Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6) What is the amount of the adjusting entry? 7) After making the adjusting entry, what is the Allowance for Bad Debts account balance as

6) What is the amount of the adjusting entry?

7) After making the adjusting entry, what is the Allowance for Bad Debts account balance as of Dec.31?

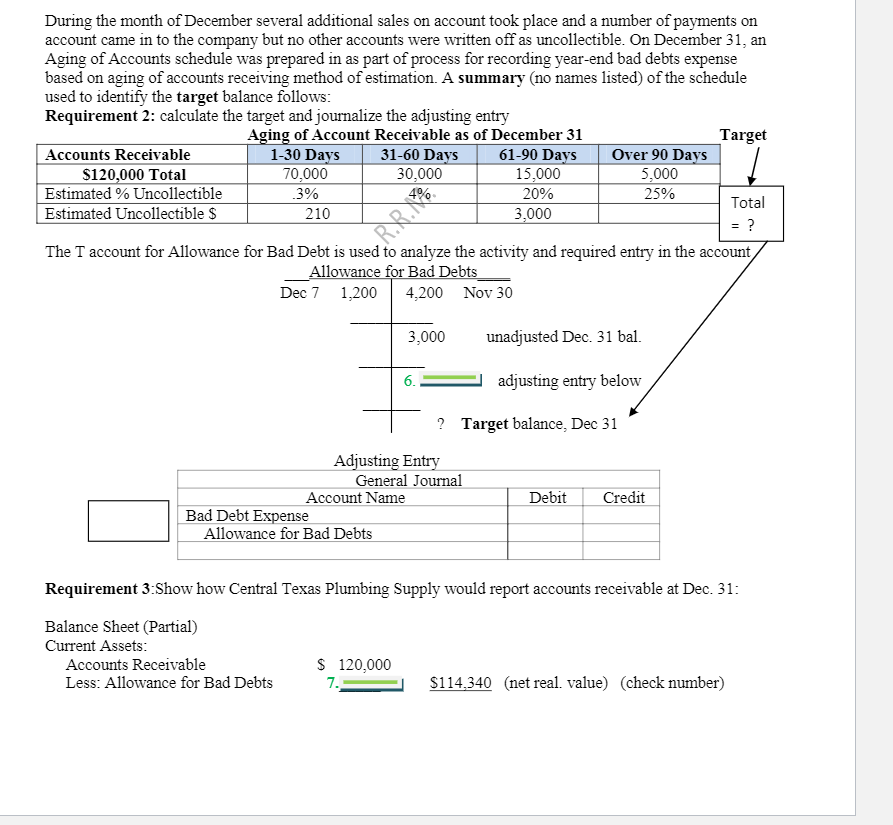

During the month of December several additional sales on account took place and a number of payments on account came in to the company but no other accounts were written off as uncollectible. On December 31, an Aging of Accounts schedule was prepared in as part of process for recording year-end bad debts expense based on aging of accounts receiving method of estimation. A summary (no names listed) of the schedule used to identify the target balance follows: Requirement 2: calculate the target and journalize the adjusting entry Aging of Account Receivable as of December 31 Target Accounts Receivable 1-30 Days 31-60 Days 61-90 Days Over 90 Days $120,000 Total 70,000 30,000 15,000 5,000 Estimated % Uncollectible .3% 20% 25% Total Estimated Uncollectible $ 210 3,000 = ? The T account for Allowance for Bad Debt is used to analyze the activity and required entry in the account Allowance for Bad Debts Dec 7 1.200 4,200 Nov 30 RR. MED 3,000 unadjusted Dec. 31 bal. 6. adjusting entry below ? Target balance, Dec 31 Adjusting Entry General Journal Account Name Debit Credit Bad Debt Expense Allowance for Bad Debts Requirement 3: Show how Central Texas Plumbing Supply would report accounts receivable at Dec. 31: Balance Sheet (Partial) Current Assets: Accounts Receivable Less: Allowance for Bad Debts $ 120,000 7. $114.340 (net real. value) (check number)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started