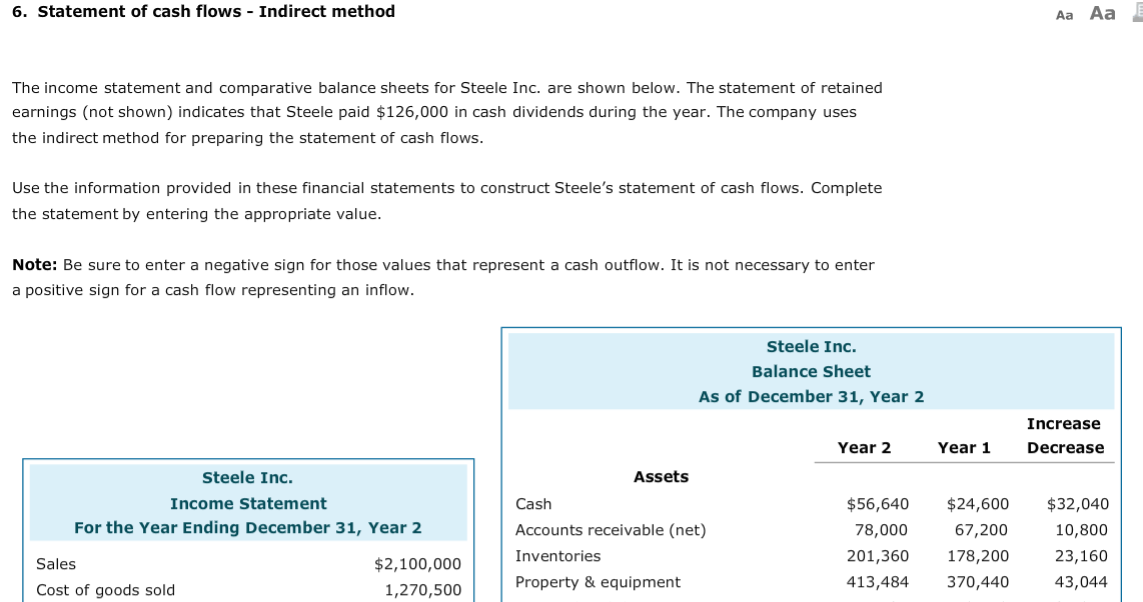

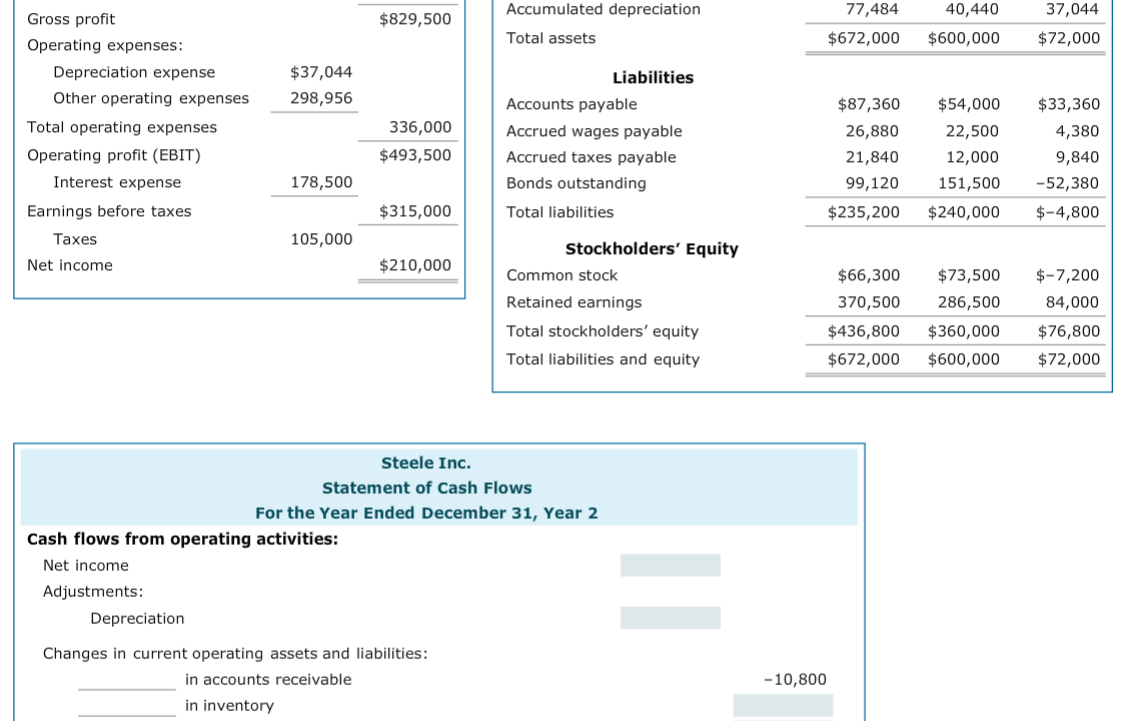

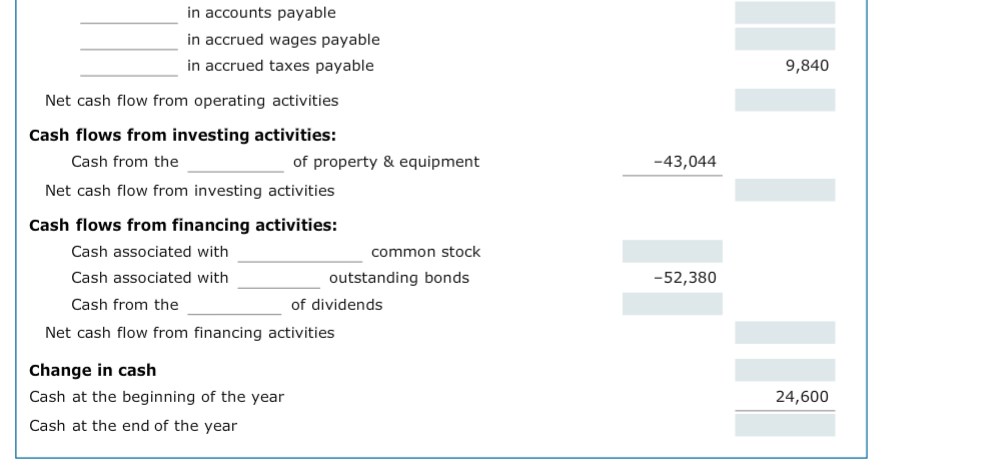

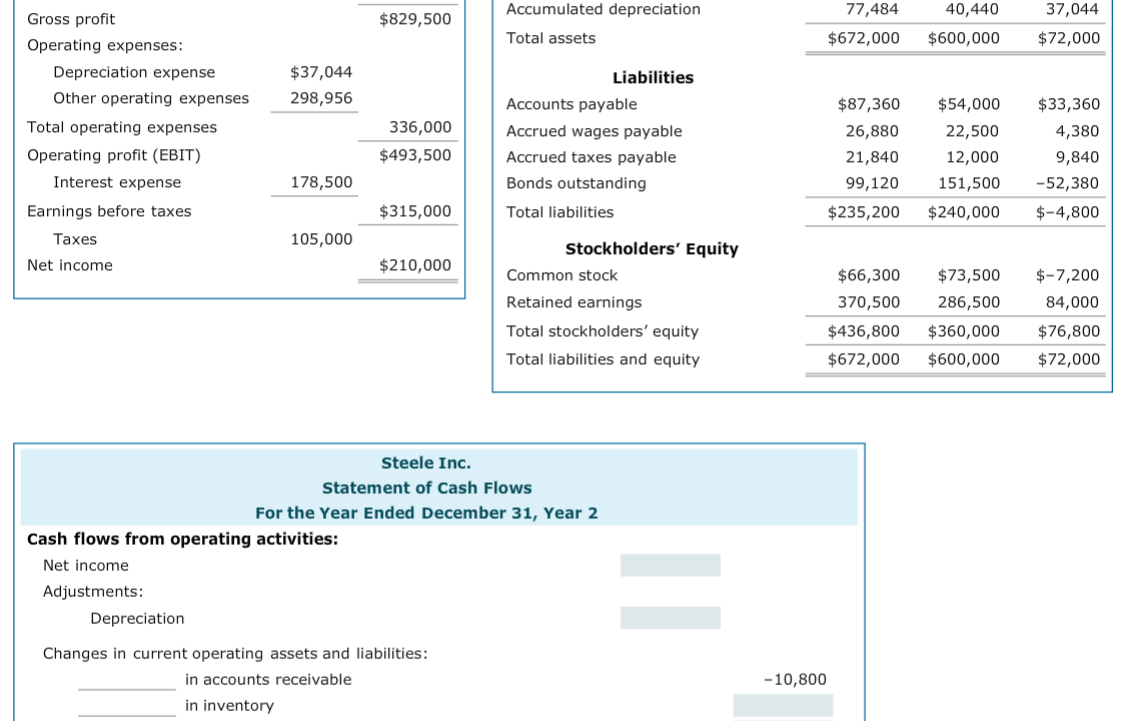

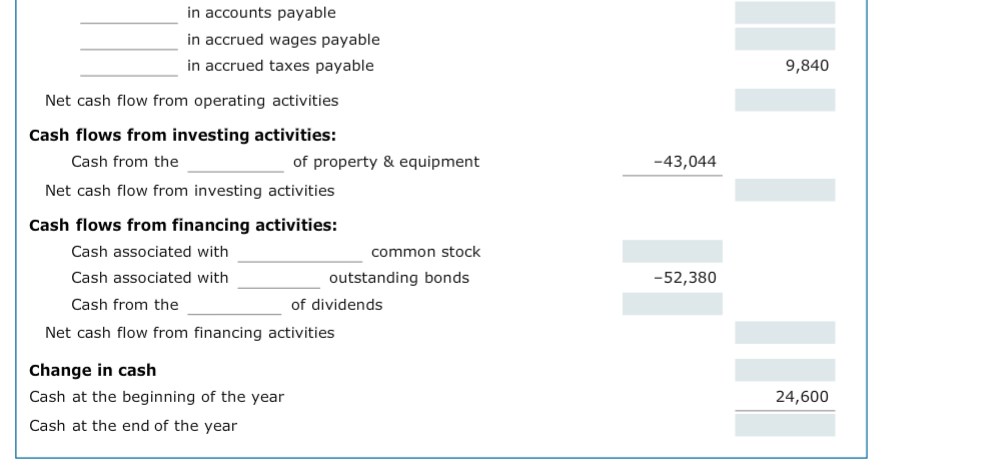

6. Statement of cash flows - Indirect method Aa Aa The income statement and comparative balance sheets for Steele Inc. are shown below. The statement of retained earnings (not shown) indicates that Steele paid $126,000 in cash dividends during the year. The company uses the indirect method for preparing the statement of cash flows. Use the information provided in these financial statements to construct Steele's statement of cash flows. Complete the statement by entering the appropriate value. Note: Be sure to enter a negative sign for those values that represent a cash outflow. It is not necessary to enter a positive sign for a cash flow representing an inflow. Steele Inc. Balance Sheet As of December 31, Year 2 Year 2 Increase Decrease Year 1 Steele Inc. Income Statement For the Year Ending December 31, Year 2 Assets Cash Accounts receivable (net) Inventories Property & equipment $56,640 78,000 201,360 413,484 $24,600 67,200 178,200 370,440 $32,040 10,800 23,160 43,044 Sales Cost of goods sold $2,100,000 1,270,500 $829,500 Accumulated depreciation Total assets 77,484 $672,000 40,440 $600,000 37,044 $72,000 $37,044 298,956 Gross profit Operating expenses: Depreciation expense Other operating expenses Total operating expenses Operating profit (EBIT) Interest expense Earnings before taxes Taxes Net income 336,000 $493,500 Liabilities Accounts payable Accrued wages payable Accrued taxes payable Bonds outstanding Total liabilities $87,360 26,880 21,840 99,120 $235,200 $54,000 22,500 12,000 151,500 $240,000 $33,360 4,380 9,840 -52,380 $-4,800 178,500 $315,000 105,000 $210,000 Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and equity $66,300 370,500 $436,800 $672,000 $73,500 286,500 $360,000 $600,000 $-7,200 84,000 $76,800 $72,000 Steele Inc. Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities: Net income Adjustments: Depreciation Changes in current operating assets and liabilities: in accounts receivable in inventory -10,800 in accounts payable in accrued wages payable in accrued taxes payable 9,840 Net cash flow from operating activities Cash flows from investing activities: Cash from the of property & equipment Net cash flow from investing activities -43,044 Cash flows from financing activities: Cash associated with common stock Cash associated with outstanding bonds Cash from the of dividends Net cash flow from financing activities -52,380 Change in cash Cash at the beginning of the year Cash at the end of the year 24,600