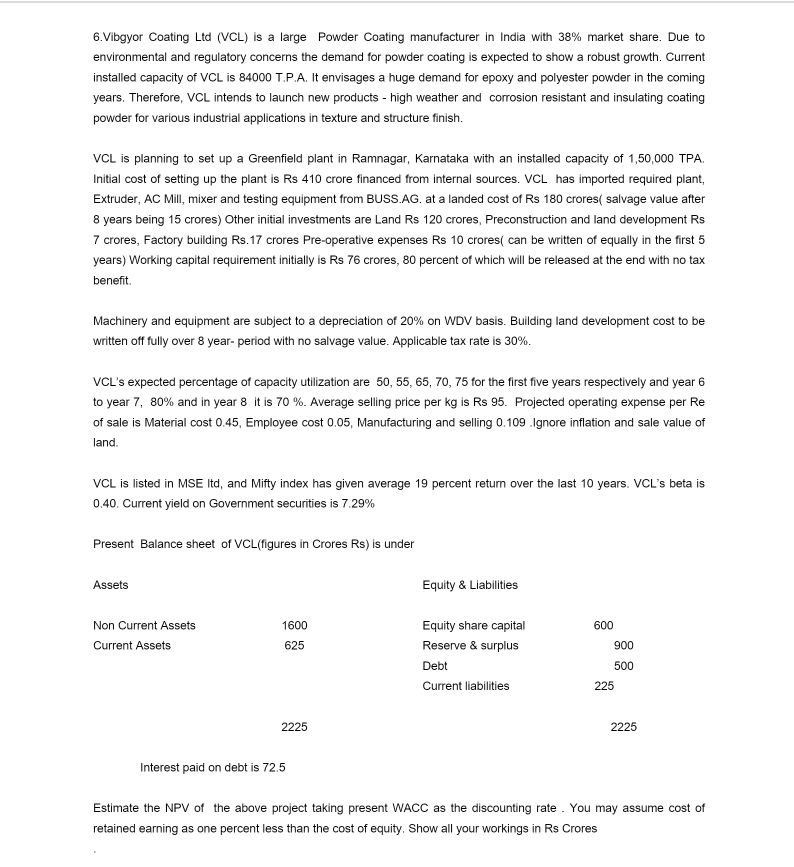

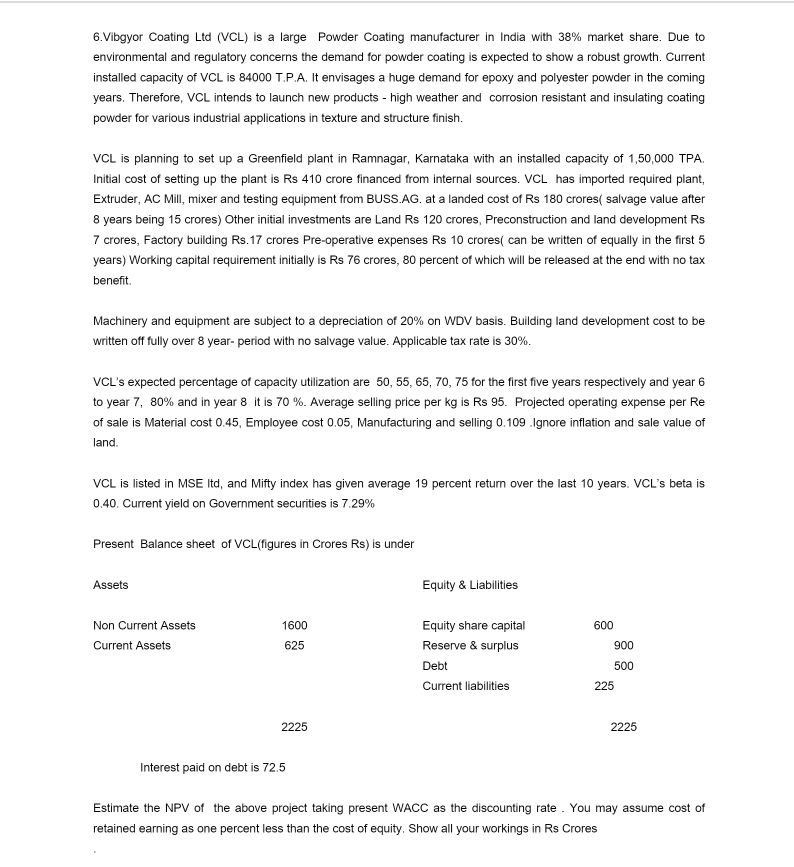

6. Vibgyor Coating Ltd (VCL) is a large Powder Coating manufacturer in India with 38% market share. Due to environmental and regulatory concerns the demand for powder coating is expected to show a robust growth. Current installed capacity of VCL is 84000 L.P.A. It envisages a huge demand for epoxy and polyester powder in the coming years. Therefore, VCL intends to launch new products - high weather and corrosion resistant and insulating coating powder for various industrial applications in texture and structure finish. VCL is planning to set up a Greenfield plant in Ramnagar, Karnataka with an installed capacity of 1,50,000 TPA. Initial cost of setting up the plant is Rs 410 crore financed from internal sources. VCL has imported required plant, Extruder, AC Mill, mixer and testing equipment from BUSS.AG. at a landed cost of Rs 180 crores( salvage value after 8 years being 15 crores) Other initial investments are Land Rs 120 crores, Preconstruction and land development Rs 7 crores, Factory building Rs. 17 crores Pre-operative expenses Rs 10 crores can be written of equally in the first 5 years) Working capital requirement initially is Rs 76 crores, 80 percent of which will be released at the end with no tax benefit Machinery and equipment are subject to a depreciation of 20% on WDV basis. Building land development cost to be written off fully over 8 year- period with no salvage value. Applicable tax rate is 30%. VCL's expected percentage of capacity utilization are 50, 55, 65, 70, 75 for the first five years respectively and year 6 to year 7, 80% and in year 8 it is 70 %. Average selling price per kg is Rs 95. Projected operating expense per Re of sale is Material cost 0.45, Employee cost 0.05, Manufacturing and selling 0.109.Ignore inflation and sale value of land. VCL is listed in MSE Itd, and Mifty index has given average 19 percent return over the last 10 years. VCL's beta is 0.40. Current yield on Government securities is 7.29% Present Balance sheet of VCL(figures in Crores Rs) is under Assets Equity & Liabilities 600 Non Current Assets Current Assets 1600 625 Equity share capital Reserve & surplus 900 Debt 500 225 Current liabilities 2225 2225 Interest paid on debt is 72.5 Estimate the NPV of the above project taking present WACC as the discounting rate. You may assume cost of retained earning as one percent less than the cost of equity. Show all your workings in Rs Crores 6. Vibgyor Coating Ltd (VCL) is a large Powder Coating manufacturer in India with 38% market share. Due to environmental and regulatory concerns the demand for powder coating is expected to show a robust growth. Current installed capacity of VCL is 84000 L.P.A. It envisages a huge demand for epoxy and polyester powder in the coming years. Therefore, VCL intends to launch new products - high weather and corrosion resistant and insulating coating powder for various industrial applications in texture and structure finish. VCL is planning to set up a Greenfield plant in Ramnagar, Karnataka with an installed capacity of 1,50,000 TPA. Initial cost of setting up the plant is Rs 410 crore financed from internal sources. VCL has imported required plant, Extruder, AC Mill, mixer and testing equipment from BUSS.AG. at a landed cost of Rs 180 crores( salvage value after 8 years being 15 crores) Other initial investments are Land Rs 120 crores, Preconstruction and land development Rs 7 crores, Factory building Rs. 17 crores Pre-operative expenses Rs 10 crores can be written of equally in the first 5 years) Working capital requirement initially is Rs 76 crores, 80 percent of which will be released at the end with no tax benefit Machinery and equipment are subject to a depreciation of 20% on WDV basis. Building land development cost to be written off fully over 8 year- period with no salvage value. Applicable tax rate is 30%. VCL's expected percentage of capacity utilization are 50, 55, 65, 70, 75 for the first five years respectively and year 6 to year 7, 80% and in year 8 it is 70 %. Average selling price per kg is Rs 95. Projected operating expense per Re of sale is Material cost 0.45, Employee cost 0.05, Manufacturing and selling 0.109.Ignore inflation and sale value of land. VCL is listed in MSE Itd, and Mifty index has given average 19 percent return over the last 10 years. VCL's beta is 0.40. Current yield on Government securities is 7.29% Present Balance sheet of VCL(figures in Crores Rs) is under Assets Equity & Liabilities 600 Non Current Assets Current Assets 1600 625 Equity share capital Reserve & surplus 900 Debt 500 225 Current liabilities 2225 2225 Interest paid on debt is 72.5 Estimate the NPV of the above project taking present WACC as the discounting rate. You may assume cost of retained earning as one percent less than the cost of equity. Show all your workings in Rs Crores