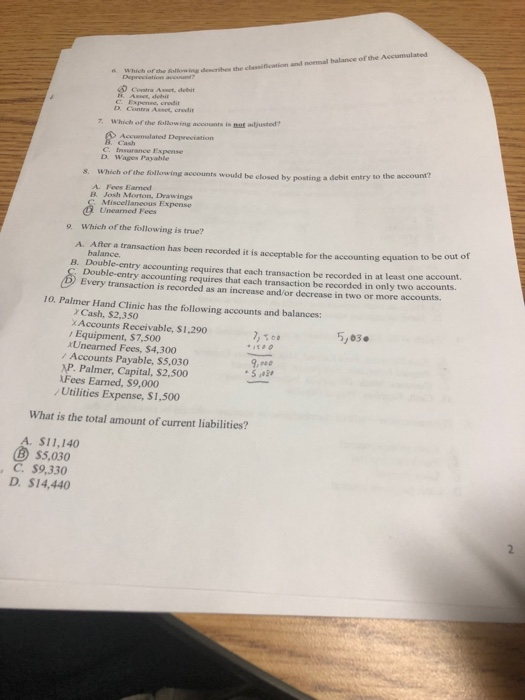

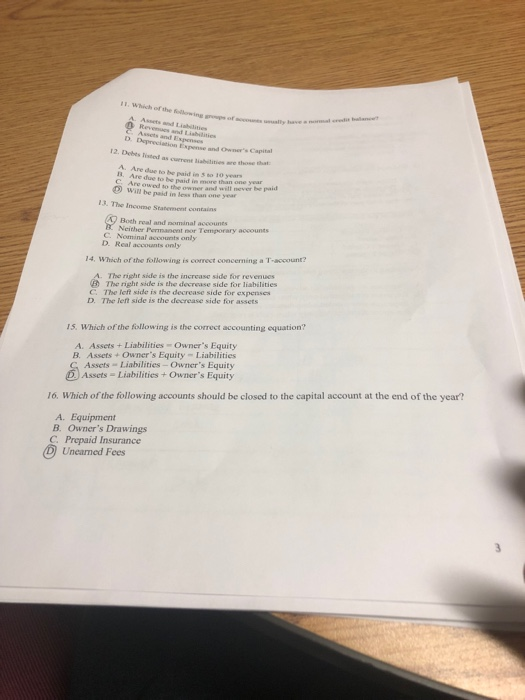

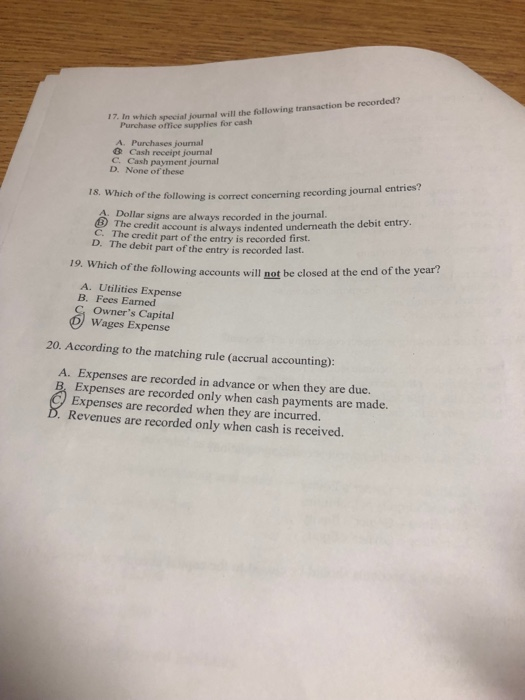

6 Which of he Bline describes the classification and normal balance of the Accumulated D Contra Asset, credit 7 Which of the foflowing accounts is not adjusted Accuemalated Depreciation C. Insurance Exponse D. Waes Payable s. Which of the Bollowing accounts would be closed by posting a debit entry to the account? A. Fees Earned B. Josh Morton, Drawings Miscellaneous Expense Uneamed Fees 9 Which of the following is true? After a transaction has been recorded it is acceptable for the accounting equation to be out o A. balance Double-entry accounting requires that each transaction be recorded in at least one account. Double-entry accounting requires that each transaction be recorded in only two accounts. Every transaction is recorded as an increase and/or decrease in two or more accounts. B. 10. Palmer Hand Clinic has the following accounts and balances: Cash, S2,350 Accounts Receivable, S 1,290 Equipment, $7,500 ,so 5,03. xUnearned Fees, $4,300 / Accounts Payable, $5,030 XP. Palmer, Capital, $2,500 Fees Earned, $9,000 Utilities Expense, $1,500 What is the total amount of current liabilities? A. $11,140 B$5,030 C. $9,330 D. $14,440 1. Which of the folowing g D. Depreciation Expense and Ownes Capital 12. Debts listed as current liabilities are those that Ii. Are due to be paid in more than one Are owed to win be paid in less than one year will never be paid 1.3. The Income Statement contains Both real and nominal accounes Neither Permanent or Temporary accounts C. Nominal accounts only D. Real accounts only 14, Which of the folowing is conrect concerning a T-account? The right side is the increase side for revenues The right side is the decrease side for liabilities C. The left side is the decrease side for expenses D. The left side is the decrease side for assets 1S. Which of the following is the correct accounting equation? A. Assets+ Liabilities Owner's Equity B. Assets Owner's Equity Liabilities Assets -Liabilities -Owner's Equity Assets-Liabilities+ Owner's Equity 16. Which of the following accounts should be closed to the capital account at the end of the year? A. Equipment B. Owner's Drawings C Prepaid Insurance Unearned Fees u whch special journal will the following transaction be recorded? Purchase office supplies for cash A. Purchases journal & Cash receipt joumal C. Cash payment journal D. None of these 18. Which of the following is correct concerning recording journal entries? A Dollar signs are always record led in the journal. credit account is always indented underneath the debit entry. C. The credit part of the entry is recorded first. D. The debit part of the entry is recorded last. 19. Which of the following accounts will nat be closed at the end of the year? A. Utilities Expense B. Fees Earned Owner's Capital Wages Expense 20. According to the matching rule (accrual accounting): A. Expenses are recorded in advance or when they are due. Expenses are recorded only when cash payments are made. Expenses are recorded when they are incurred. Revenues are recorded only when cash is received