Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#6 Suppose you are a life insurance broker with a cillent who is interested in buying a whole life insurance policy. You explain to him

#6

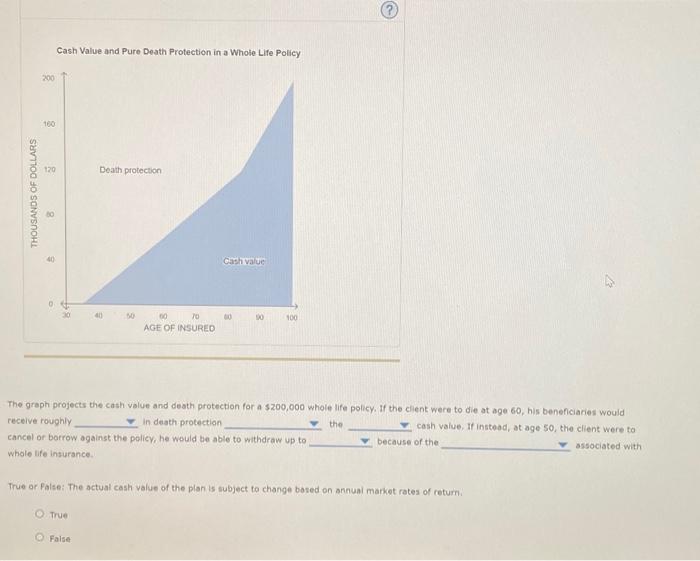

Suppose you are a life insurance broker with a cillent who is interested in buying a whole life insurance policy. You explain to him the three major types of whole life insurance continuous premium, also known as limited payment, and single premium. Your client is a 33-year- old man and a father of four who is looking for the policy that provides the most permanent death protection for a given number of premium dollars. Based on this information alone, you recommand that he purchase a whole life policy Your cient takes your advice but wants to understand more about the different features of his policy: specifically the relationship between the prerniums he pays, the cash value of his plan, and the death benefits his beneficiaries would receive in the event of his passing. To help llustrate, you show him the following graph Cash Value and Pure Death Protection in a Whole Life Policy 8 Death protection 8 THOUSANDS OF DOLLARS ya 100 AGE OF INSURED Cash Value and Pure Death Protection in a Whole Life Policy 200 100 120 Death protection THOUSANDS OF DOLLARS . 40 Cash value O 0 100 70 AGE OF INSURED The graph projects the cash value and death protection for a $200,000 whole life policy. If the client were to die at age 60, his beneficiaries would receive roughly In death protection the cash value. If instead, at age 50, the client were to cancel or borrow against the policy, he would be able to withdraw up to because of the associated with whole life insurance True or False: The actual cash value of the plan is subject to change based on annual market rates of return True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started