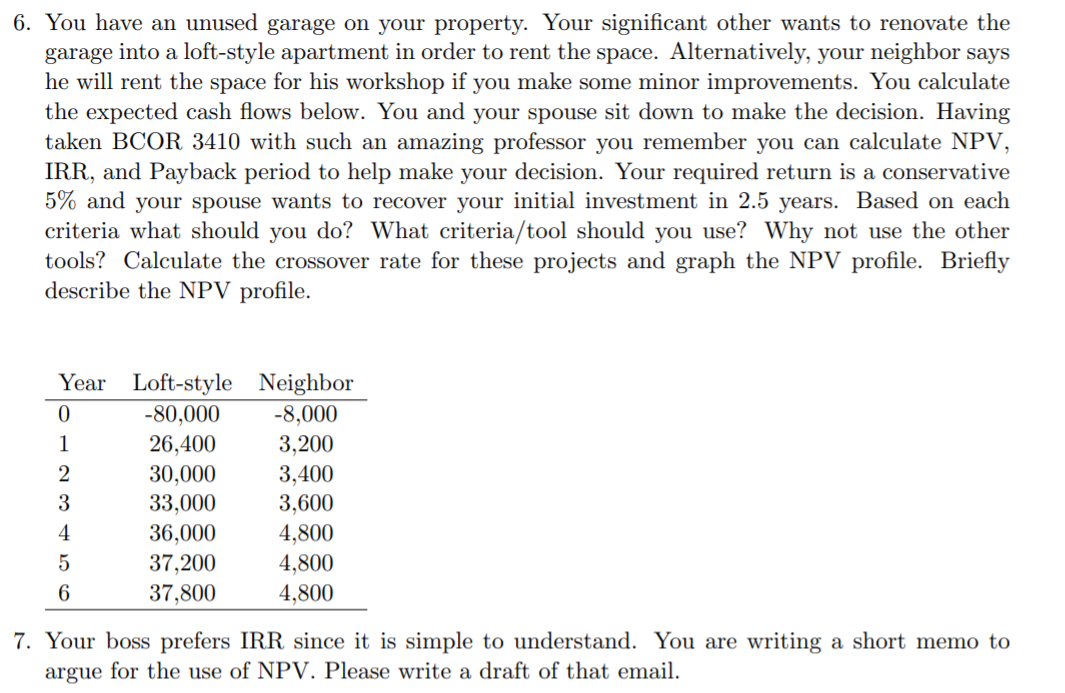

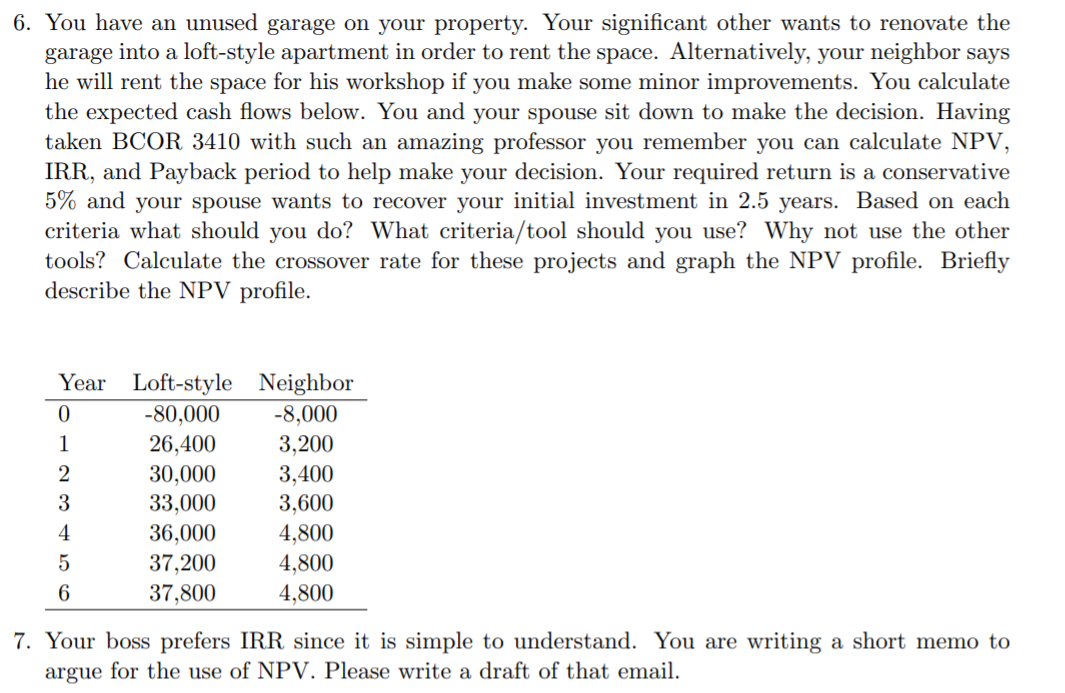

6. You have an unused garage on your property. Your significant other wants to renovate the garage into a loft-style apartment in order to rent the space. Alternatively, your neighbor says he will rent the space for his workshop if you make some minor improvements. You calculate the expected cash flows below. You and your spouse sit down to make the decision. Having taken BCOR 3410 with such an amazing professor you remember you can calculate NPV, IRR, and Payback period to help make your decision. Your required return is a conservative 5% and your spouse wants to recover your initial investment in 2.5 years. Based on each criteria what should you do? What criteria/tool should you use? Why not use the other tools? Calculate the crossover rate for these projects and graph the NPV profile. Briefly describe the NPV profile. Year Loft-style Neighbor 0 -80,000 -8,000 1 26,400 3,200 2 30,000 3,400 3 33,000 3,600 4 36,000 4,800 5 37,200 4,800 6 37,800 4,800 7. Your boss prefers IRR since it is simple to understand. You are writing a short memo to argue for the use of NPV. Please write a draft of that email. 6. You have an unused garage on your property. Your significant other wants to renovate the garage into a loft-style apartment in order to rent the space. Alternatively, your neighbor says he will rent the space for his workshop if you make some minor improvements. You calculate the expected cash flows below. You and your spouse sit down to make the decision. Having taken BCOR 3410 with such an amazing professor you remember you can calculate NPV, IRR, and Payback period to help make your decision. Your required return is a conservative 5% and your spouse wants to recover your initial investment in 2.5 years. Based on each criteria what should you do? What criteria/tool should you use? Why not use the other tools? Calculate the crossover rate for these projects and graph the NPV profile. Briefly describe the NPV profile. Year Loft-style Neighbor 0 -80,000 -8,000 1 26,400 3,200 2 30,000 3,400 3 33,000 3,600 4 36,000 4,800 5 37,200 4,800 6 37,800 4,800 7. Your boss prefers IRR since it is simple to understand. You are writing a short memo to argue for the use of NPV. Please write a draft of that email