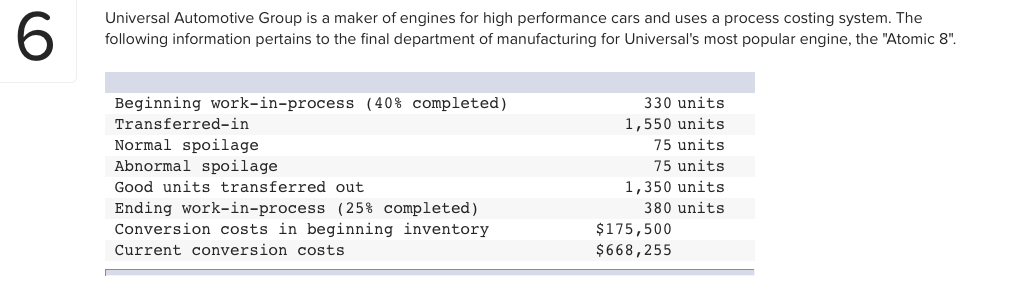

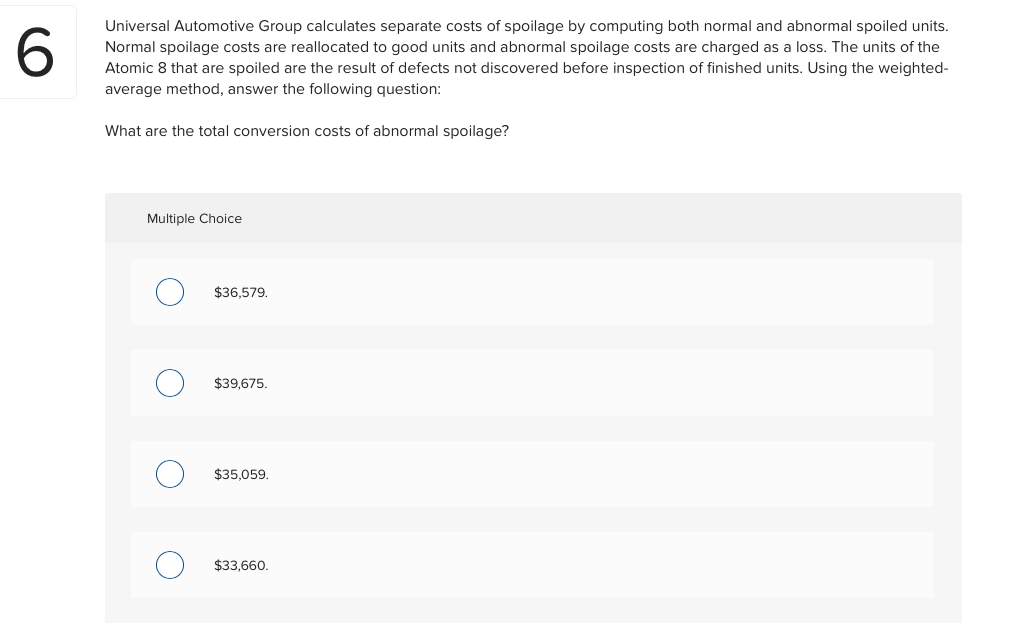

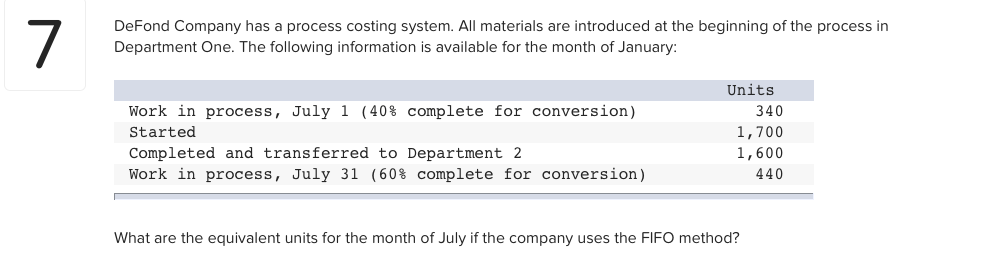

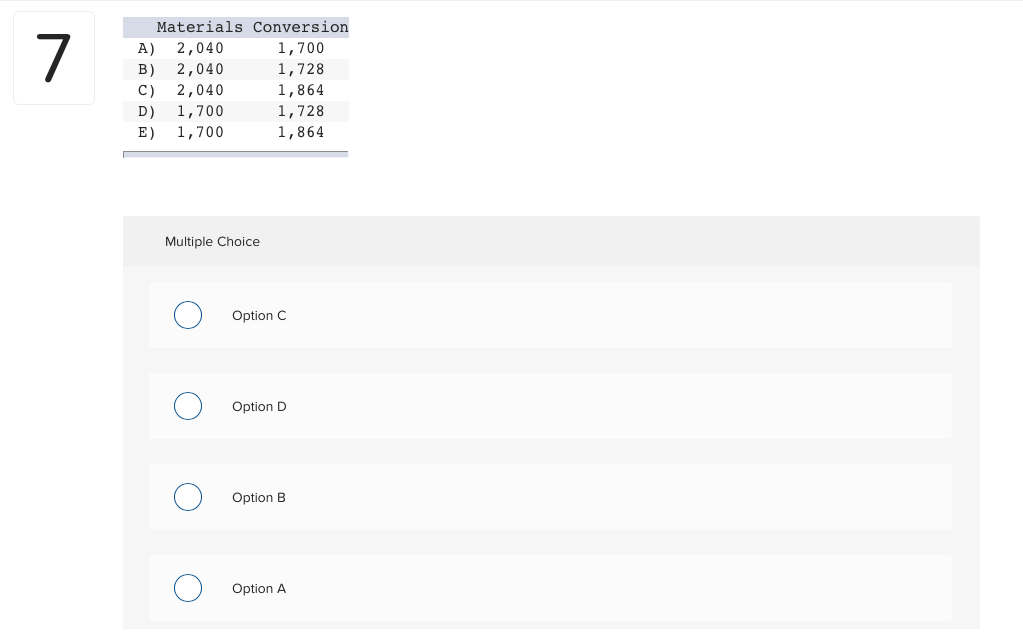

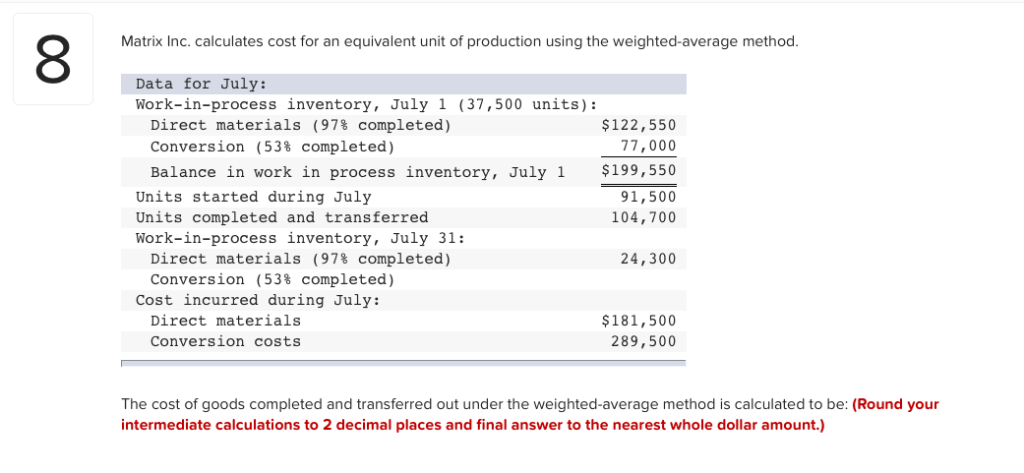

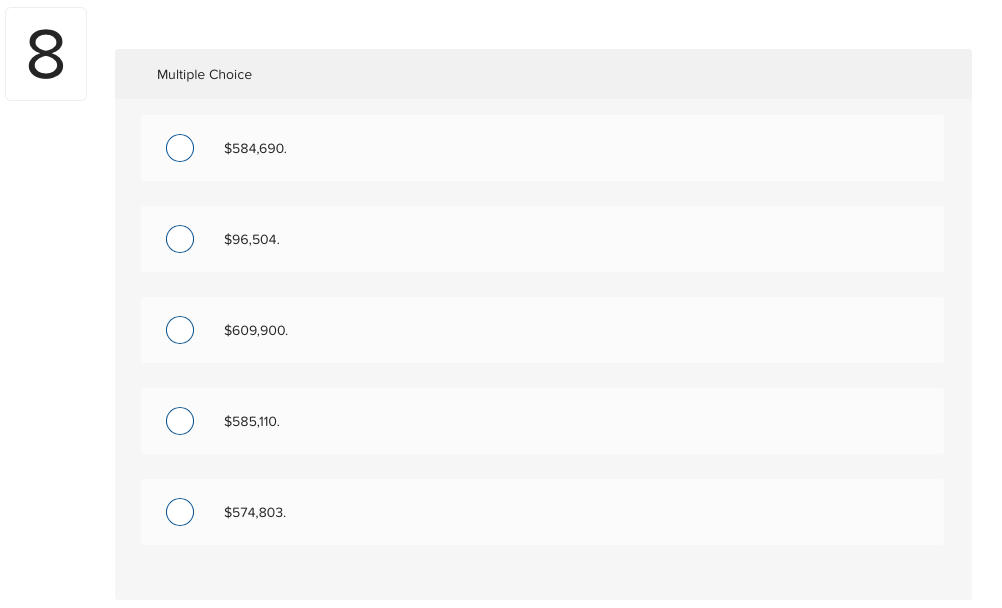

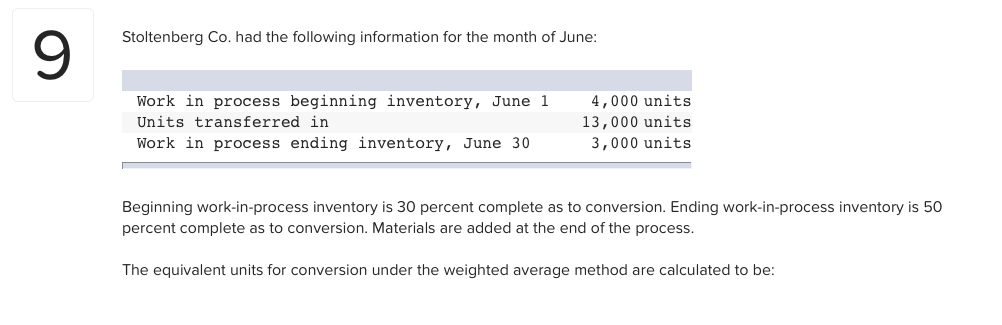

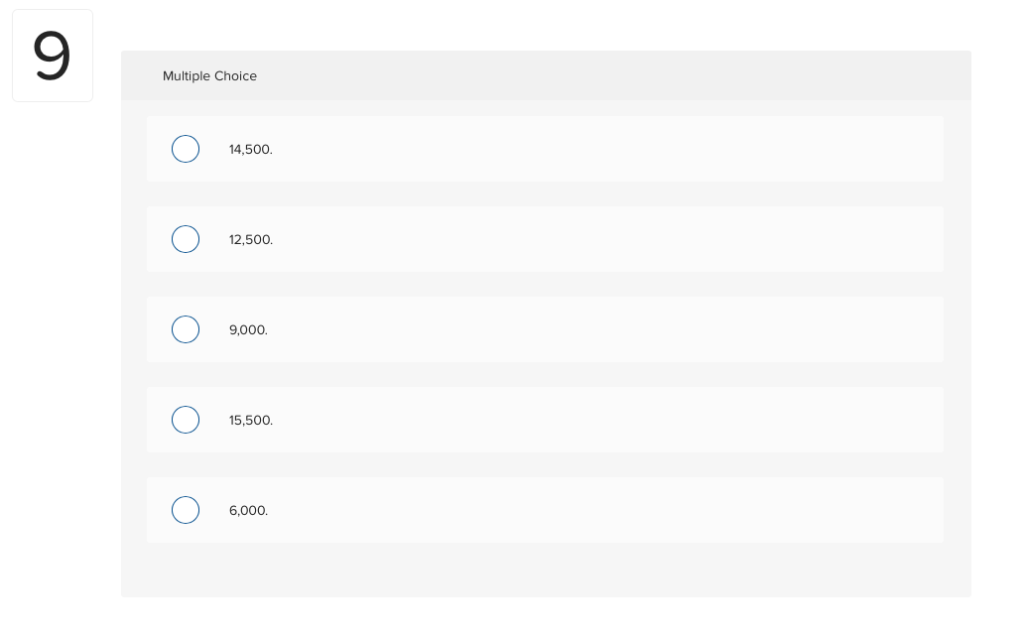

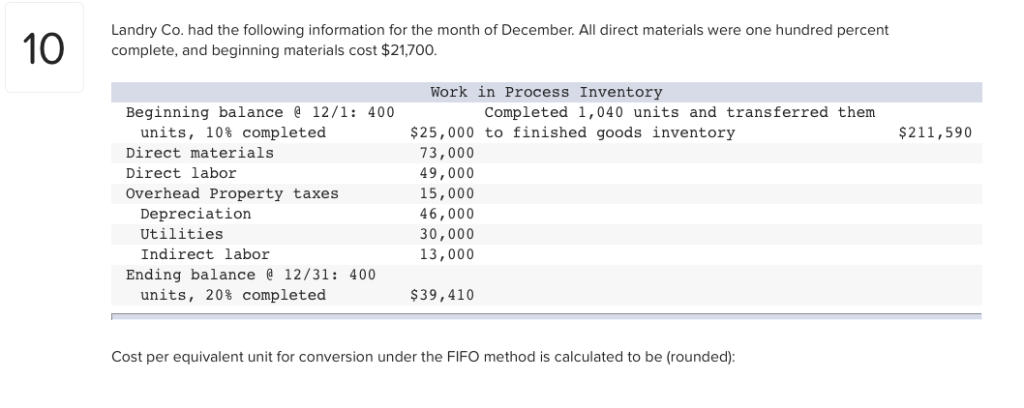

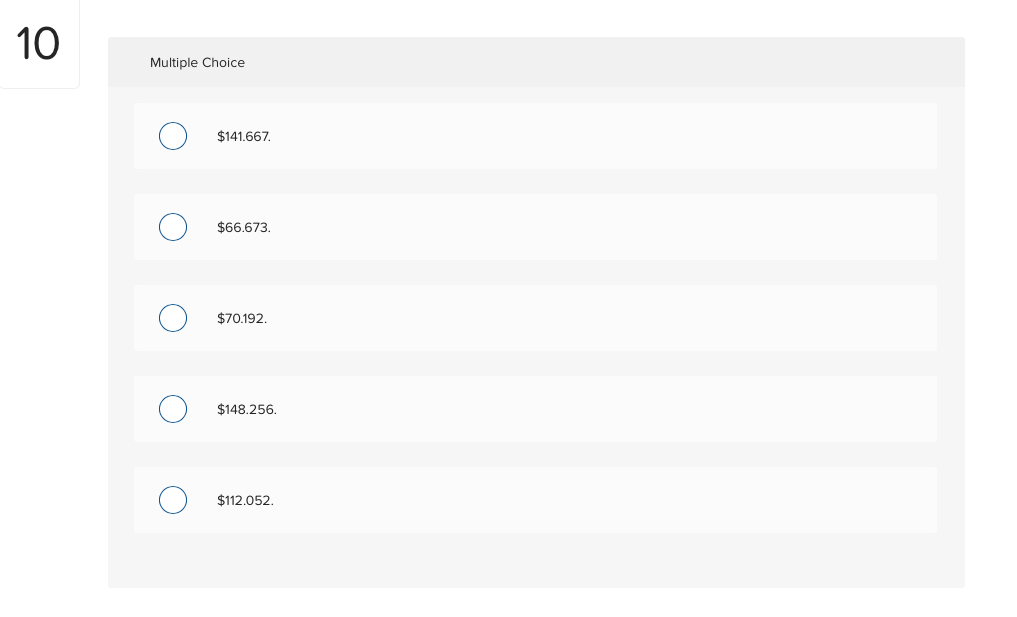

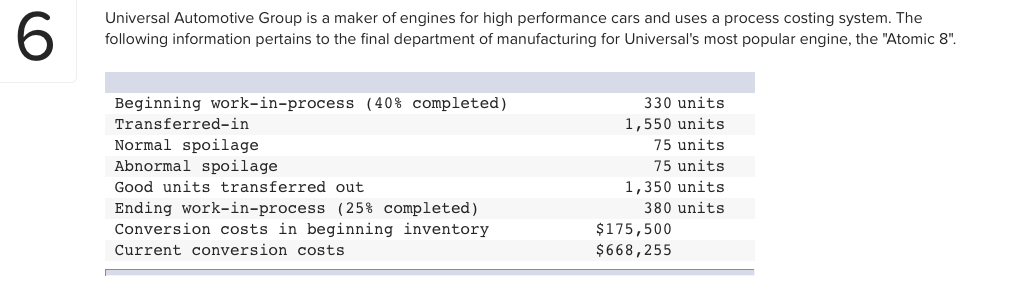

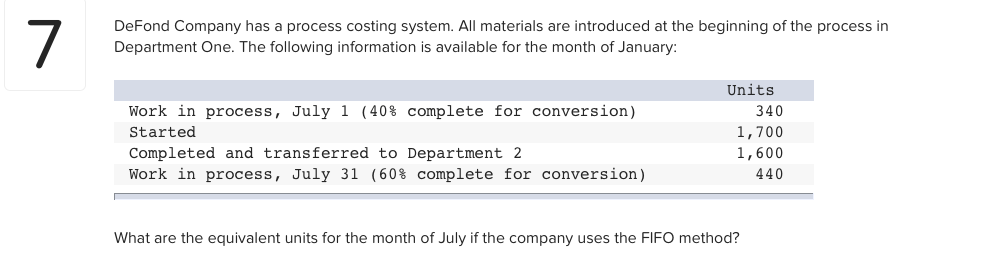

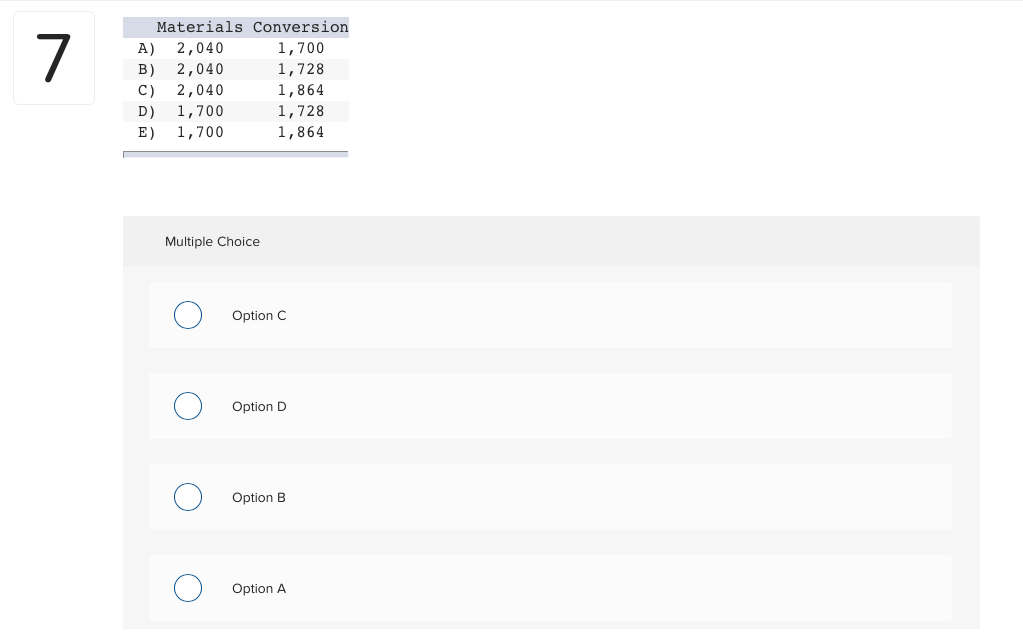

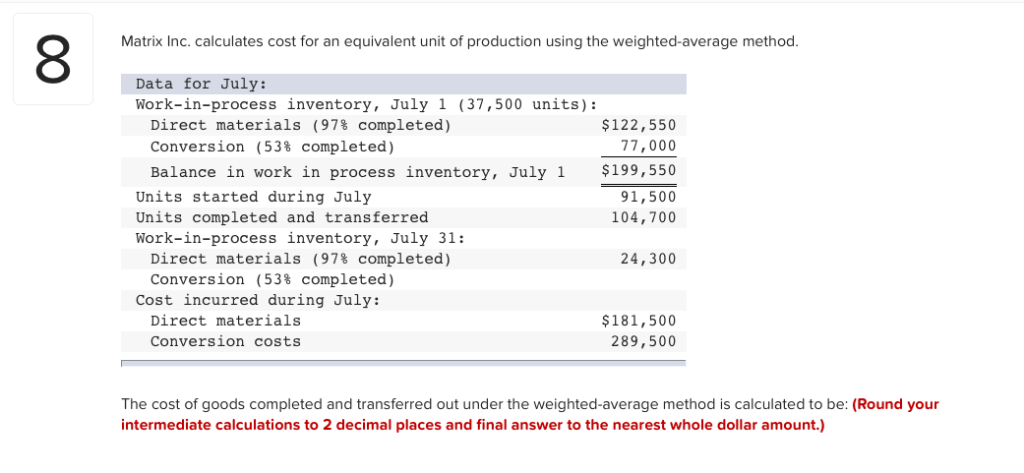

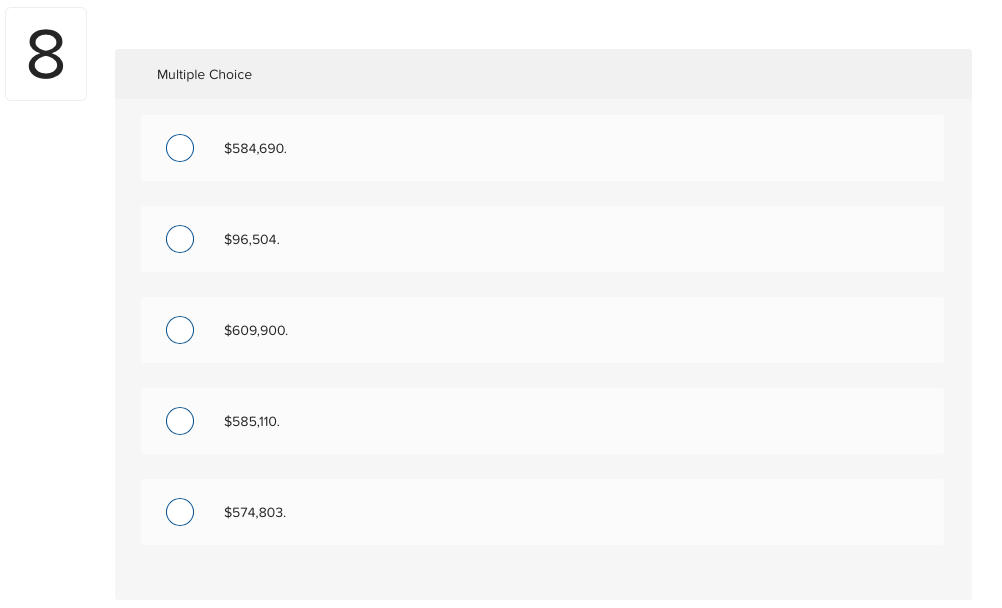

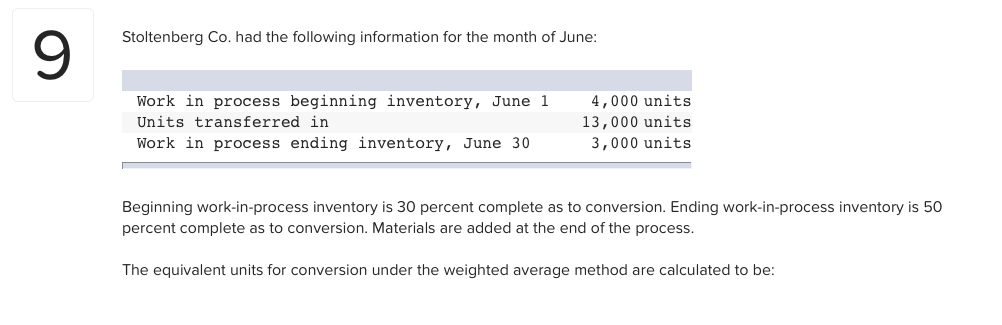

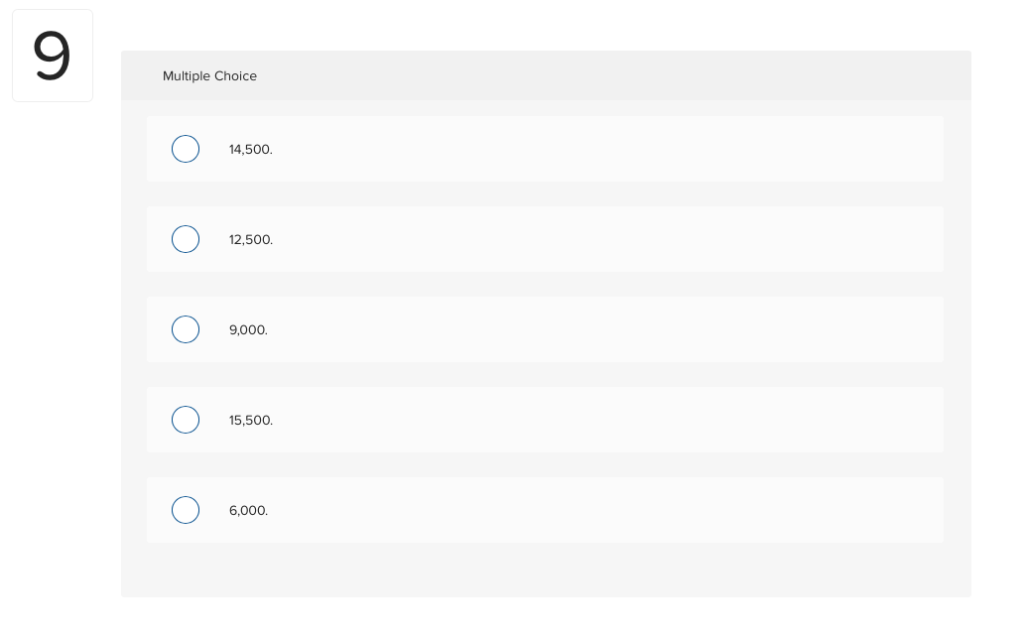

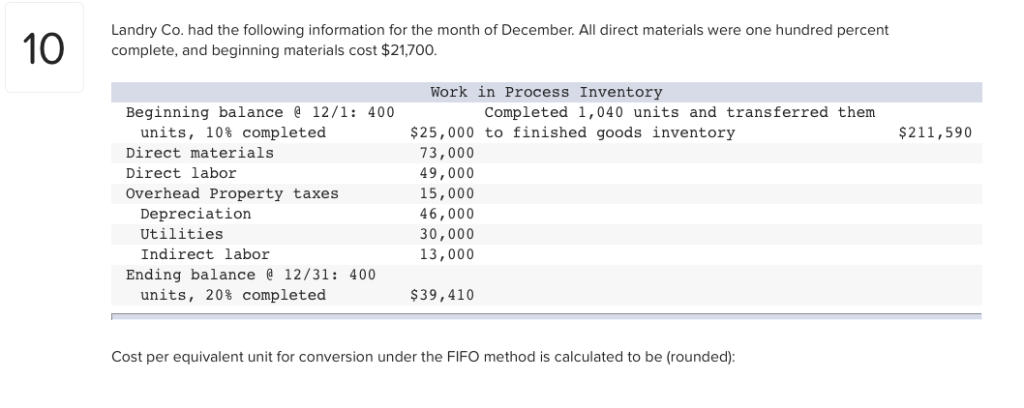

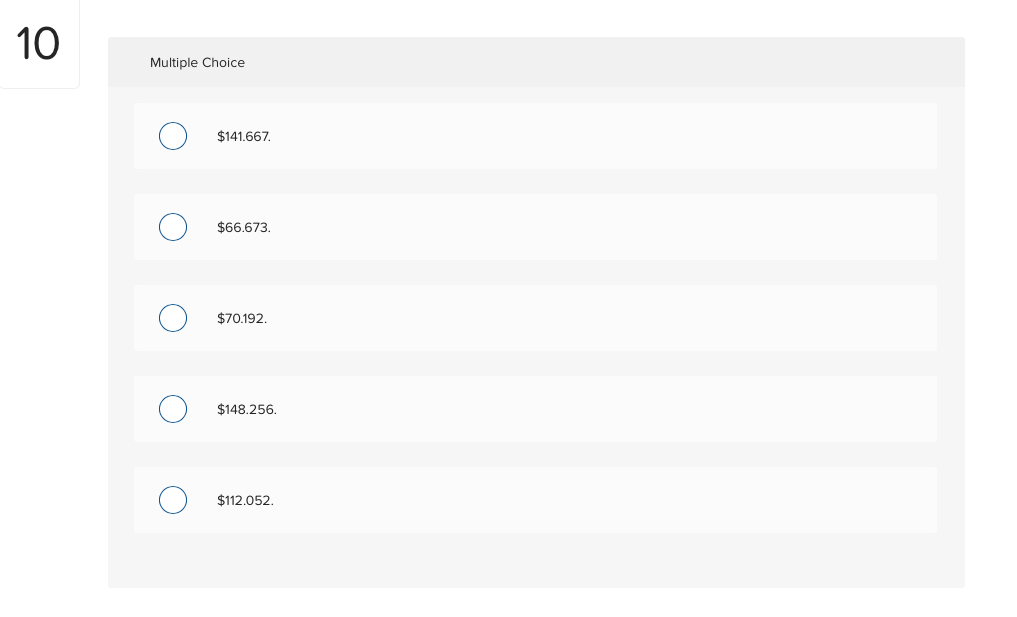

6 Universal Automotive Group is a maker of engines for high performance cars and uses a process costing system. The following information pertains to the final department of manufacturing for Universal's most popular engine, the "Atomic 8". Beginning work-in-process (40% completed) Transferred-in Normal spoilage Abnormal spoilage Good units transferred out Ending work-in-process (25% completed) Conversion costs in beginning inventory Current conversion costs 330 units 1,550 units 75 units 75 units 1,350 units 380 units $175,500 $668,255 6 Universal Automotive Group calculates separate costs of spoilage by computing both normal and abnormal spoiled units. Normal spoilage costs are reallocated to good units and abnormal spoilage costs are charged as a loss. The units of the Atomic 8 that are spoiled are the result of defects not discovered before inspection of finished units. Using the weighted- average method, answer the following question: What are the total conversion costs of abnormal spoilage? Multiple Choice $36,579 $39,675 $35,059 $33,660. DeFond Company has a process costing system. All materials are introduced at the beginning of the process in Department One. The following information is available for the month of January: Units work in process, July 1 (40% complete for conversion) Started Completed and transferred to Department 2 Work in process, July 31 (60% complete for conversion) 340 1,700 1,600 440 What are the equivalent units for the month of July if the company uses the FIFO method? Materials Conversion A) 2,040 B) 2,040 1,728 C) 2,0401,864 D) 1,700 1,728 E) 1,7001,864 1,700 Multiple Choice Option C Option D Option B Option A Option E Matrix Inc. calculates cost for an equivalent unit of production using the weighted-average method Data for July: Work-in-process inventory, July 1 (37,500 units): Direct materials (97% completed) conversion (53% completed) Balance in work in process inventory, July 1 $122,550 77,000 $199,550 91,500 104,700 Units started during July Units completed and transferred Work-in-process inventory, July 31: Direct materials (97% completed) conversion (53% completed) 24,300 Cost incurred during July: Direct materials Conversioncosts $181,500 289,500 The cost of goods completed and transferred out under the weighted-average method is calculated to be: (Round your intermediate calculations to 2 decimal places and final answer to the nearest whole dollar amount.) 8 Multiple Choice $584,690. $96,504 $609,900 $585,110. $574,803. 9 Stoltenberg Co. had the following information for the month of June: Work in process beginning inventory, June 1 Units transferred in Work in process ending inventory, June 30 4,000 units 13,000 units 3,000 units Beginning work-in-process inventory is 30 percent complete as to conversion. Ending work-in-process inventory is 50 percent complete as to conversion. Materials are added at the end of the process The equivalent units for conversion under the weighted average method are calculated to be 9 Multiple Choice 14,500 2,500. 9,000 5,500. 6,000. Landry Co. had the following information for the month of December. All direct materials were one hundred percent complete, and beginning materials cost $21,700. Work in Process Inventory Beginning balance 12/1: 400 Completed 1,040 units and transferred them units, 10% completed Direct materials Direct labor Overhead Property taxes 25,000 to finished goods inventory 73,000 49,000 15,000 46,000 30,000 13,000 $211,590 Depreciation Utilities Indirect labor Ending balance 12/31: 400 units, 20% completed $39,410 Cost per equivalent unit for conversion under the FIFO method is calculated to be (rounded) 10 H.toge Drace Multiple Choice $141.667. $66.673 $70.192 $148.256 $112.052