Question

6. The file MutualFunds contains a data set with information for 45 mutual funds that are part of the Morningstar Funds 500. The closing price

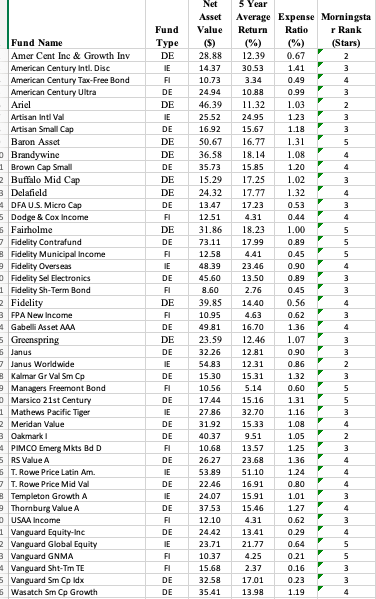

6. The file MutualFunds contains a data set with information for 45 mutual funds that are part of the Morningstar Funds 500. The closing price per share Five-Year Average Return (%): The average annual return for the fund over the past five years Expense Ratio (%): a. Prepare a PivotTable that gives the frequency count of the data by Fund Type (rows) and the five-year average annual return (columns). Use classes of 09.99, 1019.99, 2029.99, 3039.99, 4049.99, and 5059.99 for the Five-Year Average Return (%).

6. The file MutualFunds contains a data set with information for 45 mutual funds that are part of the Morningstar Funds 500. The closing price per share Five-Year Average Return (%): The average annual return for the fund over the past five years Expense Ratio (%): a. Prepare a PivotTable that gives the frequency count of the data by Fund Type (rows) and the five-year average annual return (columns). Use classes of 09.99, 1019.99, 2029.99, 3039.99, 4049.99, and 5059.99 for the Five-Year Average Return (%).

I am unable to include the given data due to Chegg not allowing the question to be that long. I will respond with the needed dataset from Excel

mm Fund Name Amer Cent Inc & Growth Inv American Century Intl. Disc American Century Tax-Free Bond American Century Ultra Ariel Artisan Intl Val Artisan Small Cap Baron Asset Brandywine 1 Brown Cap Small Buffalo Mid Cap 3 Delafield 4 DFA U.S. Micro Cap 5 Dodge & Cox Income 5 Fairholme 7 Fidelity Contrafund 8 Fidelity Municipal Income Fidelity Overseas Fidelity Sel Electronics 1 Fidelity Sh-Term Bond Fidelity 3 FPA New Income Gabelli Asset AMA 5 Greenspring 5 Janus 7 Janus Worldwide Kalmar Gr Val Sm Cp 9 Managers Freemont Bond Marsico 21st Century 1 Mathews Pacific Tiger 2 Meridan Value 3 Oakmark 1 4 PIMCO Emerg Mats Bd D 5 RS Value A 5 T. Rowe Price Latin Am. 7 T. Rowe Price Mid Val 8 Templeton Growth A Thornburg Value A USA Income 1 Vanguard Equity Inc 2 Vanguard Global Equity 3 Vanguard GNMA 4 Vanguard Sht-Tm TE 5 Vanguard Sm Cp idx 6 Wasatch Sm Cp Growth Fund Type DE IE FI DE DE IE DE DE DE DE DE DE DE FI DE DE FI IE DE FI DE FI DE DE DE IE DE FI DE IE DE DE FI DE Net Asset Value (5) 28.88 14.37 10.73 24.94 46.39 25.52 16.92 50.67 36.58 35.73 15.29 24.32 13.47 1251 31.86 73.11 12.58 48.39 45.60 8.60 39.85 10.95 49.81 23.59 32.26 54.83 15.30 10.56 17.44 27.86 31.92 40.37 10.68 26.27 53.89 22.46 24.07 37.53 12.10 24.42 23.71 10.37 15.68 32.58 35.41 5 Year Average Expense Morningsta Return Ratio r Rank (%) (%) (Stars) 12.39 0.67 2 30.53 1.41 3 3.34 0.49 4 10.88 0.99 3 11.32 1.03 2 24.95 1.23 15.67 1.18 16.77 1.31 5 18.14 1.08 4 15.85 1.20 4 17.25 1.02 3 17.77 1.32 4 17.23 0.53 3 4.31 0.44 4 18.23 1.00 5 17.99 0.89 5 4.41 0.45 5 23.46 0.90 4 13.50 0.89 3 2.76 0.45 3 14.40 0.56 4 4.63 0.62 3 16.70 1.36 4 12.46 1.07 3 12.81 0.90 3 12.31 0.86 2 15.31 1.32 3 5.14 0.60 5 15.16 1.31 5 32.70 1.16 3 15.33 1.08 4 9.51 1.05 2 13.57 1.25 3 23.68 1.36 4 51.10 1.24 4 16.91 0.80 4 15.91 1.01 3 15.46 1.27 4 4.31 0.62 13.41 0.29 21.77 0.64 5 4.25 0.21 5 2.37 0.16 3 17.01 0.23 13.98 1.19 4 IE DE IE DE FI DE IE FI FI DE DE ms in ww mm Fund Name Amer Cent Inc & Growth Inv American Century Intl. Disc American Century Tax-Free Bond American Century Ultra Ariel Artisan Intl Val Artisan Small Cap Baron Asset Brandywine 1 Brown Cap Small Buffalo Mid Cap 3 Delafield 4 DFA U.S. Micro Cap 5 Dodge & Cox Income 5 Fairholme 7 Fidelity Contrafund 8 Fidelity Municipal Income Fidelity Overseas Fidelity Sel Electronics 1 Fidelity Sh-Term Bond Fidelity 3 FPA New Income Gabelli Asset AMA 5 Greenspring 5 Janus 7 Janus Worldwide Kalmar Gr Val Sm Cp 9 Managers Freemont Bond Marsico 21st Century 1 Mathews Pacific Tiger 2 Meridan Value 3 Oakmark 1 4 PIMCO Emerg Mats Bd D 5 RS Value A 5 T. Rowe Price Latin Am. 7 T. Rowe Price Mid Val 8 Templeton Growth A Thornburg Value A USA Income 1 Vanguard Equity Inc 2 Vanguard Global Equity 3 Vanguard GNMA 4 Vanguard Sht-Tm TE 5 Vanguard Sm Cp idx 6 Wasatch Sm Cp Growth Fund Type DE IE FI DE DE IE DE DE DE DE DE DE DE FI DE DE FI IE DE FI DE FI DE DE DE IE DE FI DE IE DE DE FI DE Net Asset Value (5) 28.88 14.37 10.73 24.94 46.39 25.52 16.92 50.67 36.58 35.73 15.29 24.32 13.47 1251 31.86 73.11 12.58 48.39 45.60 8.60 39.85 10.95 49.81 23.59 32.26 54.83 15.30 10.56 17.44 27.86 31.92 40.37 10.68 26.27 53.89 22.46 24.07 37.53 12.10 24.42 23.71 10.37 15.68 32.58 35.41 5 Year Average Expense Morningsta Return Ratio r Rank (%) (%) (Stars) 12.39 0.67 2 30.53 1.41 3 3.34 0.49 4 10.88 0.99 3 11.32 1.03 2 24.95 1.23 15.67 1.18 16.77 1.31 5 18.14 1.08 4 15.85 1.20 4 17.25 1.02 3 17.77 1.32 4 17.23 0.53 3 4.31 0.44 4 18.23 1.00 5 17.99 0.89 5 4.41 0.45 5 23.46 0.90 4 13.50 0.89 3 2.76 0.45 3 14.40 0.56 4 4.63 0.62 3 16.70 1.36 4 12.46 1.07 3 12.81 0.90 3 12.31 0.86 2 15.31 1.32 3 5.14 0.60 5 15.16 1.31 5 32.70 1.16 3 15.33 1.08 4 9.51 1.05 2 13.57 1.25 3 23.68 1.36 4 51.10 1.24 4 16.91 0.80 4 15.91 1.01 3 15.46 1.27 4 4.31 0.62 13.41 0.29 21.77 0.64 5 4.25 0.21 5 2.37 0.16 3 17.01 0.23 13.98 1.19 4 IE DE IE DE FI DE IE FI FI DE DE ms in wwStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started