Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Splish makes income tax payments in the first month of each quarter based on income for the prior quarter. The tax rate is 30%.

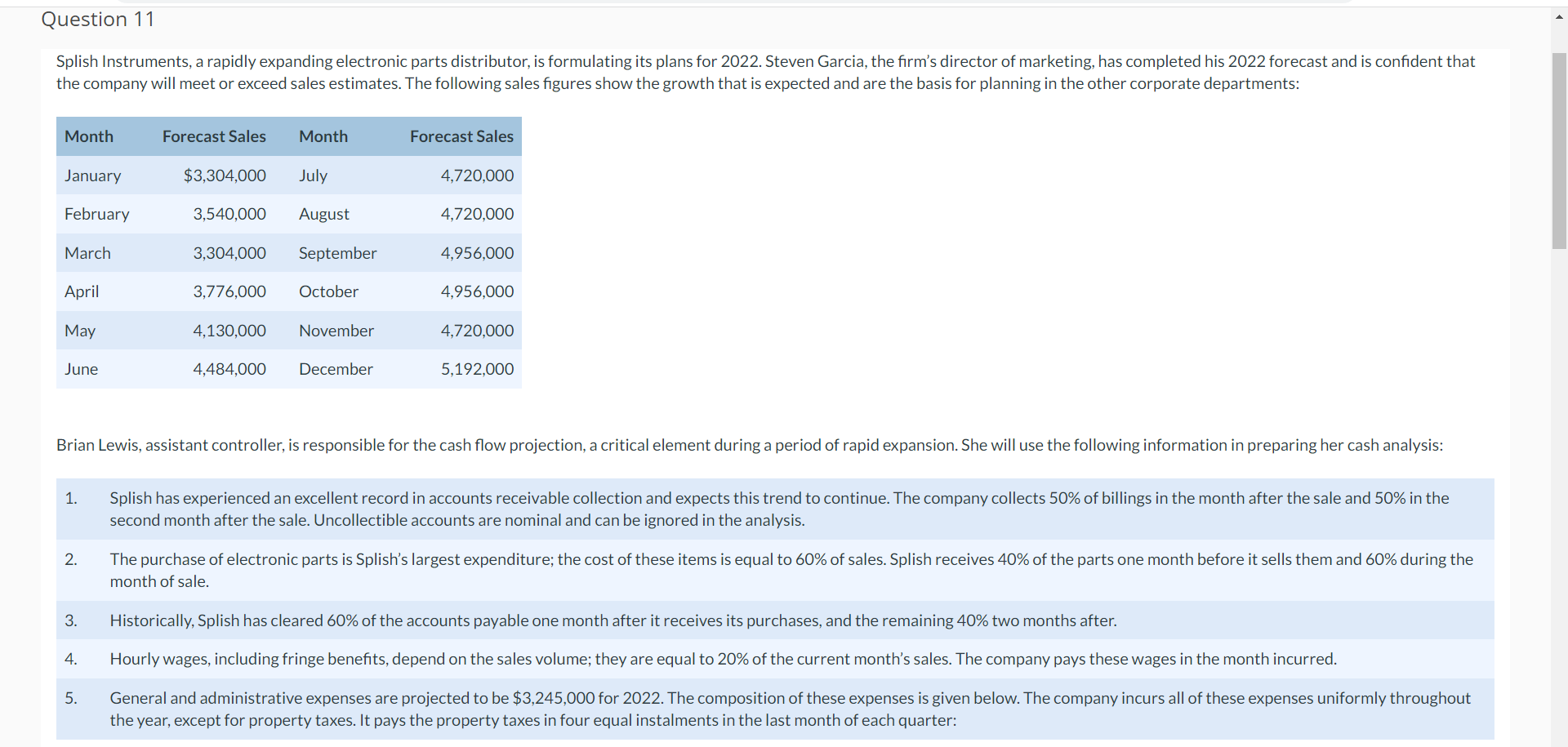

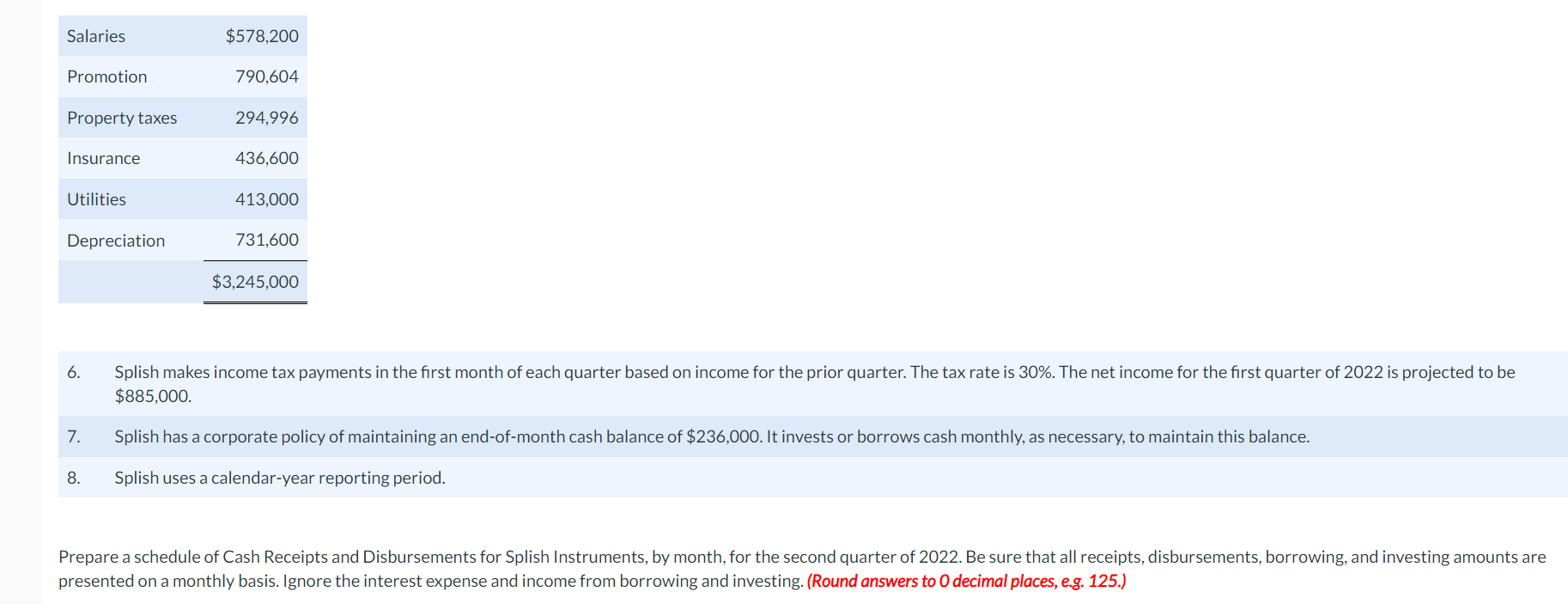

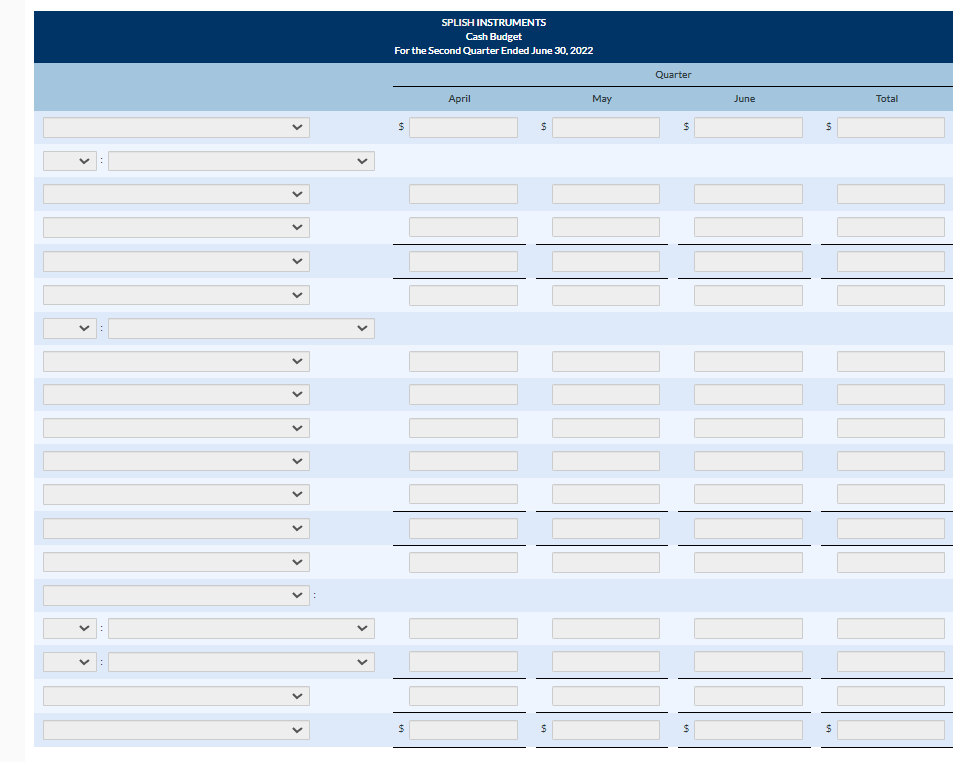

6. Splish makes income tax payments in the first month of each quarter based on income for the prior quarter. The tax rate is 30%. The net income for the first quarter of 2022 is projected to be $885,000. 7. Splish has a corporate policy of maintaining an end-of-month cash balance of $236,000. It invests or borrows cash monthly, as necessary, to maintain this balance. 8. Splish uses a calendar-year reporting period. second month after the sale. Uncollectible accounts are nominal and can be ignored in the analysis. month of sale. 3. Historically, Splish has cleared 60% of the accounts payable one month after it receives its purchases, and the remaining 40% two months after. the year, except for property taxes. It pays the property taxes in four equal instalments in the last month of each quarter: SPLISH INSTRUMENTS Cash Budget For the Second Quarter Ended June 30, 2022

6. Splish makes income tax payments in the first month of each quarter based on income for the prior quarter. The tax rate is 30%. The net income for the first quarter of 2022 is projected to be $885,000. 7. Splish has a corporate policy of maintaining an end-of-month cash balance of $236,000. It invests or borrows cash monthly, as necessary, to maintain this balance. 8. Splish uses a calendar-year reporting period. second month after the sale. Uncollectible accounts are nominal and can be ignored in the analysis. month of sale. 3. Historically, Splish has cleared 60% of the accounts payable one month after it receives its purchases, and the remaining 40% two months after. the year, except for property taxes. It pays the property taxes in four equal instalments in the last month of each quarter: SPLISH INSTRUMENTS Cash Budget For the Second Quarter Ended June 30, 2022 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started