Question

6. You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 5% and a risky portfolio,

6. You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 5% and a risky portfolio, P, constructed with two risky securities, X and Y. The optimal weights of X and Y in P are 60% and 40% respectively. X has an expected rate of return of 14%, and Y has an expected rate of return of 10%. To form a complete portfolio with an expected rate of return of 8%, you should invest approximately __________ in the risky portfolio. This will mean you will also invest approximately 24% and __________ of your complete portfolio in security X and Y, respectively. *

A) 0%; 40%

B) 25%; 30%

C) 40%; 16%

D) 50%; 20%

E) None of the above

7. An investor is forming a portfolio by investing $50,000 in stock A that has a beta of 1.50, and $25,000 in stock B that has a beta of 0.90. The return on the market is equal to 6 percent and Treasury bonds have a yield of 4 percent. What is the required rate of return on the investors portfolio? *

A) 6.6%

B) 6.8%

C) 5.8%

D) 7.0%

E) None of the above

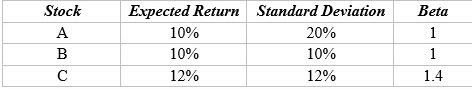

8. Consider the following information for three stocks, A, B, and C. The stocks' returns are positively but not perfectly positively correlated with one another, i.e., the correlations are all between 0 and 1. Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Knowing that the standard deviation of portfolio AB is 20%, Which of the following statements is CORRECT? *

A) Portfolio AB's coefficient of variation is greater than 2.0.

B) Portfolio AB's required return is greater than the required return on Stock A.

C) Portfolio ABC's expected return is 10.66667%.

D) None of the above.

E) All of the above

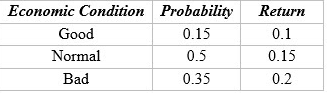

9. Given the following probability distribution, what are the expected return, the standard deviation of returns, and coefficient of variation for Security TQQ? *

A) 16%; 2.1%; 3.3%

B) 3.3%; 16%, 0.21

C) 16%; 3.3%; 0.21

D) 16%; 0.115%; 0.71

E) None of the above

Stock A B Expected Return Standard Deviation 10% 20% 10% 10% 12% 12% Beta 1 1 1.4 Economic Condition Probability Good 0.15 Normal 0.5 Bad 0.35 Return 0.1 0.15 0.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started