Answered step by step

Verified Expert Solution

Question

1 Approved Answer

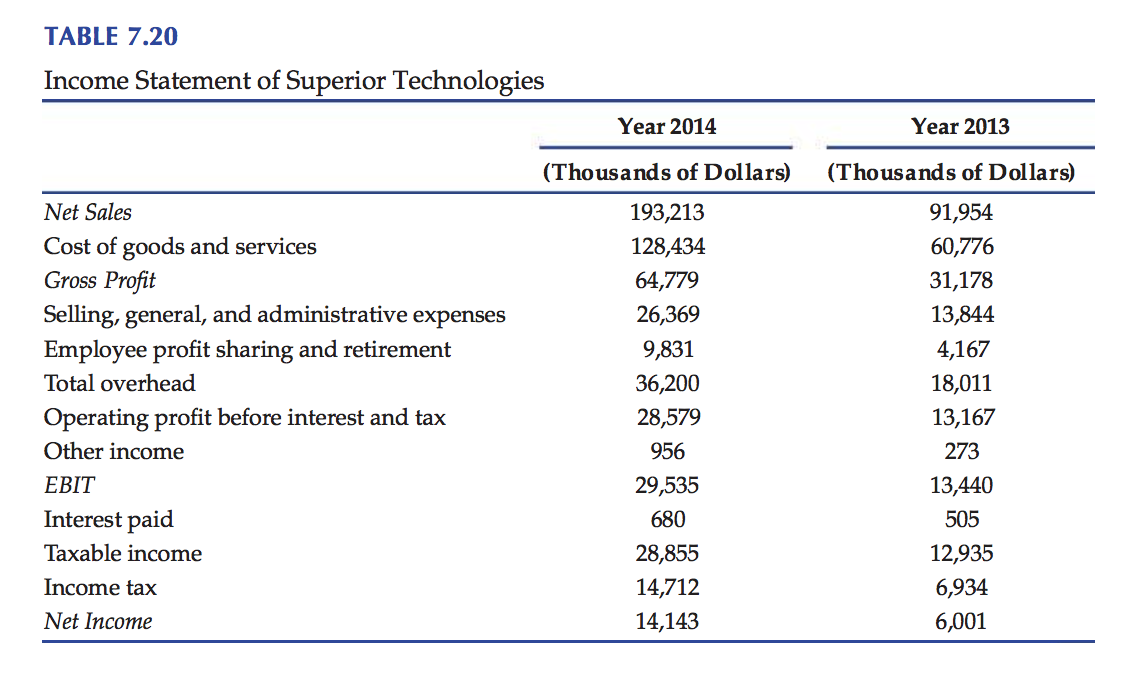

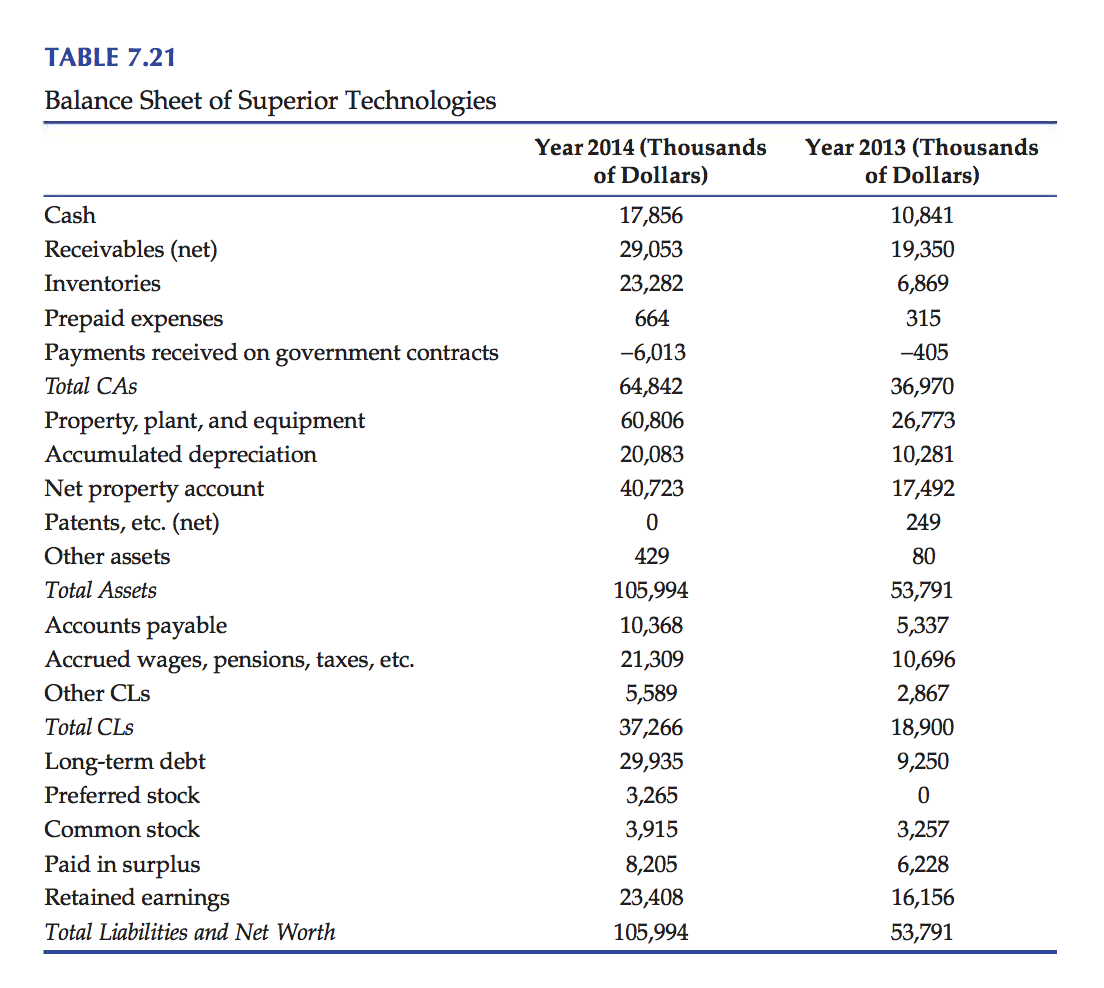

6. The income statement and balance sheet of Superior Technologies are exhibited in Tables 7.20 and 7.21. Conduct a ratio analysis and observe major

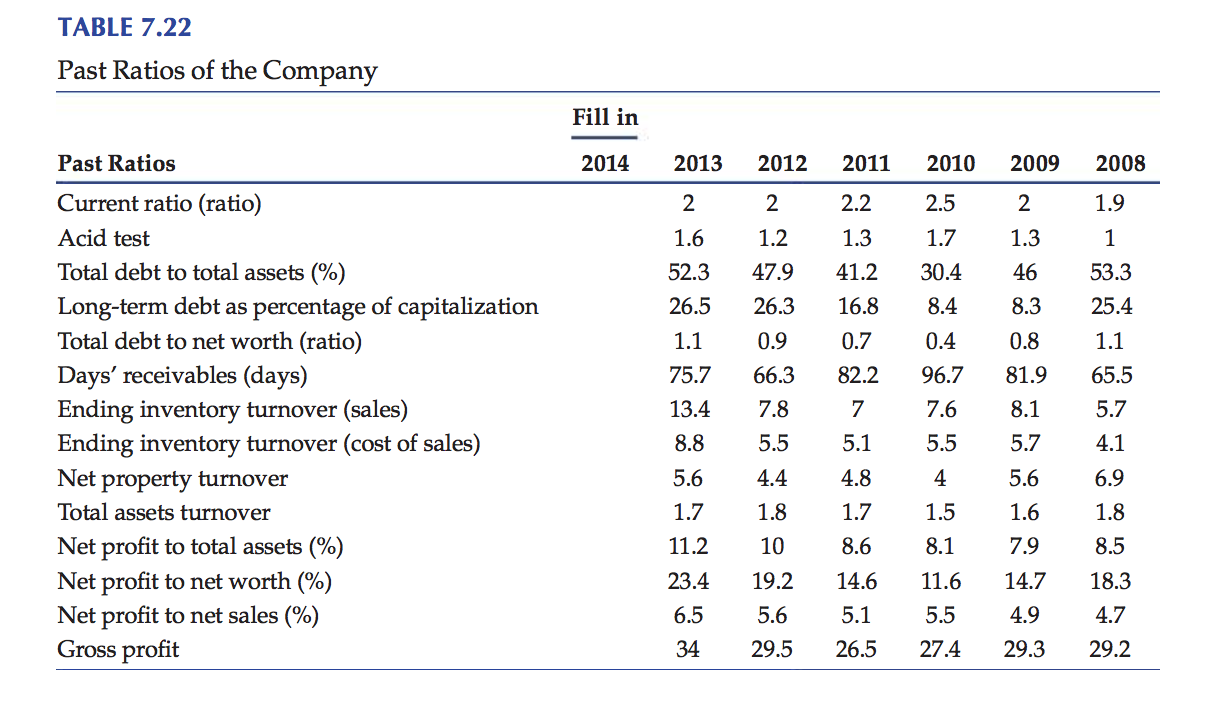

6. The income statement and balance sheet of Superior Technologies are exhibited in Tables 7.20 and 7.21. Conduct a ratio analysis and observe major trends and TABLE 7.20 Income Statement of Superior Technologies Net Sales Cost of goods and services Gross Profit Selling, general, and administrative expenses Employee profit sharing and retirement Total overhead Operating profit before interest and tax Other income EBIT Interest paid Taxable income Income tax Net Income Year 2014 (Thousands of Dollars) 193,213 128,434 64,779 26,369 9,831 36,200 28,579 956 29,535 680 28,855 14,712 14,143 Year 2013 (Thousands of Dollars) 91,954 60,776 31,178 13,844 4,167 18,011 13,167 273 13,440 505 12,935 6,934 6,001 TABLE 7.21 Balance Sheet of Superior Technologies Cash Receivables (net) Inventories Prepaid expenses Payments received on government contracts Total CAS Property, plant, and equipment Accumulated depreciation Net property account Patents, etc. (net) Other assets Total Assets Accounts payable Accrued wages, pensions, taxes, etc. Other CLS Total CLS Long-term debt Preferred stock Common stock Paid in surplus Retained earnings Total Liabilities and Net Worth Year 2014 (Thousands of Dollars) 17,856 29,053 23,282 664 -6,013 64,842 60,806 20,083 40,723 0 429 105,994 10,368 21,309 5,589 37,266 29,935 3,265 3,915 8,205 23,408 105,994 Year 2013 (Thousands of Dollars) 10,841 19,350 6,869 315 -405 36,970 26,773 10,281 17,492 249 80 53,791 5,337 10,696 2,867 18,900 9,250 0 3,257 6,228 16,156 53,791 deviations from the available historical company information and industry data (see also Table 7.22). TABLE 7.22 Past Ratios of the Company Past Ratios Current ratio (ratio) Acid test Total debt to total assets (%) Long-term debt as percentage of capitalization Total debt to net worth (ratio) Days' receivables (days) Ending inventory turnover (sales) Ending inventory turnover (cost of sales) Net property turnover Total assets turnover Net profit to total assets (%) Net profit to net worth (%) Net profit to net sales (%) Gross profit Fill in 2014 2013 2012 2 2 1.6 1.2 52.3 47.9 26.5 26.3 1.1 75.7 13.4 8.8 5.6 1.7 11.2 2011 2010 2009 2.2 2.5 2 1.3 1.7 1.3 41.2 30.4 46 16.8 8.4 8.3 0.9 0.7 0.4 0.8 66.3 82.2 96.7 81.9 7.8 7 7.6 8.1 5.5 5.1 5.5 5.7 4.4 4.8 4 5.6 1.8 1.7 1.5 1.6 10 8.6 8.1 7.9 19.2 14.6 11.6 14.7 5.6 5.1 5.5 4.9 29.5 26.5 27.4 29.3 23.4 6.5 34 2008 1.9 1 53.3 25.4 1.1 65.5 5.7 4.1 6.9 1.8 8.5 18.3 4.7 29.2

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To conduct a ratio analysis for Superior Technologies lets calculate some common financial ratios using the data from the income statement and balance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started