Answered step by step

Verified Expert Solution

Question

1 Approved Answer

60- Jack had a $ 70000 debt discharged in 2015. Jack was not in bankruptcy when the debt was discharged . Jack had $ 100,000

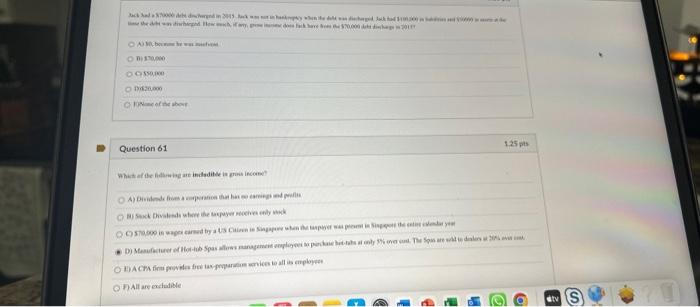

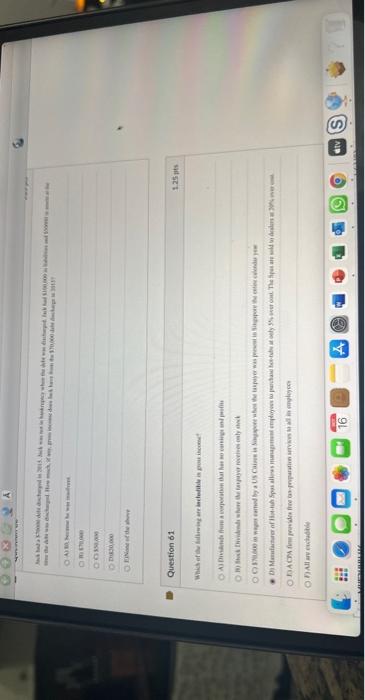

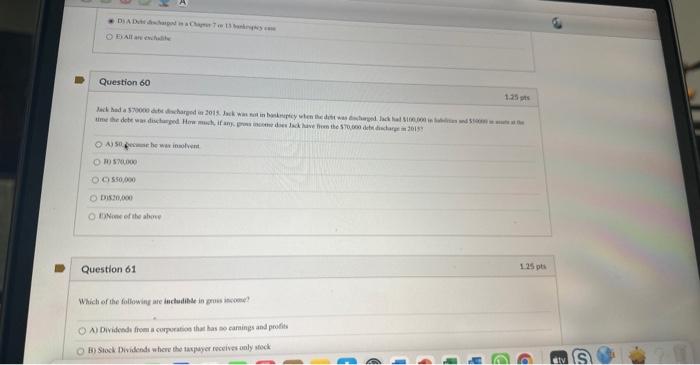

60- Jack had a $ 70000 debt discharged in 2015. Jack was not in bankruptcy when the debt was discharged . Jack had $ 100,000 in liabilities and $ 50000 in assets at the time the debt was discharged . How much , if any , gross income does Jack have from the $ 70,000 debt discharge in 2015? ) $ 0 , because he was insolvent OB ) 70,000 ) 50,000 20,000 OE None of the above

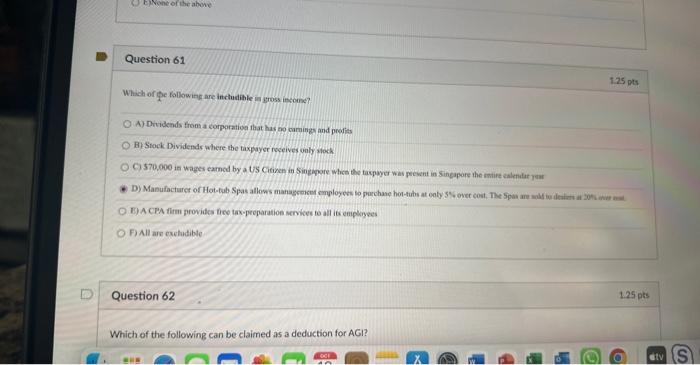

mi thetion on s4. (i) Privane atde thent Question 61 125nts Which of the following are inctudible in isross incons? A) Brickends troms a corporation that has no carnings and protits B) Stock Dividends where the taxpayce roceives wnly whock 1.) A CPA fitan provides tice tax-peparation services to all ito empliyees F) All ars exeludible Question 62 Which of the following can be claimed as a deduction for AGl? Eyait ahe ewhillite Question 60 1.19 its 4sin(0,0) Pix. fiphowe ef the ahire Question 61 A) Dividendy from a coperation that bas as caraings and polits mi thetion on s4. (i) Privane atde thent Question 61 125nts Which of the following are inctudible in isross incons? A) Brickends troms a corporation that has no carnings and protits B) Stock Dividends where the taxpayce roceives wnly whock 1.) A CPA fitan provides tice tax-peparation services to all ito empliyees F) All ars exeludible Question 62 Which of the following can be claimed as a deduction for AGl? Eyait ahe ewhillite Question 60 1.19 its 4sin(0,0) Pix. fiphowe ef the ahire Question 61 A) Dividendy from a coperation that bas as caraings and polits 61-Which of the following are includible in gross income ? ) Dividends from a corporation that has no earnings and profits OB ) Stock Dividends where the taxpayer receives only stock ) 70,000 in wages earned by a US Citizen in Singapore when the taxpayer was present in Singapore the entire calendar year D ) Manufacturer of Hot - tub Spas allows management employees to purchase hot - tubs at only 5 % over cost . The Spas are sold to dealers at 20 % over cost . ) A CPA firm provides free tax - preparation services to all its employees OF ) All are excludible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started