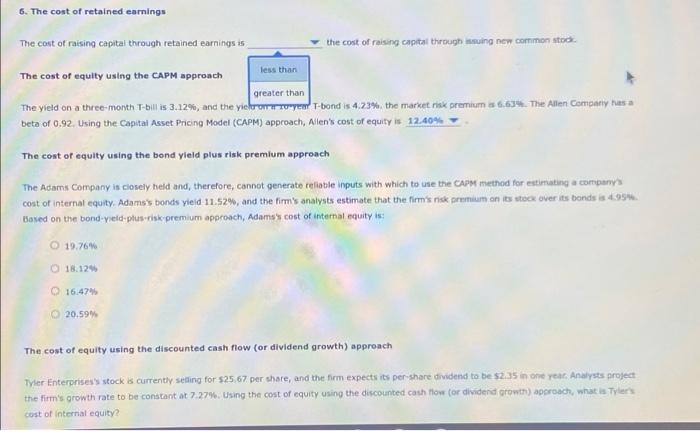

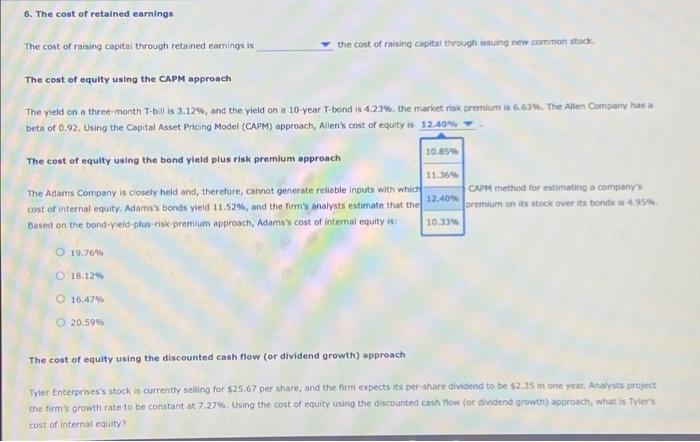

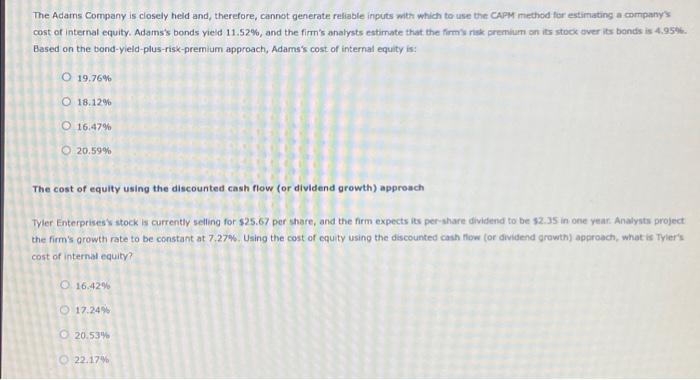

6. The cost of retained earnings The cost of raising capital through retained earnings is the cost of raising capital through sing new common stod The cost of equity using the CAPM approach less than greater than The yield on a three-month T-bill is 3.12%, and the yieltromoyen-bond is 4.23% the market risk premium is 6.634. The Allen Company has a beta of 0.92. Using the Capital Asset Pricing Model (CAPM) approach, Allen's cost of equity is 12.40% The cost of equity using the bond yield plus risk premium approach The Adams Company is closely held and therefore, cannot generate reliable inputs with which to use the CAM method for estimating a companys cost of internal equity. Adams's bonds yield 11.52%, and the firm's analysts estimate that the firm's risk premium on stock over its bonds is 2.994 Based on the bond yield-plus-risk premium approach, Adamay cont of internal equity is 19.76% 18.12 16.47% 20.59% The cost of equity using the discounted cash flow (or dividend growth approach Tyler Enterprises stock is currently selling for $25.67 per share, and the firm expects its per share dividend to be $2.35 in one year. Analysts project the firm's growth rate to be constant at 7.27%. Using the cost of equity using the discounted cash flow or dividend growth) approach, what is Tyler's cost of internal equity 6. The cost of retained earnings The cost of raising capital through retained earnings is the cost of raising capital through issuing new common stock The cost of equity using the CAPM approach The yield on a three-month T-bills 3.12, and the yield on a 10-year T-bond 4.23%. the market risk premium is 6.63. The Allen Company has a bets of 0.92. Using the Capital Asset Pricing Model (CAPM) approach, Allen's cost of equity is 12.40% The cost of equity using the bond Vield plus risk premium approach 10.85 11.369 The Adams Company is closely held and, therefore, cannot generate reliable inputs with which CAPM method for estimating a company cost of internal equity Adams's bonds yield 11.52%, and the firm's analysts estimate that the 12.404 premium on its stock over its bonds is 4.95 Based on the bond-yield-plus-risk premium approach, Adams's cost of internal equity is 10.33 19.76% O 18.129 16.47% 20.59% The cost of equity using the discounted cash flow (or dividend growth) approach Tyler Enterprises's stock is currently selling for $25.67 per share, and the firm expects its per share dividend to be 52 35 in one year. Analysts project the firm's growth rate to be constant at 7.27%. Using the cost of equity using the discounted cash now (or dividend growth approach what is Tyler's cost of internal equity? The Adams Company is closely held and therefore, cannot generate reliable inputs with which to use the CAP method for estimating a company's cost of Internal equity. Adams's bonds yield 11.52%, and the firm's analysts estimate that the firm's risk premium on its stock over its bonds is 4,95%. Based on the bond-yield-plus-risk-premium approach, Adams's cost of internal equity is: O 19.76% 18.12% 16.47% 20.59% The cost of equity using the discounted cash flow (or dividend growth) approach Tyler Enterprises stock is currently selling for $25.67 per share, and the firm expects its per share dividend to be $2.35 in one year. Analysts project the firm's growth rate to be constant at 7.27%. Using the cost of equity using the discounted cash flow (or dividend growth) approach, what is Tyler's cost of internal equity? 0.16.42% O 17.24% 20.53% 22.17