Answered step by step

Verified Expert Solution

Question

1 Approved Answer

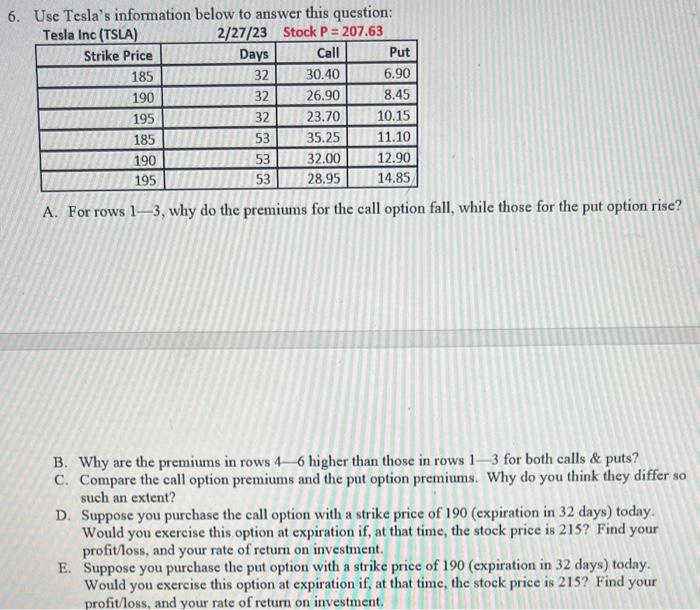

6. Use Tesla's information below to answer this question: Tesla Inc (TSLA) 2/27/23 Stock P = 207.63 Call 30.40 Strike Price Days Put 185

6. Use Tesla's information below to answer this question: Tesla Inc (TSLA) 2/27/23 Stock P = 207.63 Call 30.40 Strike Price Days Put 185 32 6.90 190 32 26.90 8.45 195 32 23.70 10.15 185 53 35.25 11.10 190 53 32.00 12.90 195 53 28.95 14.85 A. For rows 1-3, why do the premiums for the call option fall, while those for the put option rise? B. Why are the premiums in rows 4-6 higher than those in rows 1-3 for both calls & puts? C. Compare the call option premiums and the put option premiums. Why do you think they differ so such an extent? D. Suppose you purchase the call option with a strike price of 190 (expiration in 32 days) today. Would you exercise this option at expiration if, at that time, the stock price is 215? Find your profit/loss, and your rate of return on investment. E. Suppose you purchase the put option with a strike price of 190 (expiration in 32 days) today. Would you exercise this option at expiration if, at that time, the stock price is 215? Find your profit/loss, and your rate of return on investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer A For rows 13 the premiums for the call option fall while those for the put option rise because of changes in the underlying stock price relati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started