Answered step by step

Verified Expert Solution

Question

1 Approved Answer

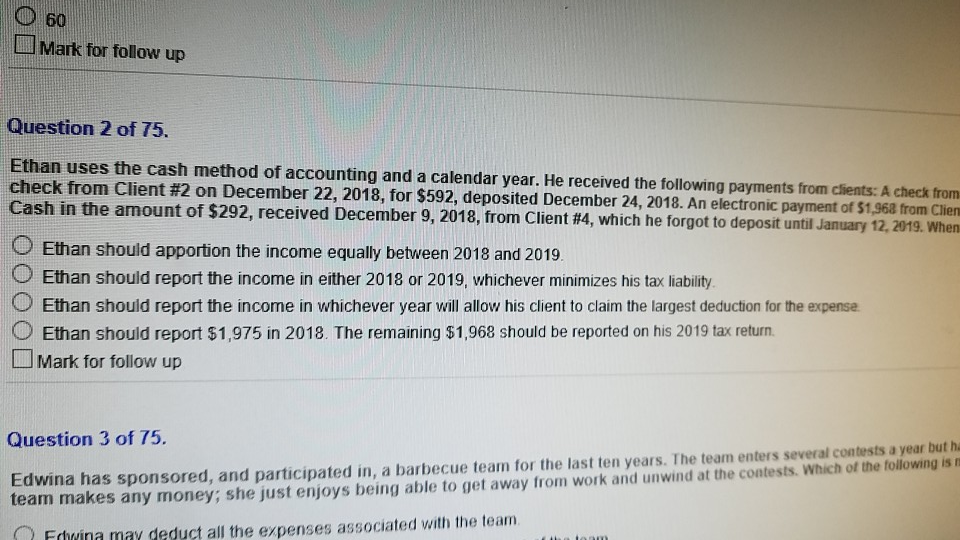

60 Mark for follow up Question 2 of 75. Ethan uses the cash method of accounting and a calendar year. He received the following payments

60 Mark for follow up Question 2 of 75. Ethan uses the cash method of accounting and a calendar year. He received the following payments from clients: A check from check from Client # 2 on December 22, 2018, for $592, deposited December 24, 2018. An electronic payment of $1,968 from Clien Cash in the amount of $292, received December 9, 2018, from Client #4, which he forgot to deposit until January 12, 2019. When Ethan should apportion the income equally between 2018 and 2019. Ethan should report the income in either 2018 or 2019, whichever minimizes his tax liability Ethan should report the income in whichever year will allow his client to claim the largest deduction for the expense Ethan should report $1,975 in 2018. The remaining $1,968 should be reported on his 2019 tax return. Mark for follow up Question 3 of 75. Edwina has sponsored, and participated in, a barbecue team for the last ten years. The team enters several contests a year but ha team makes any money; she just enjoys being able to get away from work and unwind at the contests. Which of the following is m Frhwina may deduct all the expenses associated with the team 60 Mark for follow up Question 2 of 75. Ethan uses the cash method of accounting and a calendar year. He received the following payments from clients: A check from check from Client # 2 on December 22, 2018, for $592, deposited December 24, 2018. An electronic payment of $1,968 from Clien Cash in the amount of $292, received December 9, 2018, from Client #4, which he forgot to deposit until January 12, 2019. When Ethan should apportion the income equally between 2018 and 2019. Ethan should report the income in either 2018 or 2019, whichever minimizes his tax liability Ethan should report the income in whichever year will allow his client to claim the largest deduction for the expense Ethan should report $1,975 in 2018. The remaining $1,968 should be reported on his 2019 tax return. Mark for follow up Question 3 of 75. Edwina has sponsored, and participated in, a barbecue team for the last ten years. The team enters several contests a year but ha team makes any money; she just enjoys being able to get away from work and unwind at the contests. Which of the following is m Frhwina may deduct all the expenses associated with the team

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started