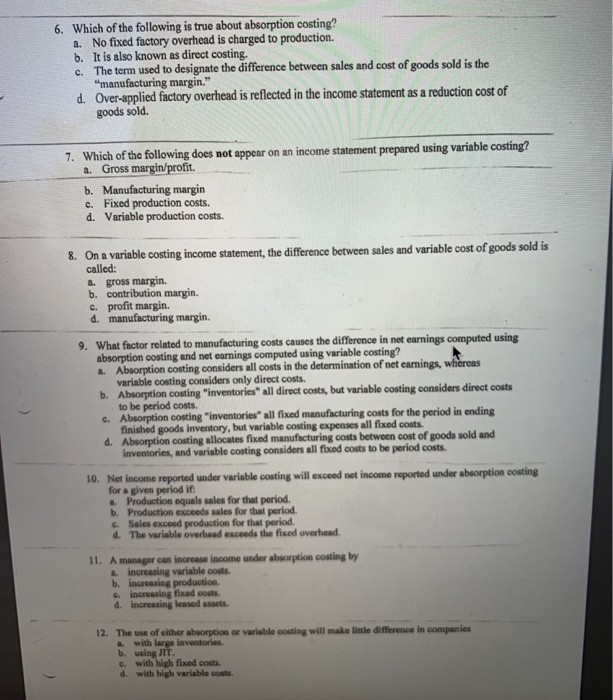

6. Which of the following is true about absorption costing? a. No fixed factory overhead is charged to production. b. It is also known as direct costing. C. The term used to designate the difference between sales and cost of goods sold is the "manufacturing margin." d. Over-applied factory overhead is reflected in the income statement as a reduction cost of goods sold. 7. Which of the following does not appear on an income statement prepared using variable costing? a. Gross margin/profit. b. Manufacturing margin c. Fixed production costs. d. Variable production costs. 8. On a variable costing income statement, the difference between sales and variable cost of goods sold is called: a. gross margin. b. contribution margin. c. profit margin. d. manufacturing margin. 9. What factor related to manufacturing costs causes the difference in net earnings computed using absorption costing and net earnings computed using variable costing? Absorption costing considers all costs in the determination of net earnings, whereas variable costing considers only direct costs. b. Absorption costing "inventories" all direct costs, but variable costing considers direct costs to be period costs. Absorption costing "inventories" all fixed manufacturing costs for the period in ending finished goods inventory, but variable costing expenses all fixed costs. d. Absorption costing allocates fixed manufacturing costs between cost of goods sold and inventories, and variable costing considers all fixed costs to be period costs. 10. Net income reported under variable costing will exceed net income reported under absorption costing for a given period if . Production equals sales for that period. b. Production exceeds sales for that period. c. Sales exceed production for that period. d. The variable overhead exceeds the fixed overhead 11. A manager can increase income under absorption costing by increasing variable costs. b. increasing production o increasing fixed costs. d. increasing leased assets. 12. The use of either absorption or variable costing will make little difference in companies with large inventories. b. using JIT. c. with high fixed costs. d. with high variable costs