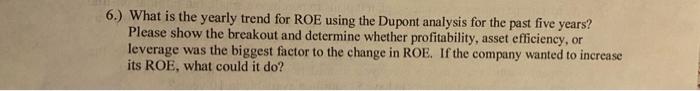

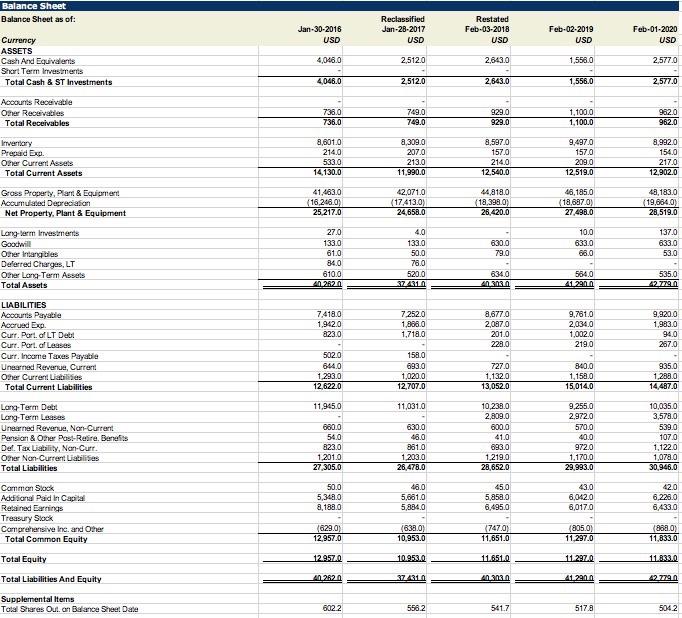

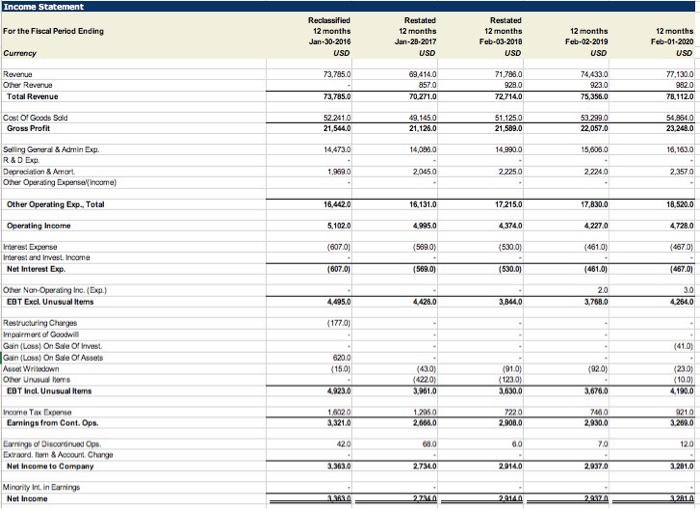

6.) What is the yearly trend for ROE using the Dupont analysis for the past five years? Please show the breakout and determine whether profitability, asset efficiency, or leverage was the biggest factor to the change in ROE. If the company wanted to increase its ROE, what could it do? Balance Sheet Balance Sheet as of: Reclassified Jan-28-2017 USD Jan-30-2016 USD Restated Feb-03-2018 USD Feb-01-2020 Feb-02-2019 USD USD Currency ASSETS Cash And Equivalents Short Term Investments Total Cash & ST Investments 4,046,0 2,512.0 2,643.0 1,558.0 2,5770 4,046.0 2.512.0 2,643.0 1,556.0 2.577.0 Accounts Receivable Other Receivables Total Receivables 738,0 736.0 749.0 749.0 929.0 929.0 1,100.0 1,100.0 982.0 962.0 Inventory Prepaid Exp Omer Current Assets Total Current Assets 8,601,0 214,0 533.0 14,130.0 8,309.0 2070 213.0 11,990.0 8,5970 157.0 214.0 12,540.0 9,497.0 157.0 209,0 12,519,0 8,992.0 154.0 217.0 12.902.0 Gross Property, Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment 41.463.0 (16.248.0) 25.217.0 42,071.0 (17,413.0) 24,658.0 44,818.0 (18,398.0) 26.420.0 46,185.0 (18,6970) 27.498.0 48,183.0 (19.664.0) 28.519.0 630.0 79.0 Long-term investments Goodwill Other Intangibles Deferred Charges, LT Omer Long Term Assets Total Assets 4.0 133.0 50.0 78.0 520.0 137.0 633.0 53.0 27.0 133.0 61.0 84.0 610.0 402621 10.0 633.0 68.0 - 564,0 412200 - 6340 0303 535.0 A277190 7.418.0 1,942.0 223.0 7.252.0 1,368,0 1,718.0 LIABILITIES Accounts Payable Accrued Exp. Curr. Port of LT Deb! Curr. Portal Leases Curr. Income Taxes Payable Unearned Revenue, Current Oher Current Ladies Total Current Liabilities 8,6770 2,087.0 201.0 228.0 9,781.0 2,034.0 1,002.0 219,0 9,920.0 1,983.0 94.0 267.0 502.0 644.0 1.293.0 12,622.0 158.0 693.0 1,020.0 12,707.0 727.0 1,132.0 13,052.0 840,0 1,158.0 15,014.0 935.0 1,2830 14,487.0 11,945,0 11,031,0 Long-Term Debt Long-Term Leases Unearned Revenue, Non-Current Pension & Omer Pas-Reira, Banats Del. Tax Liability. Non-Curr. Other Non-Current Liabilities Total Liabilities 650.0 54.0 823.0 1.2010 27,305.0 630.0 48.0 881.0 1.203.0 26.478.0 10,238.0 2.809.0 600.0 41.0 693.0 1.219.0 28,652.0 9.255.0 2.972.0 570.0 40.0 972.0 1.170.0 29,993.0 10,035.0 3,578.0 539.0 1070 1,122.0 1,078,0 30,946.0 50.0 5,348.0 8,188.0 48.0 5,061.0 5.884.0 45.0 5,853.0 6.495.0 42.0 6,228.0 6,433.0 Common Slack Additional Paid in Capital Retained Earnings Treasury Stock Comprehensive Inc. and Other Total Common Equity 43.0 6,042.0 6,017.0 - (2050) 11.297.0 (629.0) 12.957.0 638,0) 10,953.0 (747.0) 11.651.0 (888.0) 11.833.0 Total Equity 12.957.0 10.9520 11.051.0 11. 2070 11.8330 Total Liabilities And Equity 40.262 37 4310 10.303.0 412200 4277 Supplemental Items Total Shares Out. on Balance Shee! Date 6022 5562 541.7 517.8 5042 Income Statement For the Fiscal Period Ending Reclassified 12 months Jan-30-2016 USD Restated 12 months Jan-20-2017 USO Restated 12 months Feb-03-2010 USD 12 months Feb-02-2019 USD 12 months Feb-01-2020 USD Currency 73,7850 Revenue Other Revenue Total Revenue 69,414,0 8570 70.271.0 71.788.0 9280 72.714.0 74433.0 9230 75,356.0 77,130.0 982.0 78.112.0 73.785.0 Cost Of Goods Sold Gross Profit 52.2410 21,544.0 19.145.0 21,126.0 51.125.0 21,589.0 53.299.0 22.057.0 54,8540 23.248.0 14.4730 14.00.0 14.990.0 15,6080 18,163.0 1.9690 2.0.5.0 22250 2.2240 2.3570 16,4420 16.131.0 17.215.0 17,830.0 18.520.0 Selling General Admin Exp. R&D EXO Depreciation & Amor Other Operating persa income Other Operating Exp. Total Operating Income Interest Expense Interest and Invest. Income Net Interest Exp. Other Non-Operating Inc. (Exp.) EOT Excl. Unusual terms 5.1020 4,995.0 4374,0 4.227.0 4.728.0 (607.01 (5990) 5300) (4610) (4670) (607.01 (569.0) (530.01 (461.0) (467.0) 20 3.768.0 30 4.254.0 4,495.0 4.420.0 3.844.0 (1770) (410 Restructuring Charges Implement of cowill Gain (Loss) On Sale Of Invest Gun (L018) On Sale Of Asset Ass Windown Other Unud EDT incl. Unusual Items 6200 (15.0) (92.0) (430) (4220) 379610 (910) (123.0) 630.0 (230) (100) 4.190.0 492370 3,676.0 Income Tax Earnings from Cont. Ops. 10020 3.321.0 1 2050 2.661.0 7220 2.900.0 7400 2,930.0 9210 3.260.0 00 70 120 2.3636 2.7310 2014.0 2.9370 1.261.0 Larning Disorded Ope Extraord. Tom & Account Change Not Income to Company Minority in Earnings Net Income 21 2014 22:12 12