Answered step by step

Verified Expert Solution

Question

1 Approved Answer

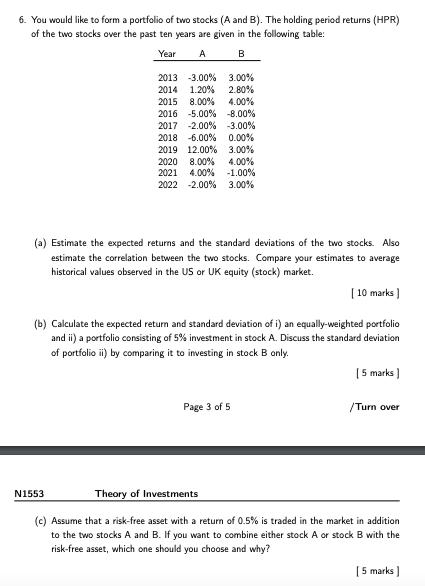

6. You would like to form a portfolio of two stocks (A and B). The holding period returns (HPR) of the two stocks over

6. You would like to form a portfolio of two stocks (A and B). The holding period returns (HPR) of the two stocks over the past ten years are given in the following table: Year A B 2013 -3.00% 2014 1.20% 2015 8.00% 2016 -5.00 % N1553 3.00% 2.80% 4.00% -8.00% 2017 -2.00% -3.00% 2018 6.00% 0.00% 2019 12.00% 3.00% 2020 8.00% 4.00% 2021 4.00% -1.00% 2022 -2.00% 3.00% (a) Estimate the expected returns and the standard deviations of the two stocks. Also estimate the correlation between the two stocks. Compare your estimates to average historical values observed in the US or UK equity (stock) market. [10 marks] (b) Calculate the expected return and standard deviation of i) an equally-weighted portfolio and ii) a portfolio consisting of 5% investment in stock A. Discuss the standard deviation of portfolio ii) by comparing it to investing in stock B only. Page 3 of 5 [ 5 marks] /Turn over Theory of Investments (c) Assume that a risk-free asset with a return of 0.5% is traded in the market in addition to the two stocks A and B. If you want to combine either stock A or stock B with the risk-free asset, which one should you choose and why? [ 5 marks]

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

You have provided an image of a financerelated problem that involves calculating the expected returns standard deviations correlation between two stocks and analyzing portfolio options I will address ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started