Answered step by step

Verified Expert Solution

Question

1 Approved Answer

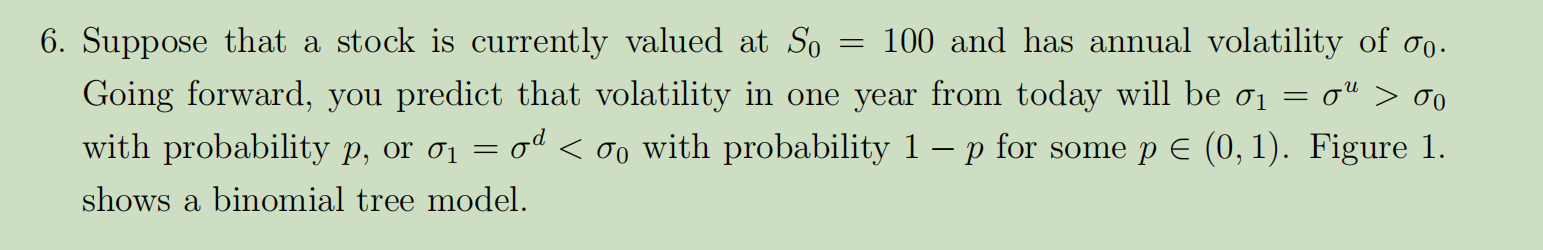

6. Suppose that a stock is currently valued at S0=100 and has annual volatility of 0. Going forward, you predict that volatility in one year

6. Suppose that a stock is currently valued at S0=100 and has annual volatility of 0. Going forward, you predict that volatility in one year from today will be 1=u>0 with probability p, or 1=dS0)=qandP~(S1S0)=1q. Show that there exist multiple such measures P~ such that the discounted expected period-1 stock price under P~ is equal to the initial price S0. That is, there are multiple P~ such that EP~[erS1]=S0. Hint: Define q=P~(1=u),qu=P~(S1>S01=u) and qd=P~(S1>S01=d). Write down the equation that S1 and S0 should satisfy under the risk neutral measure P~. Does this equation has a unique solution? (b) Show that this market is not complete. Hint: Count the number of different states at time 1. Does the number of different states match the degree of freedom of a replicating portfolio at time 1? Think about how many degree of freedom (unknown variables) in a replicating portfolio

6. Suppose that a stock is currently valued at S0=100 and has annual volatility of 0. Going forward, you predict that volatility in one year from today will be 1=u>0 with probability p, or 1=dS0)=qandP~(S1S0)=1q. Show that there exist multiple such measures P~ such that the discounted expected period-1 stock price under P~ is equal to the initial price S0. That is, there are multiple P~ such that EP~[erS1]=S0. Hint: Define q=P~(1=u),qu=P~(S1>S01=u) and qd=P~(S1>S01=d). Write down the equation that S1 and S0 should satisfy under the risk neutral measure P~. Does this equation has a unique solution? (b) Show that this market is not complete. Hint: Count the number of different states at time 1. Does the number of different states match the degree of freedom of a replicating portfolio at time 1? Think about how many degree of freedom (unknown variables) in a replicating portfolio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started