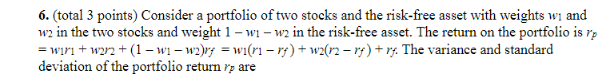

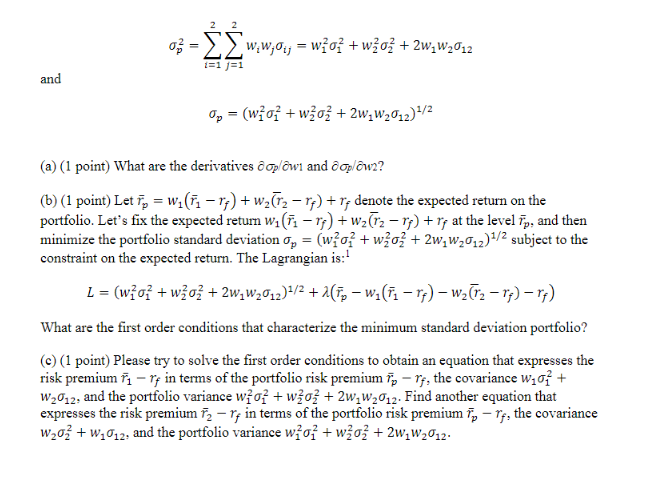

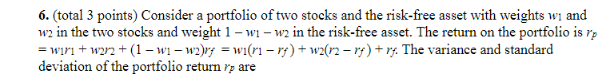

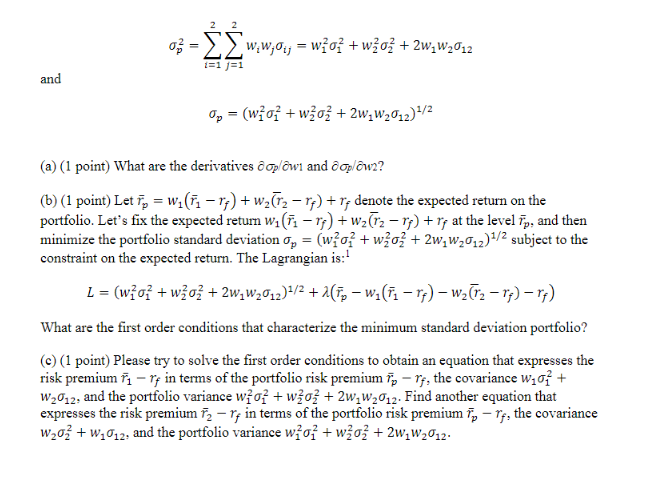

6. (total 3 points) Consider a portfolio of two stocks and the risk-free asset with weights wi and we in the two stocks and weight 1 - wi - we in the risk-free asset. The return on the portfolio is ro = wirl + w2n2 + (1 - wi w2)ry = wi(r1 rf) + w2(12 rf) + ry. The variance and standard deviation of the portfolio return rp are 2 03 - 23 w. w;07; = wo? + wo3 + 2W,W2012 = i=1 j=1 and Op = (wo + wzo + 2w,W2012)4/2 (a) (1 point) What are the derivatives plowi and Oplown? (b) (1 point) Let F, = w(11 r;) + wza rf) + r; denote the expected return on the portfolio. Let's fix the expected return wi(71-71) +wzrz-rp) + ry at the level 7p, and then minimize the portfolio standard deviation on = (wo+ wo + 2w,W2012)1/2 subject to the constraint on the expected return. The Lagrangian is: L = (wg} + wo + 2w,W2012)4/2 +2(7. - wz(7. - rf) - w2/12 ;) rf) What are the first order conditions that characterize the minimum standard deviation portfolio? () (1 point) Please try to solve the first order conditions to obtain an equation that expresses the risk premium 71 - ry in terms of the portfolio risk premium 7, - rf, the covariance wao+ W2012, and the portfolio variance wo? + wo + 2w,W2012. Find another equation that expresses the risk premium Fz - rin terms of the portfolio risk premium To rf, the covariance w203 + W2012, and the portfolio variance wo + wo + 2W,W2012. 6. (total 3 points) Consider a portfolio of two stocks and the risk-free asset with weights wi and we in the two stocks and weight 1 - wi - we in the risk-free asset. The return on the portfolio is ro = wirl + w2n2 + (1 - wi w2)ry = wi(r1 rf) + w2(12 rf) + ry. The variance and standard deviation of the portfolio return rp are 2 03 - 23 w. w;07; = wo? + wo3 + 2W,W2012 = i=1 j=1 and Op = (wo + wzo + 2w,W2012)4/2 (a) (1 point) What are the derivatives plowi and Oplown? (b) (1 point) Let F, = w(11 r;) + wza rf) + r; denote the expected return on the portfolio. Let's fix the expected return wi(71-71) +wzrz-rp) + ry at the level 7p, and then minimize the portfolio standard deviation on = (wo+ wo + 2w,W2012)1/2 subject to the constraint on the expected return. The Lagrangian is: L = (wg} + wo + 2w,W2012)4/2 +2(7. - wz(7. - rf) - w2/12 ;) rf) What are the first order conditions that characterize the minimum standard deviation portfolio? () (1 point) Please try to solve the first order conditions to obtain an equation that expresses the risk premium 71 - ry in terms of the portfolio risk premium 7, - rf, the covariance wao+ W2012, and the portfolio variance wo? + wo + 2w,W2012. Find another equation that expresses the risk premium Fz - rin terms of the portfolio risk premium To rf, the covariance w203 + W2012, and the portfolio variance wo + wo + 2W,W2012