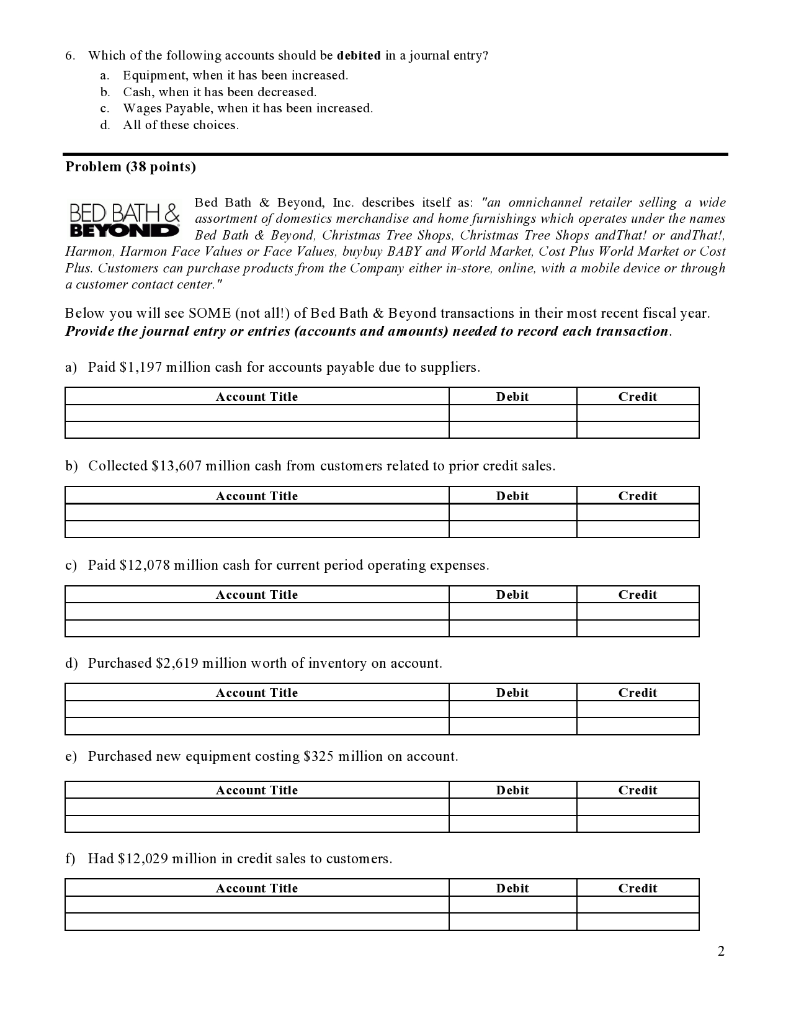

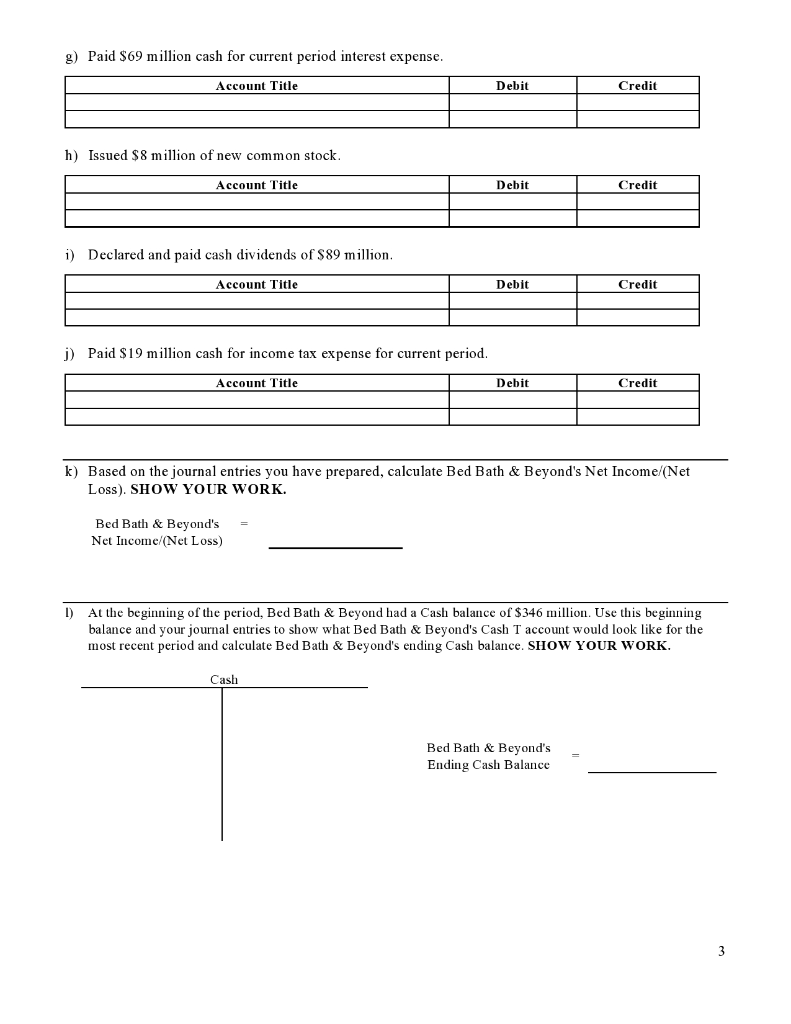

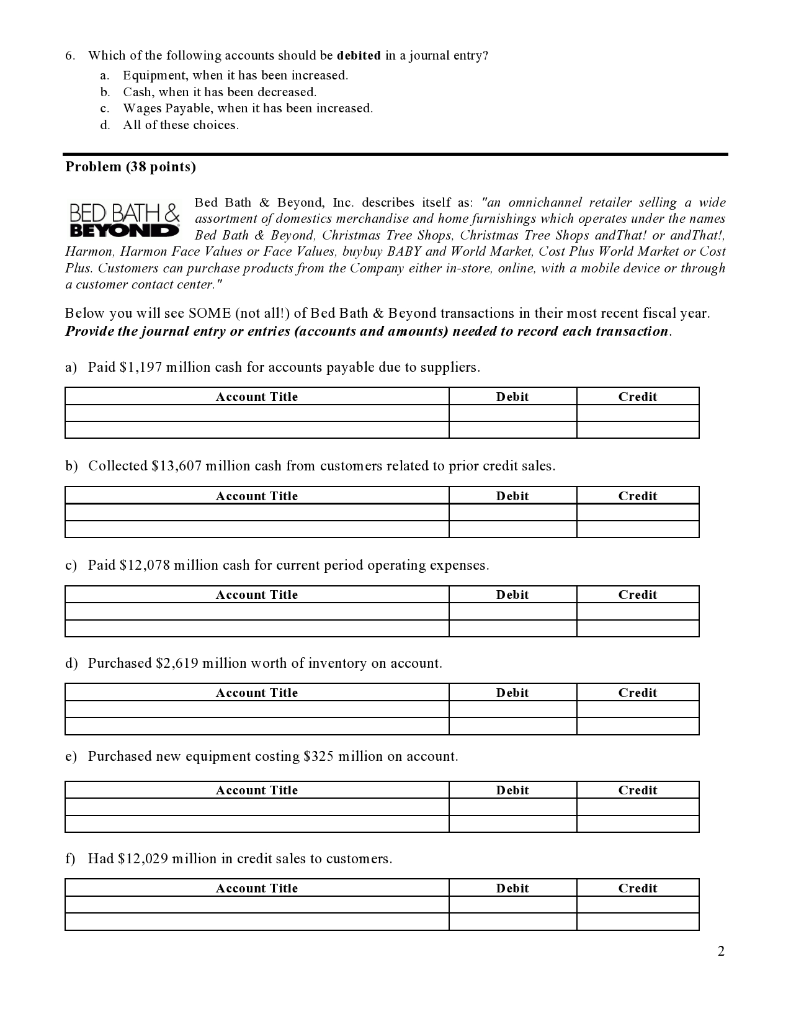

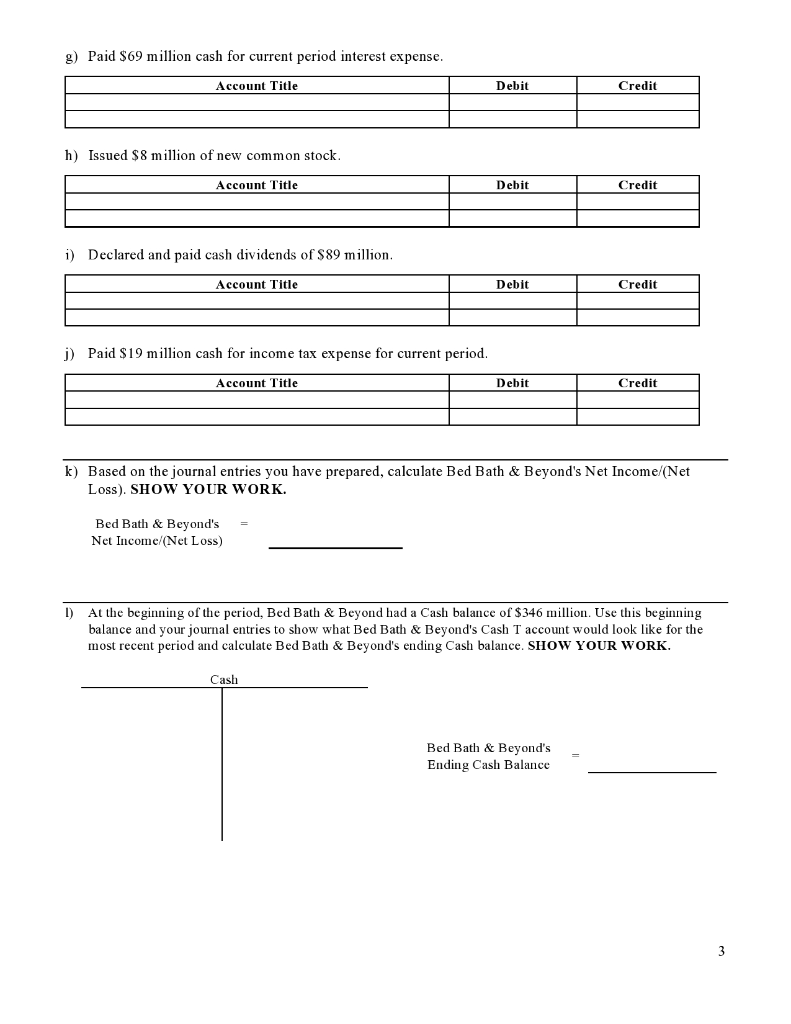

6. Which of the following accounts should be debited in a journal entry? a. Equipment, when it has been increased. b. Cash, when it has been decreased. c. Wages Payable, when it has been increased. d. All of these choices. Problem (38 points) o Bed Bath & Beyond, Inc, describes itself as: "an omnichannel retailer selling a wide DEL DALMa assortment of domestics merchandise and home furnishings which operates under the names BED BATH & BEYOND Bed Bath & Beyond, Christmas Tree Shops, Christmas Tree Shops and That! or and That!, Harmon, Harmon Face Values or Face Values, buybuy BABY and World Market, Cost Plus World Market or Cost Plus, Customers can purchase products from the Company either in-store, online, with a mobile device or through a customer contact center." Below you will see SOME (not all!) of Bed Bath & Beyond transactions in their most recent fiscal year. Provide the journal entry or entries (accounts and amounts) needed to record each transaction. a) Paid $1,197 million cash for accounts payable due to suppliers. Account Title Debit Credit b) Collected $13,607 million cash from customers related to prior credit sales. Account Title Debit c) Paid $12,078 million cash for current period operating expenses. Account Title Debit Credit d) Purchased $2,619 million worth of inventory on account. Account Title Debit Credit e) Purchased new equipment costing $325 million on account. Account Title Debit Credit f) Had $12,029 million in credit sales to customers. Account Title Debit Credit g) Paid $69 million cash for current period interest expense. Account Title Debit Credit h) Issued $ 8 million of new common stock Account Title - Debit T Credit i) Declared and paid cash dividends of $89 million. Account Title Debit Credit j) Paid $19 million cash for income tax expense for current period. Account Title Debit Credit k) Based on the journal entries you have prepared, calculate Bed Bath & Beyond's Net Income (Net Loss). SHOW YOUR WORK. Bed Bath & Beyond's Net Income/(Net Loss) At the beginning of the period, Bed Bath & Beyond had a Casli balance of $346 million. Use this beginning balance and your journal entries to show what Bed Bath & Beyond's Cash T account would look like for the most recent period and calculate Bed Bath & Beyond's ending Cash balance. SHOW YOUR WORK. Cash Bed Bath & Beyond's Ending Cash Balance