Answered step by step

Verified Expert Solution

Question

1 Approved Answer

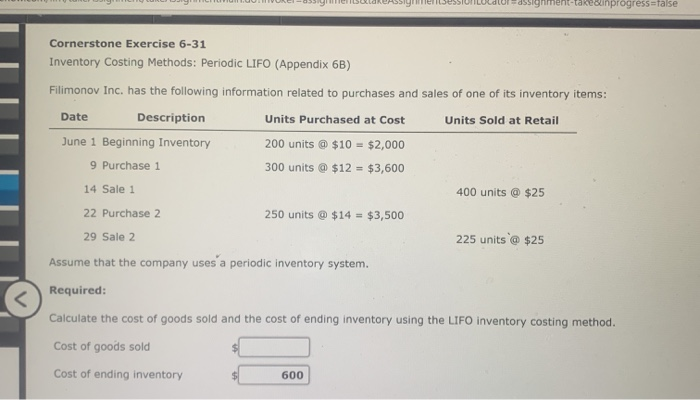

600 is incorrect dssighm Kedunprogress=false Cornerstone Exercise 6-31 Inventory Costing Methods: Periodic LIFO (Appendix 6B) Filimonov Inc. has the following information related to purchases and

600 is incorrect

dssighm Kedunprogress=false Cornerstone Exercise 6-31 Inventory Costing Methods: Periodic LIFO (Appendix 6B) Filimonov Inc. has the following information related to purchases and sales of one of its inventory items: Date Description Units Purchased at Cost Units Sold at Retail 200 units @$10 $2,000 June 1 Beginning Inventory 9 Purchase 1 300 units@$12 = $3,600 14 Sale 1 400 units@$25 250 units@$14 = $ 3,500 22 Purchase 2 29 Sale 2 225 units@$25 Assume that the company uses a periodic inventory system. Required: Calculate the cost of goods sold and the cost of ending inventory using the LIFO inventory costing method. Cost of goods sold Cost of ending inventory 600 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started