Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6) Your new employer makes you an unusual salary offer Choice A is to receive a $20.000 lump sum today and another $50,000 in one

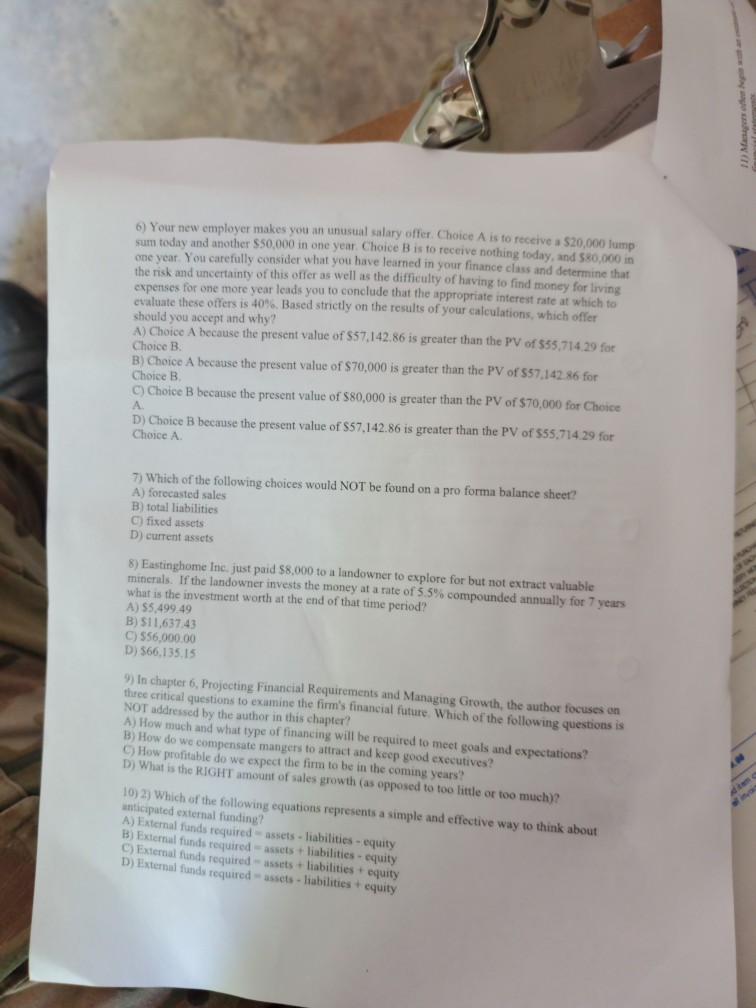

6) Your new employer makes you an unusual salary offer Choice A is to receive a $20.000 lump sum today and another $50,000 in one year Choice B is to receive nothing today, and $20.000 in one year. You carefully consider what you have learned in your finance class and determine that the risk and uncertainty of this offer as well as the difficulty of having to find money for living expenses for one more year leads you to conclude that the appropriate interest rate at which to evaluate these offers is 40%. Based strictly on the results of your calculations, which offer should you accept and why? A) Choice A because the present value of $57,142.86 is greater than the PV of $55,714 29 for Choice B B) Choice A because the present value of $70,000 is greater than the PV of $57.142.86 for Choice B. C) Choice B because the present value of $80,000 is greater than the PV of $70,000 for Choice D) Choice B because the present value of $57,142.86 is greater than the PV of 555,714.29 for Choice A. 7) Which of the following choices would NOT be found on a pro forma balance sheet? A) forecasted sales B) total liabilities C) fixed assets D) current assets 8) Eastinghome Inc. just paid $8,000 to a landowner to explore for but not extract valuable minerals. If the landowner invests the money at a rate of 5.5% compounded annually for 7 years what is the investment worth at the end of that time period? A) 55,499.49 B) $11.637.43 C) 556,000.00 D) 566,135.15 9) In chapter 6, Projecting Financial Requirements and Managing Growth, the author focuses on three critical questions to examine the Times Tinancial future. Which of the following questions is NOT addressed by the author in this chapter? A) How much and what type of financing will be required to meet goals and expectations? B) How do we compensate mangers to attract and keep good executives? C) How profitable do we expect the firm to be in the coming years? D) What is the RIGHT amount of sales growth (as opposed to too little or too much? 10) 2) Which of the following equations represents a simple and effective way to think about anticipated external funding? A) External funds required B) External funds required assets + liabilities - equity assets - liabilities - equity C) External funds required D) External funds required = assets - liabilities + equity assets + liabilities + equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started