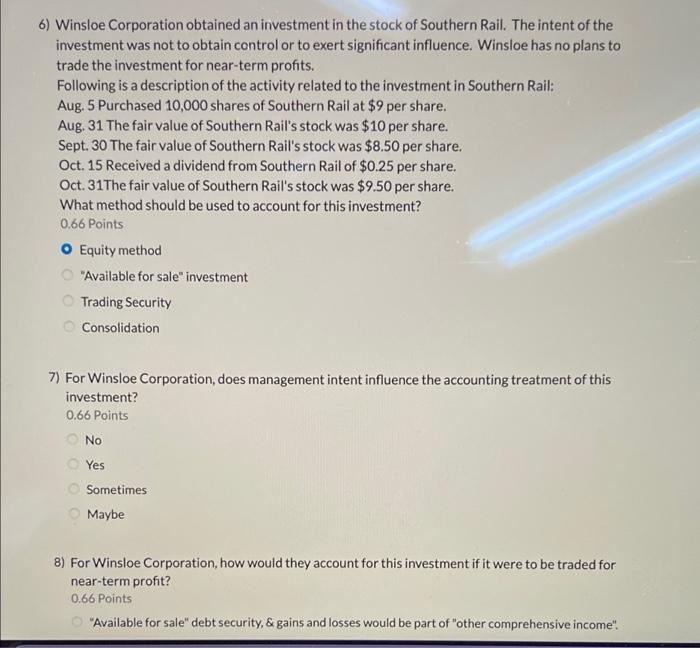

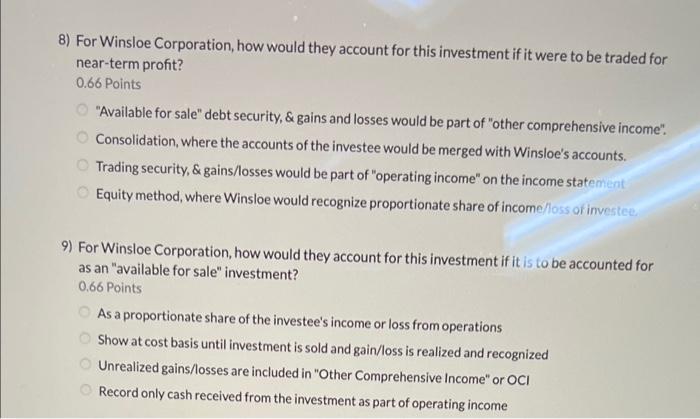

6) Winsloe Corporation obtained an investment in the stock of Southern Rail. The intent of the investment was not to obtain control or to exert significant influence. Winsloe has no plans to trade the investment for near-term profits. Following is a description of the activity related to the investment in Southern Rail: Aug. 5 Purchased 10,000 shares of Southern Rail at $9 per share. Aug, 31 The fair value of Southern Rail's stock was $10 per share. Sept. 30 The fair value of Southern Rail's stock was $8.50 per share. Oct. 15 Received a dividend from Southern Rail of $0.25 per share. Oct. 31The fair value of Southern Rail's stock was $9.50 per share. What method should be used to account for this investment? 0.66 Points O Equity method "Available for sale" investment Trading Security Consolidation 7) For Winsloe Corporation, does management intent influence the accounting treatment of this investment? 0.66 Points No Yes Sometimes Maybe 8) For Winsloe Corporation, how would they account for this investment if it were to be traded for near-term profit? 0.66 Points "Available for sale" debt security, & gains and losses would be part of other comprehensive income". 8) For Winsloe Corporation, how would they account for this investment if it were to be traded for near-term profit? 0.66 Points "Available for sale" debt security, & gains and losses would be part of other comprehensive income". Consolidation, where the accounts of the investee would be merged with Winsloe's accounts. Trading security, & gains/losses would be part of operating income" on the income statement Equity method, where Winsloe would recognize proportionate share of income/loss of investee, 9) For Winsloe Corporation, how would they account for this investment if it is to be accounted for as an "available for sale" investment? 0.66 Points As a proportionate share of the investee's income or loss from operations Show at cost basis until investment is sold and gain/loss is realized and recognized Unrealized gains/losses are included in "Other Comprehensive Income" or OCI Record only cash received from the investment as part of operating income