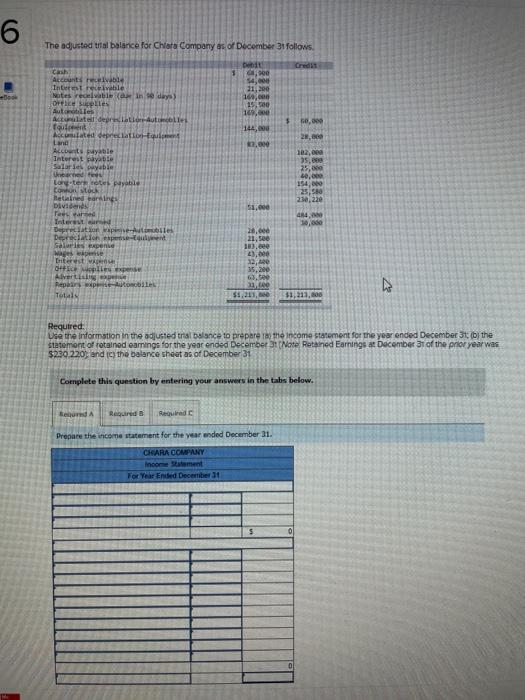

6 The adjusted trial balance for Chiara Company as of December 31 follows 1 54, 11,200 169, 15 NO 16.00 144,000 $ fo 2,000 . ca Account cable Inbetreceivable Notes receivable in days) De piles Autres Acte depreciate mollet Asculte depreciation Land Alcoyable Interest to Salas bie Une orgte payable sto and are Dividends read Internet Depreciation willes Depreciation persent Sale pene Mages Interest 04 upplies expense Avertising Represente To 102,000 25.000 25,000 10,000 154.00 25.90 23.23 51,00 414, 24.ee 21,50 103.000 23,60 12,00 5,20 63,DAN 11, $5,211, 31,211, Required: Use the information in the adjusted trial balance to prepare to the income statement for the year ended December 3the statement of retained eamings for the year ended December 3 (Note Retened Earnings at December 31 of the prior year was $230 220 and the balance sheet as of December 31 Complete this question by entering your answers in the tabs below. Bed A Regard Required Prepare the income statement for the year ended December 31. CHARA COMPANY Inoortement For Year Ended December 6 The adjusted trial balance for Chiara Company as of December 31 follows 1 54, 11,200 169, 15 NO 16.00 144,000 $ fo 2,000 . ca Account cable Inbetreceivable Notes receivable in days) De piles Autres Acte depreciate mollet Asculte depreciation Land Alcoyable Interest to Salas bie Une orgte payable sto and are Dividends read Internet Depreciation willes Depreciation persent Sale pene Mages Interest 04 upplies expense Avertising Represente To 102,000 25.000 25,000 10,000 154.00 25.90 23.23 51,00 414, 24.ee 21,50 103.000 23,60 12,00 5,20 63,DAN 11, $5,211, 31,211, Required: Use the information in the adjusted trial balance to prepare to the income statement for the year ended December 3the statement of retained eamings for the year ended December 3 (Note Retened Earnings at December 31 of the prior year was $230 220 and the balance sheet as of December 31 Complete this question by entering your answers in the tabs below. Bed A Regard Required Prepare the income statement for the year ended December 31. CHARA COMPANY Inoortement For Year Ended December