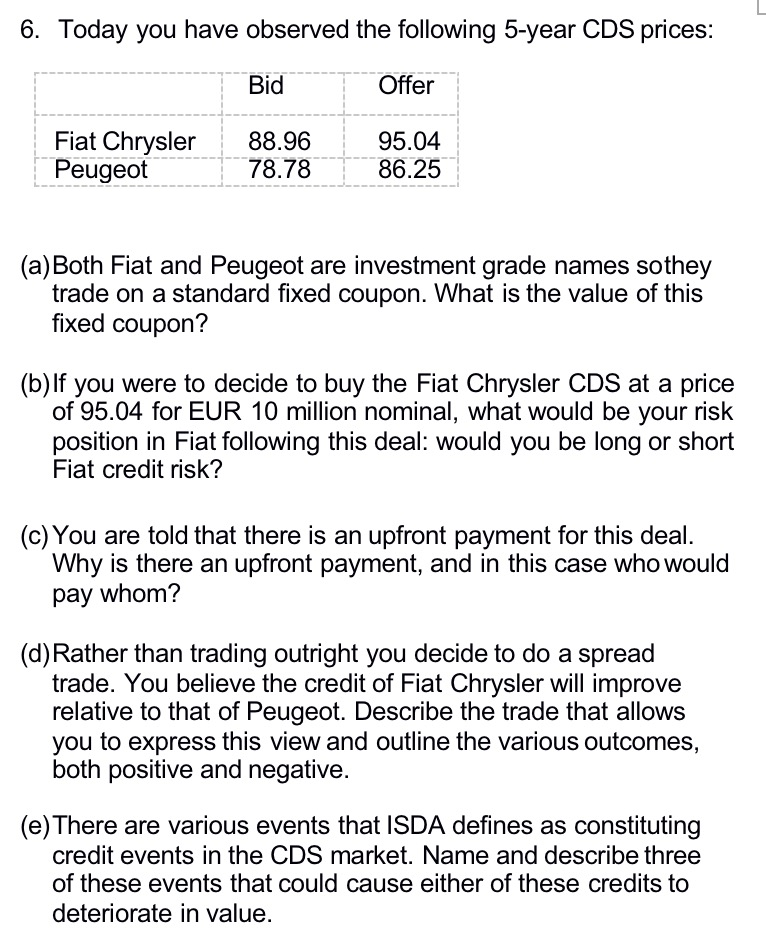

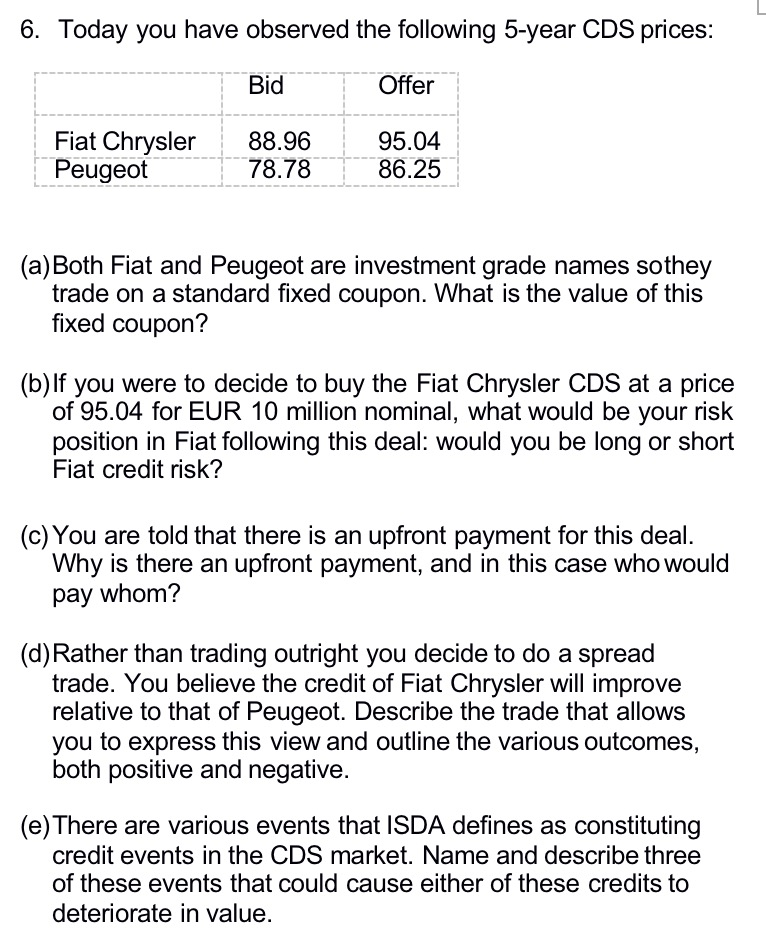

6. Today you have observed the following 5-year CDS prices: Bid Offer Fiat Chrysler Peugeot 88.96 78.78 95.04 86.25 (a)Both Fiat and Peugeot are investment grade names sothey trade on a standard fixed coupon. What is the value of this fixed coupon? (b) If you were to decide to buy the Fiat Chrysler CDS at a price of 95.04 for EUR 10 million nominal, what would be your risk position in Fiat following this deal: would you be long or short Fiat credit risk? (c) You are told that there is an upfront payment for this deal. Why is there an upfront payment, and in this case who would pay whom? (d)Rather than trading outright you decide to do a spread trade. You believe the credit of Fiat Chrysler will improve relative to that of Peugeot. Describe the trade that allows you to express this view and outline the various outcomes, both positive and negative. (e) There are various events that ISDA defines as constituting credit events in the CDS market. Name and describe three of these events that could cause either of these credits to deteriorate in value. 6. Today you have observed the following 5-year CDS prices: Bid Offer Fiat Chrysler Peugeot 88.96 78.78 95.04 86.25 (a)Both Fiat and Peugeot are investment grade names sothey trade on a standard fixed coupon. What is the value of this fixed coupon? (b) If you were to decide to buy the Fiat Chrysler CDS at a price of 95.04 for EUR 10 million nominal, what would be your risk position in Fiat following this deal: would you be long or short Fiat credit risk? (c) You are told that there is an upfront payment for this deal. Why is there an upfront payment, and in this case who would pay whom? (d)Rather than trading outright you decide to do a spread trade. You believe the credit of Fiat Chrysler will improve relative to that of Peugeot. Describe the trade that allows you to express this view and outline the various outcomes, both positive and negative. (e) There are various events that ISDA defines as constituting credit events in the CDS market. Name and describe three of these events that could cause either of these credits to deteriorate in value