Answered step by step

Verified Expert Solution

Question

1 Approved Answer

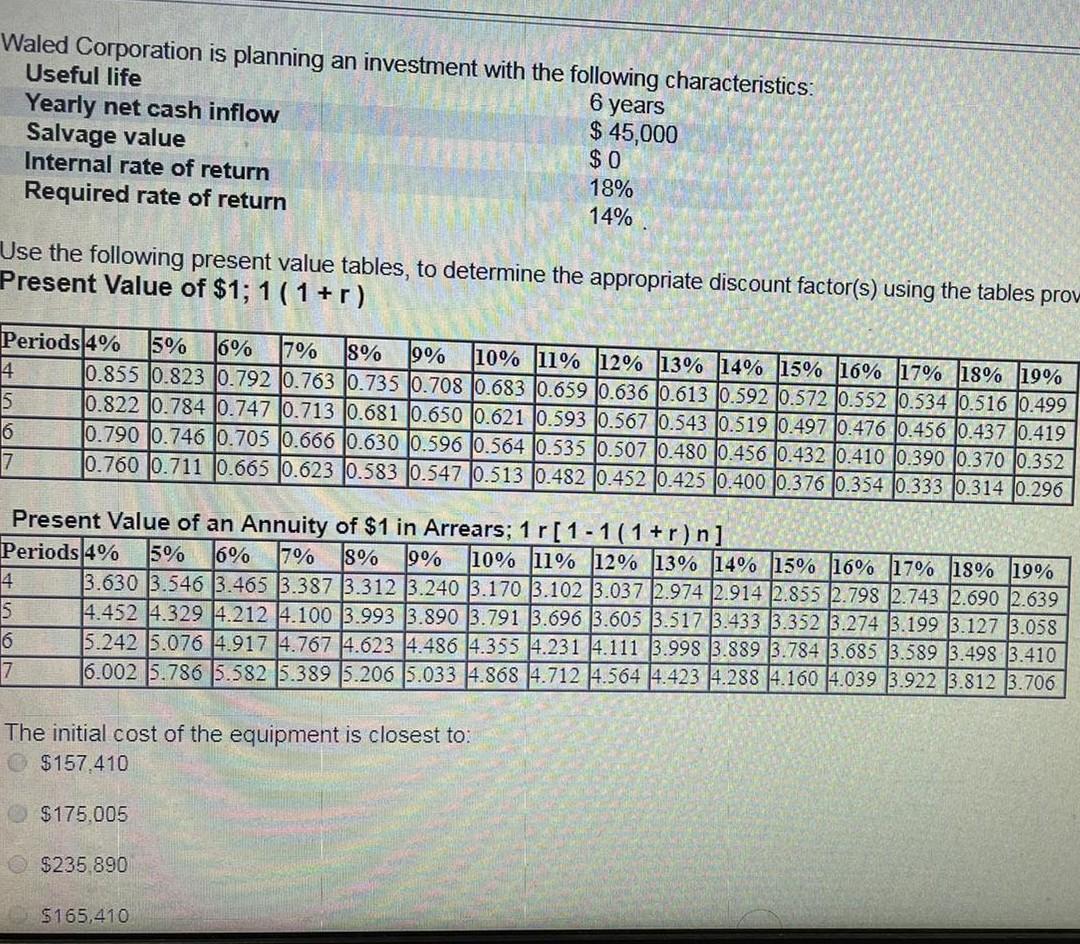

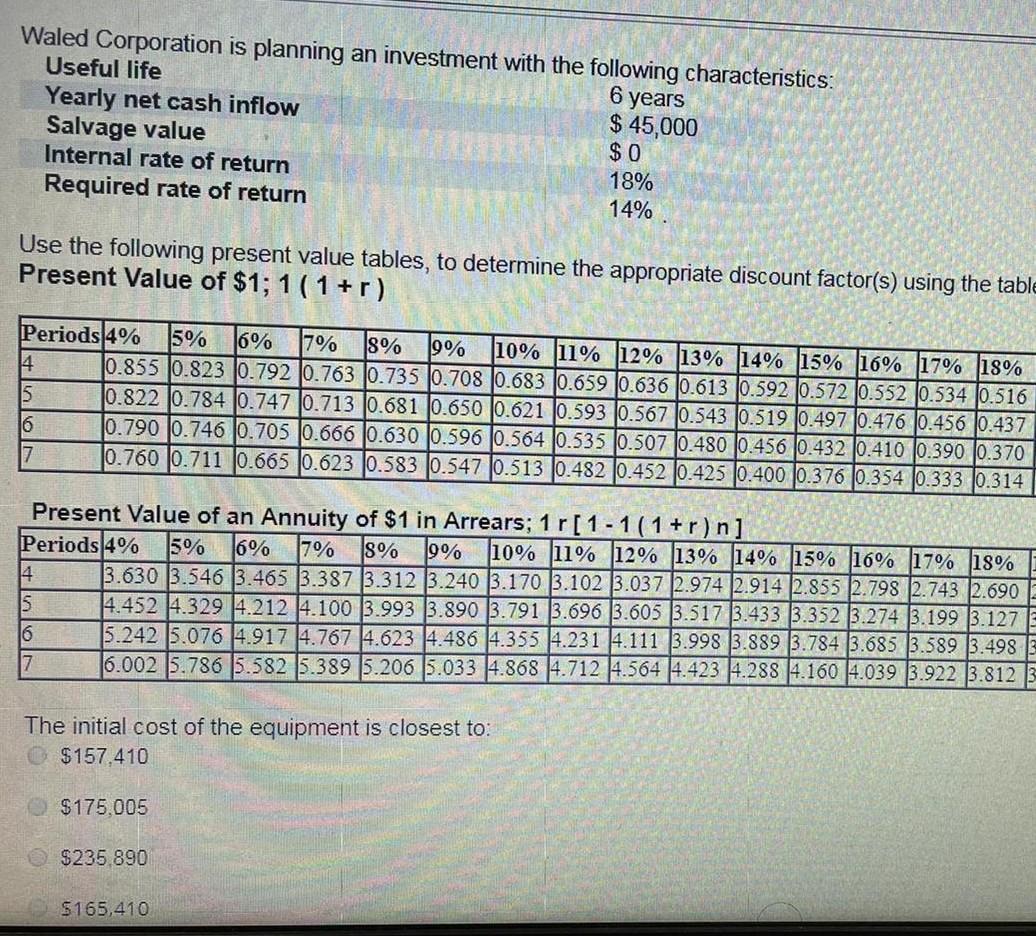

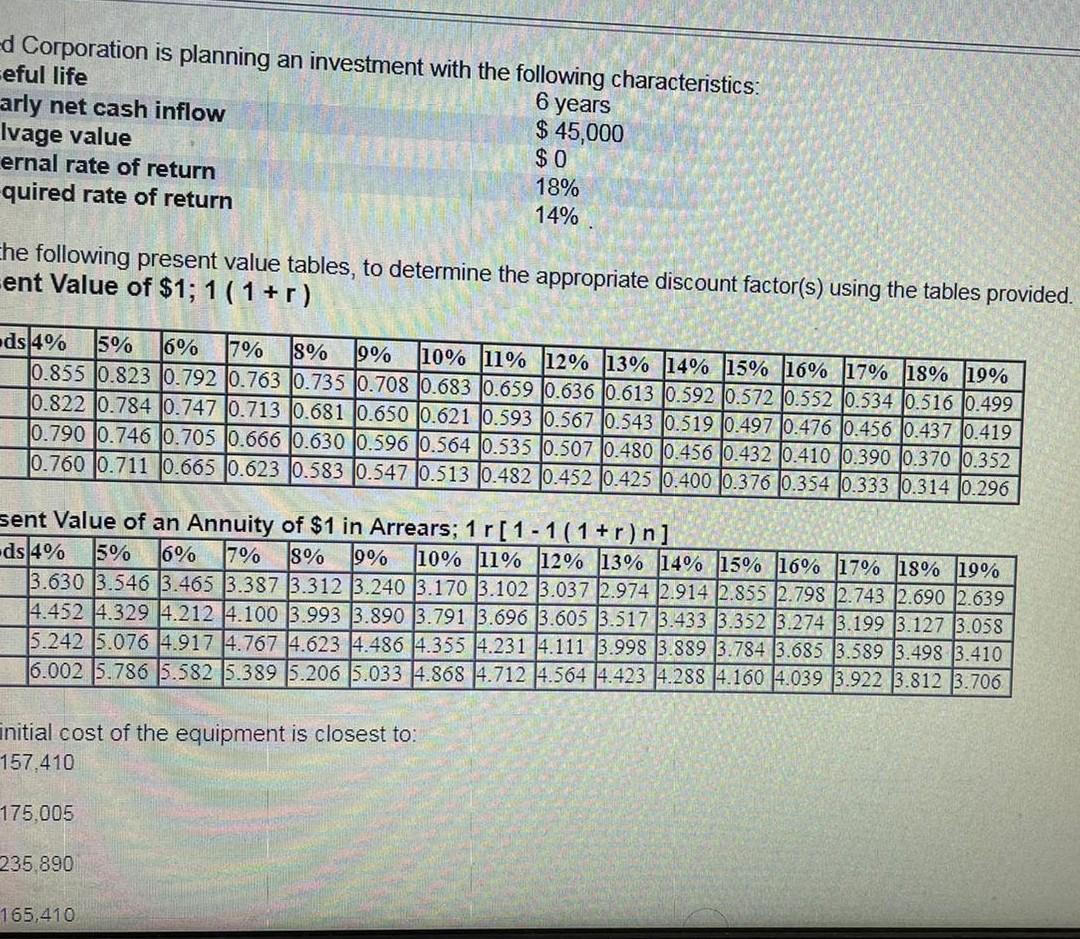

6 years Waled Corporation is planning an investment with the following characteristics: Useful life Yearly net cash inflow $ 45,000 Salvage value $0 Internal rate

6 years Waled Corporation is planning an investment with the following characteristics: Useful life Yearly net cash inflow $ 45,000 Salvage value $0 Internal rate of return 18% Required rate of return 14% Use the following present value tables, to determine the appropriate discount factor(s) using the tables prov- Present Value of $1; 1(1+r) Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 4 0.855 0.823 0.792 0.763 10.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 10.534 0.516 0.499 5 10.822 10.784 0.747 10.713 10.681 10.650 0.621 0.593 10.567 0.543 10.519 0.497 10.476 0.456 0.437 10.419 6 0.790 0.746 0.705 10.666 10.630 10.596 0.564 0.535 0.507 0.480 10.456 0.432 0.410 0.390 10.370 0.352 7 0.760 0.711 10.665 0.623 0.583 0.547 |0.513 0.482 |0.452 |0.425 10.400 10.376 0.354 0.333 0.314 |0.296 Present Value of an Annuity of $1 in Arrears; 10[1-1(1+r)n] Periods 4% 5% 6% 8% 19% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 4 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 S 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 6 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 7 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 17% The initial cost of the equipment is closest to: $157,410 $175.005 $235.890 $165,410 Waled Corporation is planning an investment with the following characteristics: Useful life 6 years Yearly net cash inflow $ 45,000 Salvage value Internal rate of return 18% Required rate of return 14% $0 Use the following present value tables, to determine the appropriate discount factor(s) using the table Present Value of $1; 1(1+r) 5% Periods 4% 6% 17% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 4 10.855 10.823 0.792 10.763 10.735 0.708 0.683 0.659 0.636 0.613 0.592 10.572 0.552 10.534 0.516 5 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 10.476 10.456 0.437 16 10.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 10.507 10.480 10.456 0.432 10.410 10.390 10.370 7 10.760 10.711 10.665 0.623 0.583 10.547 10.513 0.482 10.452 0.425 0.400 0.376 0.354 0.333 0.314 Present Value of an Annuity of $1 in Arrears; 10[1-1(1+r)n] Periods 4% 5% 6% 7% 8% 19% 10% 11% 12% 13% 14% 15% 16% 17% 18% 4 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 16 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 7 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 The initial cost of the equipment is closest to: $157,410 $175.005 $235.890 $165,410 6 years -d Corporation is planning an investment with the following characteristics: ceful life arly net cash inflow $ 45,000 Ivage value $0 ernal rate of return 18% quired rate of return 14% the following present value tables, to determine the appropriate discount factor(s) using the tables provided. ent Value of $1; 1 (1+r) 15% 19% ds4% 16% 7% 8% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 0.855 0.823 0.792 0.763 0.735 0.708 0.683 10.659 0.636 0.613 0.592 10.572 0.552 0.534 0.516 0.499 10.822 0.784 0.747 0.713 0.681 10.650 0.621 0.593 0.567 0.543 10.519 0.497 10.476 10.456 |0.437 10.419 10.790 0.746 0.705 0.666 10.630 10.596 0.564 0.535 10.507 10.480 0.456 0.432 10.410 10.390 10.370 10.352 0.760 10.711 0.665 0.623 0.583 10.547 10.513 0.482 |0.452 0.425 0.400 0.376 |0.354 10.333 0.314 0.296 sent Value of an Annuity of $1 in Arrears; 1 r[ 1 - 1 (1+r)n] -ds 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 3.630 13.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 12.855 2.798 2.743 2.690 2.639 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 initial cost of the equipment is closest to: 157,410 175.005 235 890 165,410

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started