Answered step by step

Verified Expert Solution

Question

1 Approved Answer

$6,000 charitable contributions. The Andrews claim five dependents on their return and use the itemized deduction. Determine their net alternative minimum taxable income. Net AMTI

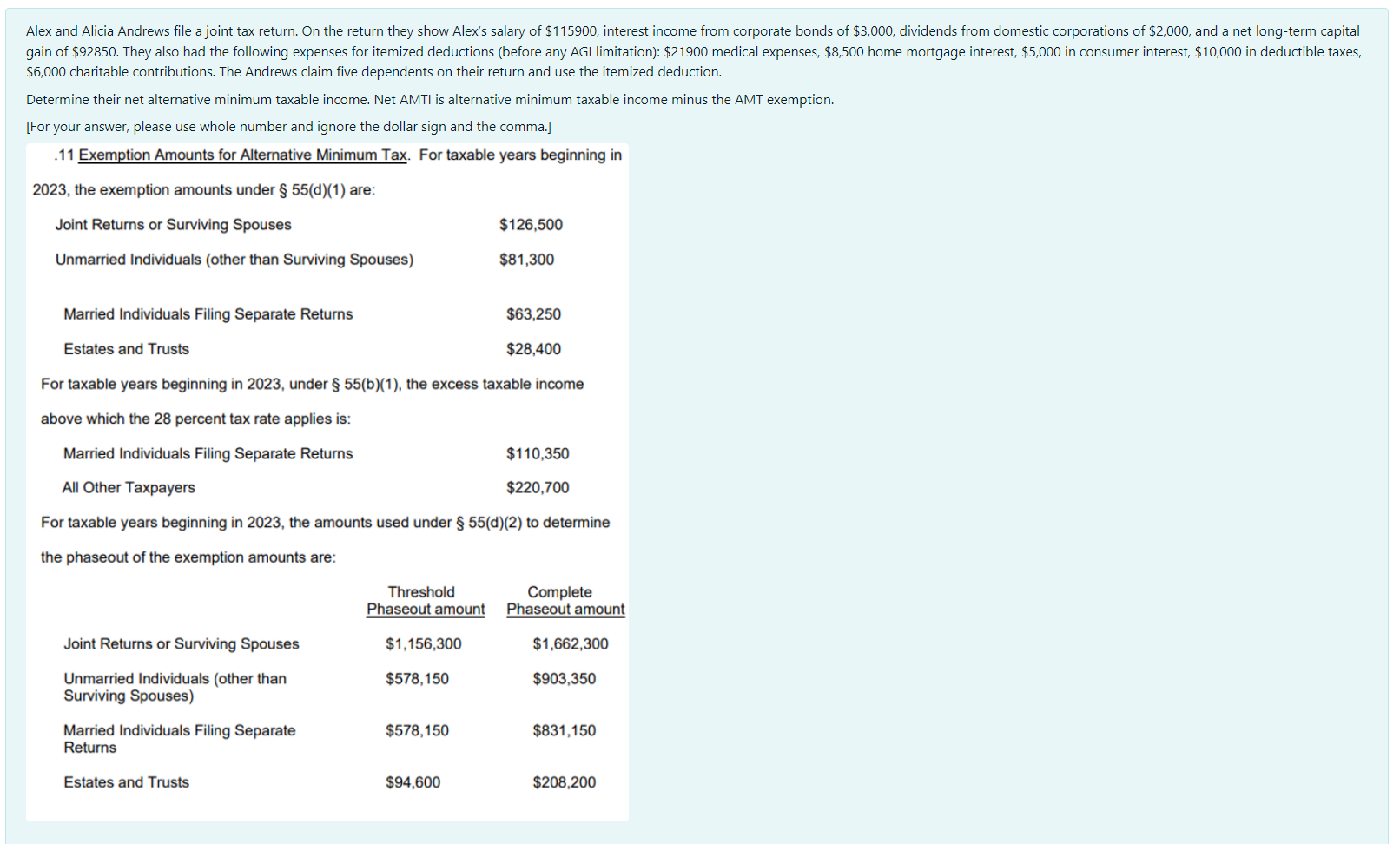

$6,000 charitable contributions. The Andrews claim five dependents on their return and use the itemized deduction. Determine their net alternative minimum taxable income. Net AMTI is alternative minimum taxable income minus the AMT exemption. [For your answer, please use whole number and ignore the dollar sign and the comma.] For taxable years beginning in 2023, under 55(b)(1), the excess taxable income above which the 28 percent tax rate applies is: For taxable years beginning in 2023, the amounts used under 55 (d)(2) to determine the phaseout of the exemption amounts are

$6,000 charitable contributions. The Andrews claim five dependents on their return and use the itemized deduction. Determine their net alternative minimum taxable income. Net AMTI is alternative minimum taxable income minus the AMT exemption. [For your answer, please use whole number and ignore the dollar sign and the comma.] For taxable years beginning in 2023, under 55(b)(1), the excess taxable income above which the 28 percent tax rate applies is: For taxable years beginning in 2023, the amounts used under 55 (d)(2) to determine the phaseout of the exemption amounts are Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started