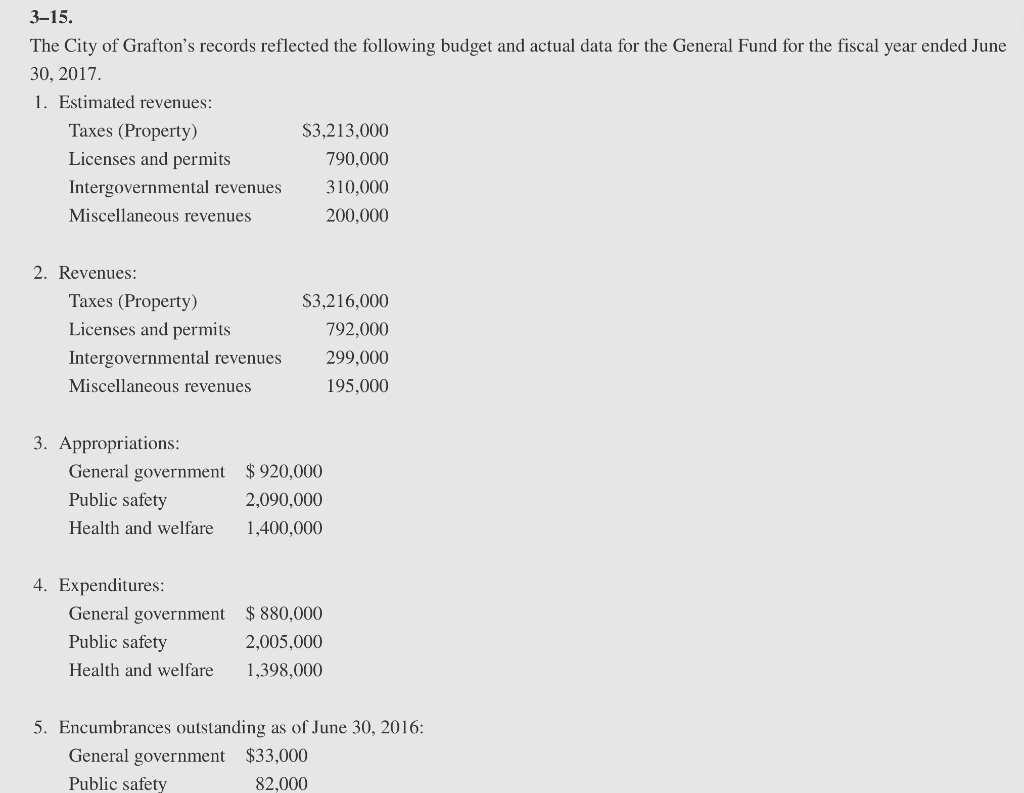

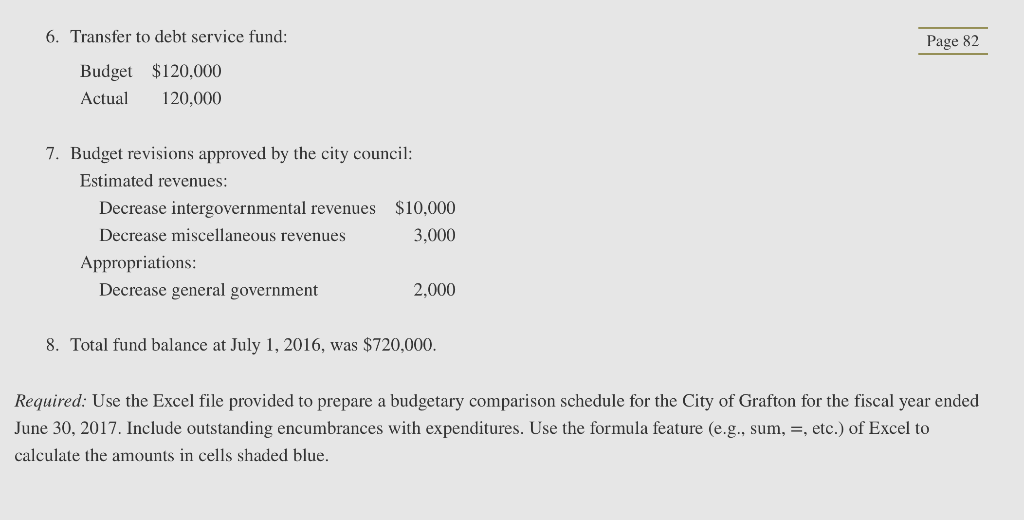

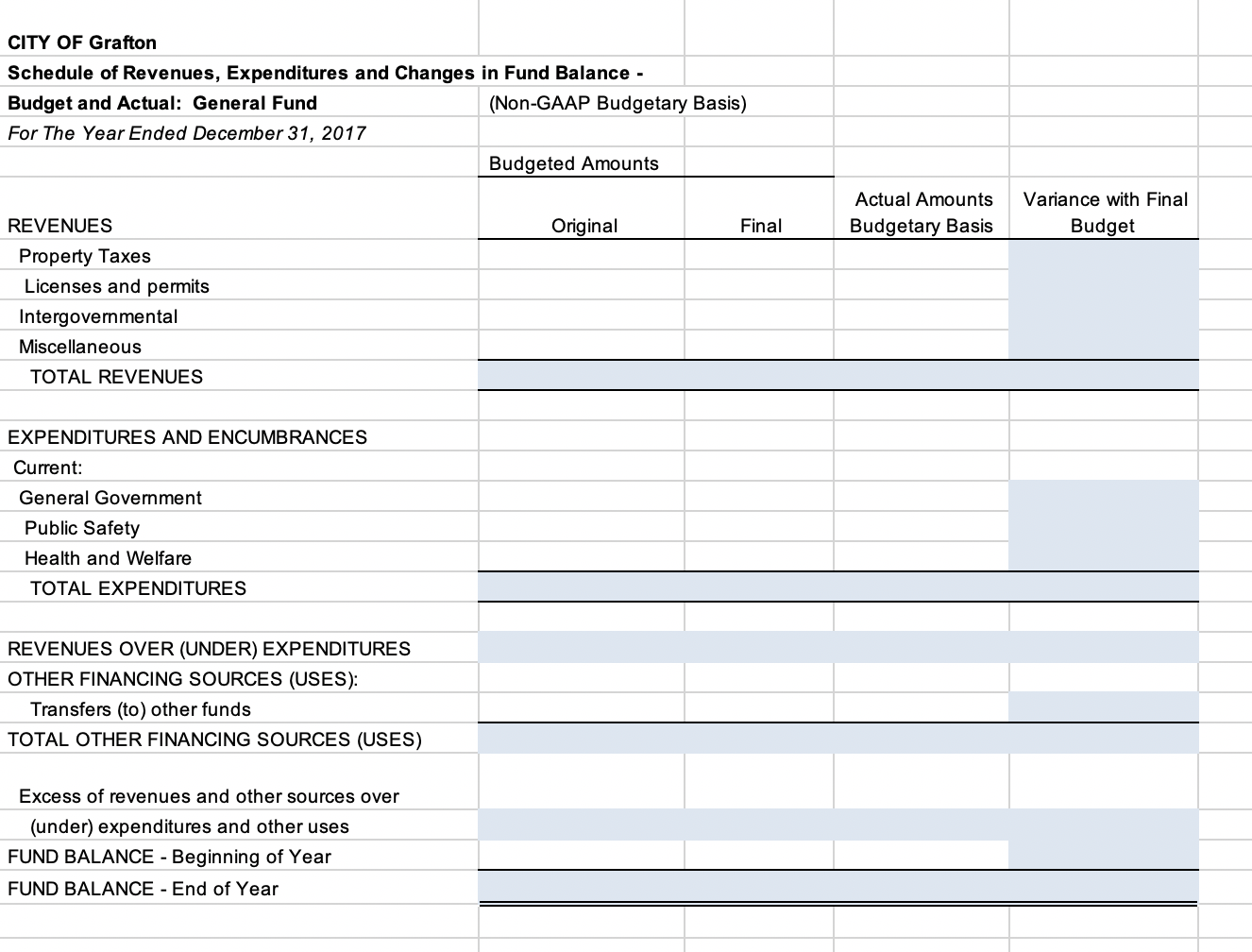

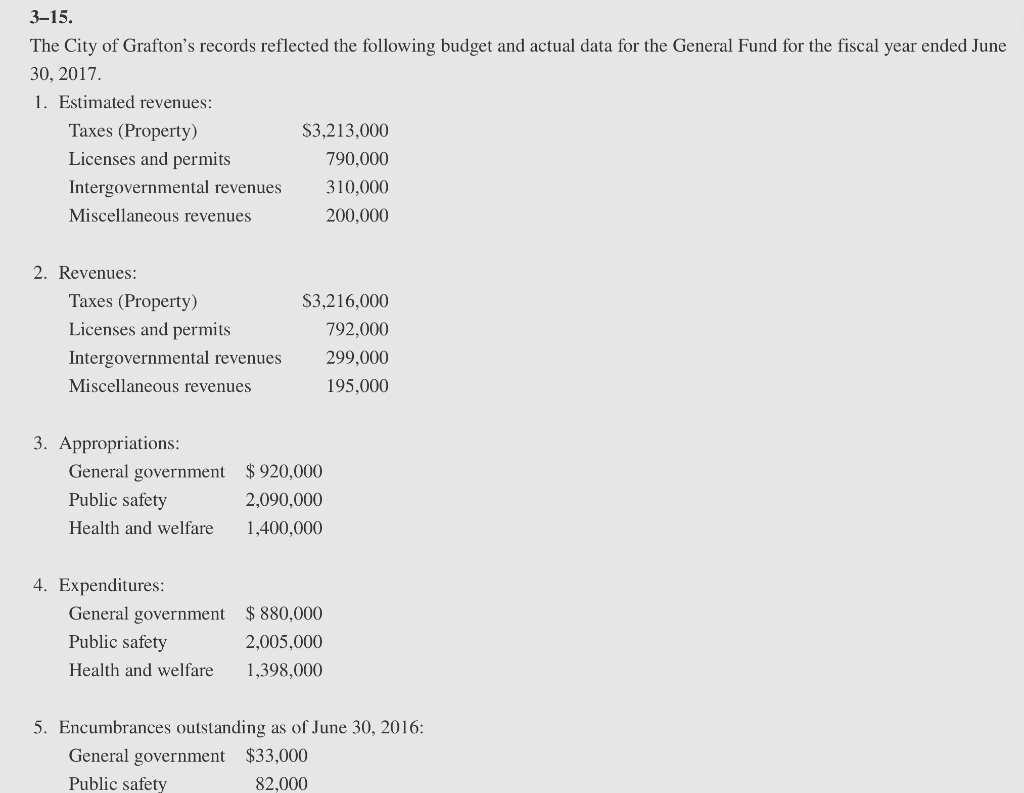

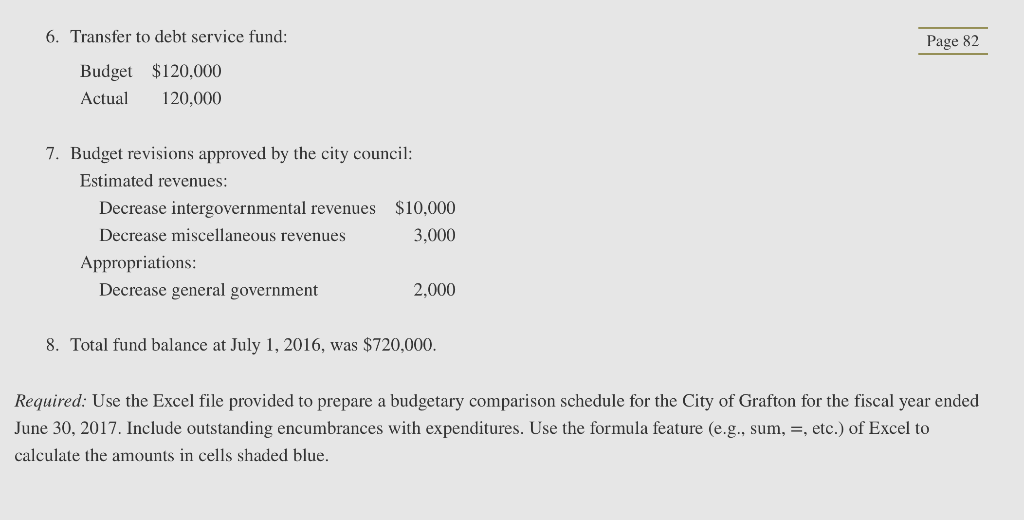

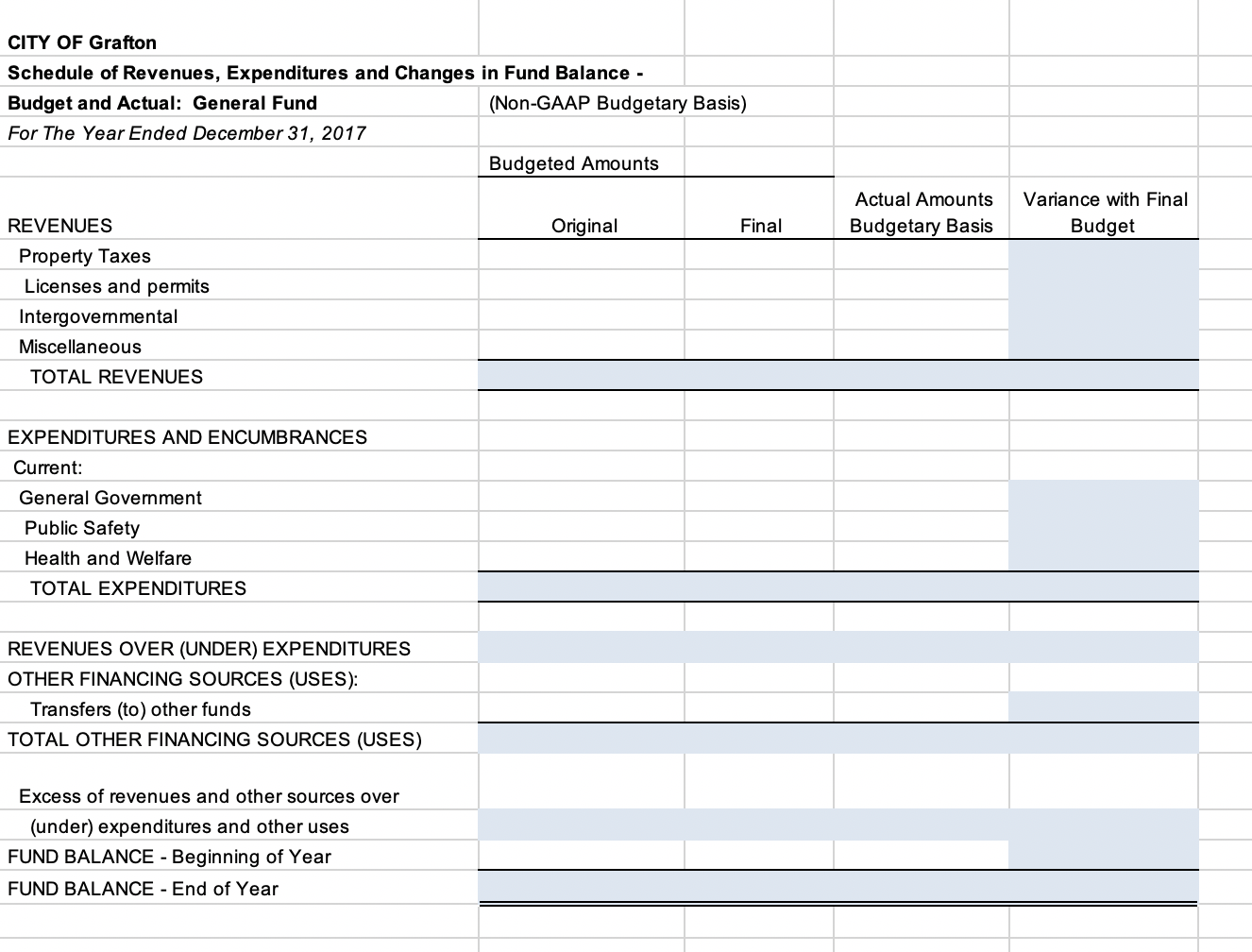

6. Transfer to debt service fund: Page 82 Budget $120,000 Actual 120.000 7. Budget revisions approved by the city council: Estimated revenues: Decrease intergovernmental revenues $10,000 Decrease miscellaneous revenues 3,000 Appropriations: Decrease general government 2,000 8. Total fund balance at July 1, 2016, was $720,000. Required: Use the Excel file provided to prepare a budgetary comparison schedule for the City of Grafton for the fiscal year ended June 30, 2017. Include outstanding encumbrances with expenditures. Use the formula feature (e.g., sum, =, etc.) of Excel to calculate the amounts in cells shaded blue. CITY OF Grafton Schedule of Revenues, Expenditures and Changes in Fund Balance - Budget and Actual: General Fund (Non-GAAP Budgetary Basis) For The Year Ended December 31, 2017 Budgeted Amounts Actual Amounts Budgetary Basis Variance with Final Budget Original Final REVENUES Property Taxes Licenses and permits Intergovernmental Miscellaneous TOTAL REVENUES EXPENDITURES AND ENCUMBRANCES Current: General Government Public Safety Health and Welfare TOTAL EXPENDITURES REVENUES OVER (UNDER) EXPENDITURES OTHER FINANCING SOURCES (USES): Transfers (to) other funds TOTAL OTHER FINANCING SOURCES (USES) Excess of revenues and other sources over (under) expenditures and other uses FUND BALANCE - Beginning of Year FUND BALANCE - End of Year 6. Transfer to debt service fund: Page 82 Budget $120,000 Actual 120.000 7. Budget revisions approved by the city council: Estimated revenues: Decrease intergovernmental revenues $10,000 Decrease miscellaneous revenues 3,000 Appropriations: Decrease general government 2,000 8. Total fund balance at July 1, 2016, was $720,000. Required: Use the Excel file provided to prepare a budgetary comparison schedule for the City of Grafton for the fiscal year ended June 30, 2017. Include outstanding encumbrances with expenditures. Use the formula feature (e.g., sum, =, etc.) of Excel to calculate the amounts in cells shaded blue. CITY OF Grafton Schedule of Revenues, Expenditures and Changes in Fund Balance - Budget and Actual: General Fund (Non-GAAP Budgetary Basis) For The Year Ended December 31, 2017 Budgeted Amounts Actual Amounts Budgetary Basis Variance with Final Budget Original Final REVENUES Property Taxes Licenses and permits Intergovernmental Miscellaneous TOTAL REVENUES EXPENDITURES AND ENCUMBRANCES Current: General Government Public Safety Health and Welfare TOTAL EXPENDITURES REVENUES OVER (UNDER) EXPENDITURES OTHER FINANCING SOURCES (USES): Transfers (to) other funds TOTAL OTHER FINANCING SOURCES (USES) Excess of revenues and other sources over (under) expenditures and other uses FUND BALANCE - Beginning of Year FUND BALANCE - End of Year