Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Company XYZ shares are currently priced in June at 250c a share. You believe that they are currently overvalued and are worth only

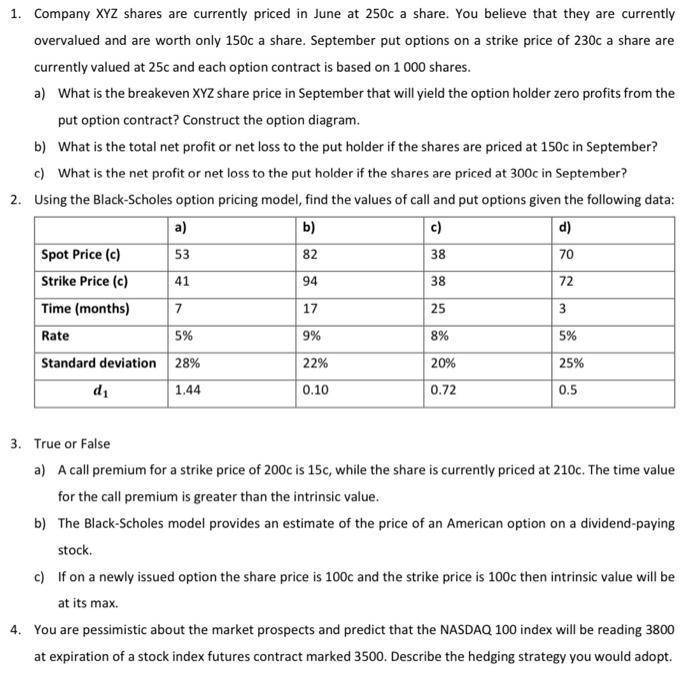

1. Company XYZ shares are currently priced in June at 250c a share. You believe that they are currently overvalued and are worth only 150c a share. September put options on a strike price of 230c a share are currently valued at 25c and each option contract is based on 1 000 shares. a) What is the breakeven XYZ share price in September that will yield the option holder zero profits from the put option contract? Construct the option diagram. b) What is the total net profit or net loss to the put holder if the shares are priced at 150c in September? c) What is the net profit or net loss to the put holder if the shares are priced at 300c in September? 2. Using the Black-Scholes option pricing model, find the values of call and put options given the following data: b) c) 82 38 94 38 17 25 9% 8% 22% 20% 0.10 0.72 Spot Price (c) Strike Price (c) Time (months) Rate a) 53 41 7 5% Standard deviation 28% 1.44 d d) 70 72 3 5% 25% 0.5 3. True or False a) A call premium for a strike price of 200c is 15c, while the share is currently priced at 210c. The time value for the call premium is greater than the intrinsic value. b) The Black-Scholes model provides an estimate of the price of an American option on a dividend-paying stock. c) If on a newly issued option the share price is 100c and the strike price is 100c then intrinsic value will be at its max. 4. You are pessimistic about the market prospects and predict that the NASDAQ 100 index will be reading 3800 at expiration of a stock index futures contract marked 3500. Describe the hedging strategy you would adopt.

Step by Step Solution

★★★★★

3.62 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

1 a To find the breakeven XYZ share price in September that will yield zero profits from the put option contract we need to consider the strike price the premium paid for the put option and the number ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started