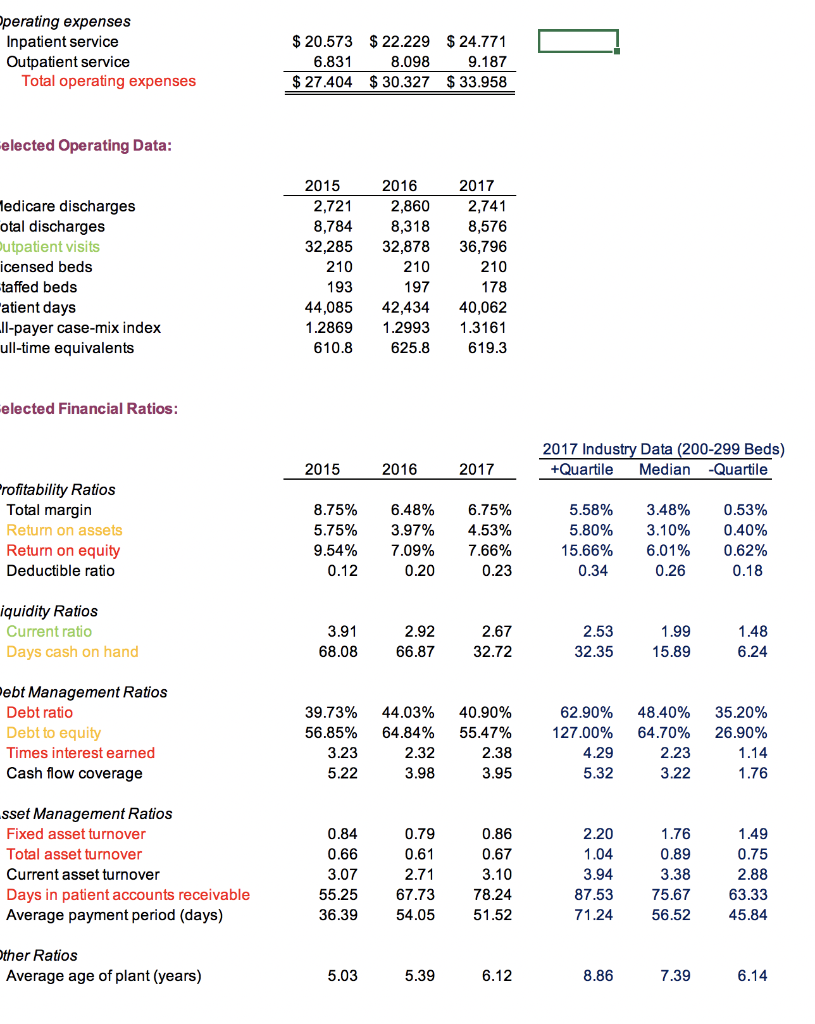

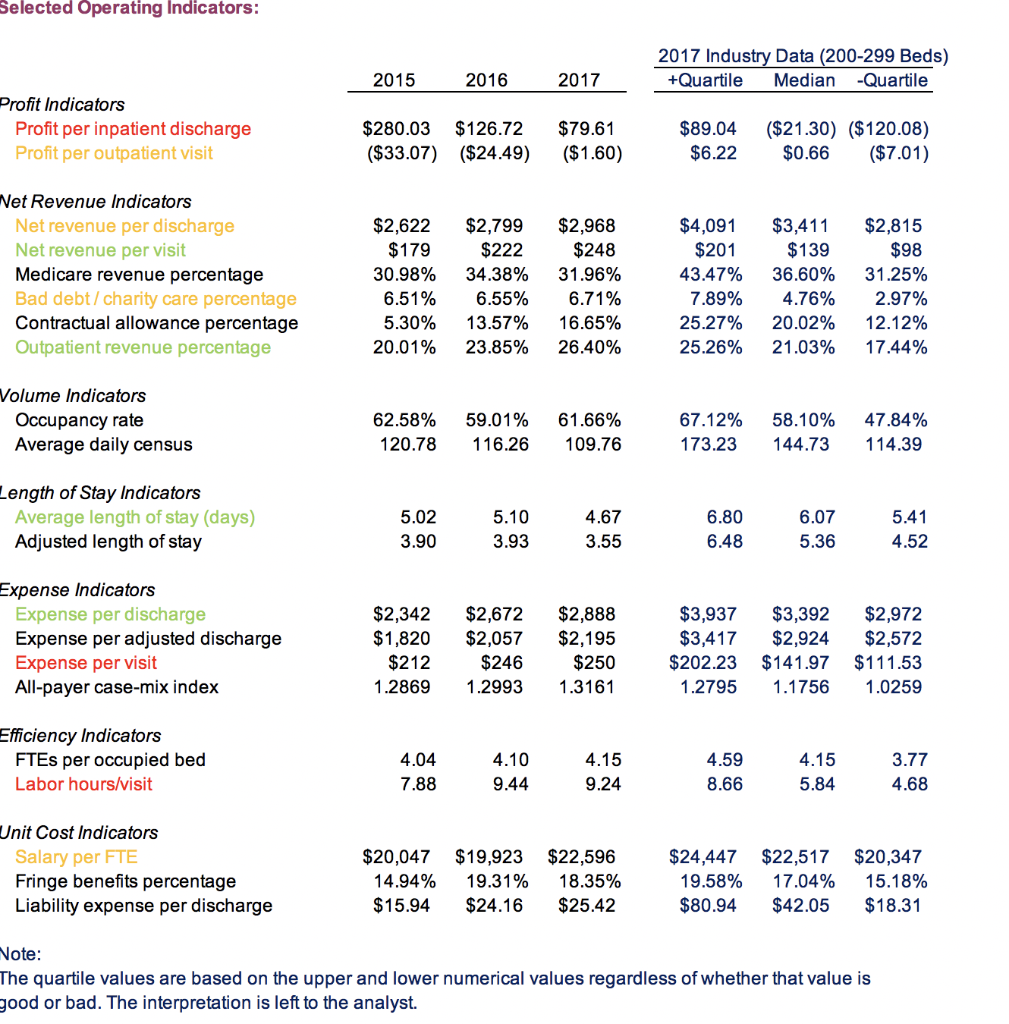

Model with Questions, Student Version Case 24 presents the opportunity to conduct an extensive financial statement and operating indicator analysis on a 210-bed not-for-profit hospital. The instructor version of the model is the same as this model. The key to student success in this case lies in the interpretation of the data presented rather than number crunching. However, there is ample opportunity for students to extend the model to include percentage change analysis and common size analysis as well as to create graphs (charts) as needed to present their findings. Note that the industry data used in this case are for instructional use only and do not represent actual industry data for the time period of the case. Balance Sheets (Millions of Dollars): tatements of Cash Flows (Millions of Dollars): lote: The depreciation and fixed asset acquisitions data in the statements of cash flows are somewhat different from what they would be if calculated directly from the other financial statements because of asset revaluations. perating Revenue and Expense Allocation (Millions of Dollars): elected Operating Data: elected Financial Ratios: Selected Operating Indicators: Pr N Vo EfA Ur1 Model with Questions, Student Version Case 24 presents the opportunity to conduct an extensive financial statement and operating indicator analysis on a 210-bed not-for-profit hospital. The instructor version of the model is the same as this model. The key to student success in this case lies in the interpretation of the data presented rather than number crunching. However, there is ample opportunity for students to extend the model to include percentage change analysis and common size analysis as well as to create graphs (charts) as needed to present their findings. Note that the industry data used in this case are for instructional use only and do not represent actual industry data for the time period of the case. Balance Sheets (Millions of Dollars): tatements of Cash Flows (Millions of Dollars): lote: The depreciation and fixed asset acquisitions data in the statements of cash flows are somewhat different from what they would be if calculated directly from the other financial statements because of asset revaluations. perating Revenue and Expense Allocation (Millions of Dollars): elected Operating Data: elected Financial Ratios: Selected Operating Indicators: Pr N Vo EfA Ur1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started