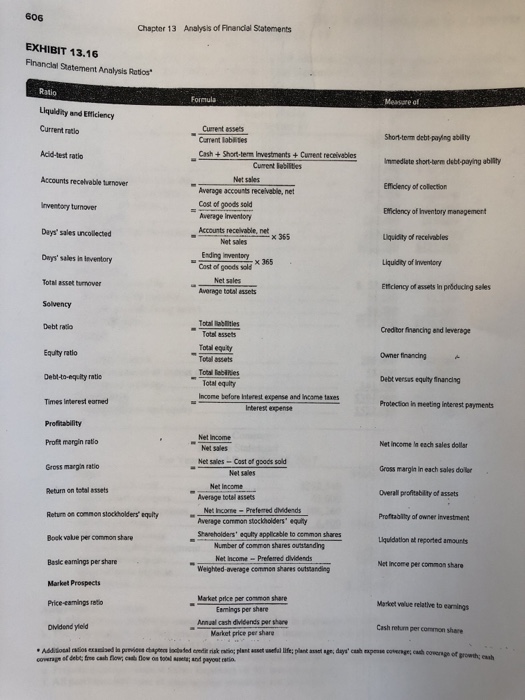

606 Chapter 13 Analysis of Financial Statements EXHIBIT 13.16 Flnanclal Statement Analysis Ratios Ratio Liquidity and Efficiency Current ratlo Acid-test ratlo Formula Measare af Current essets Curment lablites Short-temm debt paying abilty Immediate short-berm debt-paying ablithy Efficiency of colection Eficlency of Inventory management Liquidity of recelvables Liquidity of Iinventory Effciency of assets in prducing seles Cash+Short-term Investments+Cureot receivables Cument lebilties Accounts recelvable turnover Net sales Inventory turnover Days sales uncollected Deys' sales in ieventory Average accounts receiveble, net Cost of goods sold Average inventory Accounts recelvable, net x 365 Net sales Ending Inventoy Cost of goods sold x 365 Total asset turnover Net sales Average total assets Solvency Debt ratio Equity ratio Debt-to-equity ratio Creditor finencing and leverage Owner financing Debt versas equlty Snanding Totsl assets Total equity Total stsets Total abres Total equity Income before Interest expense and Incame taxes Times Interest earned Profitability Profft margin ratio Gross margin atio Return on total assets Protection in neeting Interest payments Interest expense Net Income Net sales Net income Ia each sales dollar Net saies- Cost of gos soid Net sales Gross margin In each sales doer Overall profitability of assets Proftablity of ownee investment Liquidation at reported amourts Net income per common share Net Income verage totel assecs Net Incorne- Prefemed dvidends Retarn on come ecbol Average comman stockholders" equty areholders' equlty applicable to cemman shares Bock value per common share Number of common shares outstanding Net Income-Prefered dvidends Basic eamings per share Market Prospects Price-camings reto Weighted-average common shares outstanding Market price per common share Eamings per shere Annual cash dividends per share Market price per share Markoet velue relative to eanings DMidend yleid Cash return per common share 606 Chapter 13 Analysis of Financial Statements EXHIBIT 13.16 Flnanclal Statement Analysis Ratios Ratio Liquidity and Efficiency Current ratlo Acid-test ratlo Formula Measare af Current essets Curment lablites Short-temm debt paying abilty Immediate short-berm debt-paying ablithy Efficiency of colection Eficlency of Inventory management Liquidity of recelvables Liquidity of Iinventory Effciency of assets in prducing seles Cash+Short-term Investments+Cureot receivables Cument lebilties Accounts recelvable turnover Net sales Inventory turnover Days sales uncollected Deys' sales in ieventory Average accounts receiveble, net Cost of goods sold Average inventory Accounts recelvable, net x 365 Net sales Ending Inventoy Cost of goods sold x 365 Total asset turnover Net sales Average total assets Solvency Debt ratio Equity ratio Debt-to-equity ratio Creditor finencing and leverage Owner financing Debt versas equlty Snanding Totsl assets Total equity Total stsets Total abres Total equity Income before Interest expense and Incame taxes Times Interest earned Profitability Profft margin ratio Gross margin atio Return on total assets Protection in neeting Interest payments Interest expense Net Income Net sales Net income Ia each sales dollar Net saies- Cost of gos soid Net sales Gross margin In each sales doer Overall profitability of assets Proftablity of ownee investment Liquidation at reported amourts Net income per common share Net Income verage totel assecs Net Incorne- Prefemed dvidends Retarn on come ecbol Average comman stockholders" equty areholders' equlty applicable to cemman shares Bock value per common share Number of common shares outstanding Net Income-Prefered dvidends Basic eamings per share Market Prospects Price-camings reto Weighted-average common shares outstanding Market price per common share Eamings per shere Annual cash dividends per share Market price per share Markoet velue relative to eanings DMidend yleid Cash return per common share