Answered step by step

Verified Expert Solution

Question

1 Approved Answer

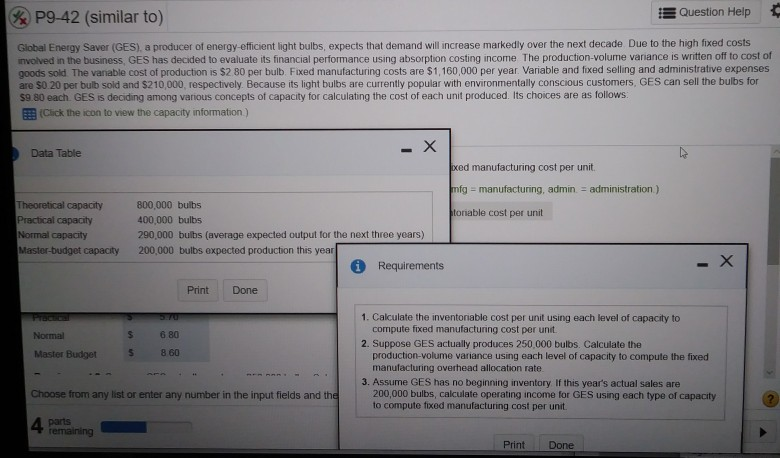

P9-42 (similar to) Question Help Global Energy Saver (GES), a producer of energy-efficient light bulbs, expects that demand will increase markedly over the next decade

P9-42 (similar to) Question Help Global Energy Saver (GES), a producer of energy-efficient light bulbs, expects that demand will increase markedly over the next decade Due to the high fixed costs involved in the business GES has decided to evaluate its financial performance using absorption costing income The production volume variance is written off to cost of goods sold The vanable cost of production is $2 80 per bulb Fixed manufacturing costs are $1,160,000 per year. Variable and fixed selling and administrative expenses are 50 20 per bulb sold and $210,000, respectively. Because its light bulbs are currently popular with environmentally conscious customers, GES can sell the bulbs for $9.80 each. GES is deciding among various concepts of capacity for calculating the cost of each unit produced. Its choices are as follows: Click the icon to view the capacity information) Data Table - X ped manufacturing cost per unit | Theoretical capacity Practical capacity Normal capacity Master-budget capacity mg = manufacturing, admin = administration) 800,000 bulbs 400,000 bulbs toriable cost per unit 290,000 bulbs (average expected output for the next three years) 200,000 bulbs expected production this year i Requirements Print Done Normal Master Budget $ 5 680 8 60 1. Calculate the inventoriable cost per unit using each level of capacity to compute fixed manufacturing cost per unit 2. Suppose GES actually produces 250 000 bulbs Calculate the production-volume variance using each level of capacity to compute the fixed manufacturing overhead allocation rate 3. Assume GES has no beginning inventory If this year's actual sales are 200,000 bulbs, calculate operating income for GES using each type of capacity to compute fixed manufacturing cost per unit. Choose from any list or enter any number in the input fields and the 4 pemaining Print Done P9-42 (similar to) Question Help Global Energy Saver (GES), a producer of energy-efficient light bulbs, expects that demand will increase markedly over the next decade Due to the high fixed costs involved in the business GES has decided to evaluate its financial performance using absorption costing income The production volume variance is written off to cost of goods sold The vanable cost of production is $2 80 per bulb Fixed manufacturing costs are $1,160,000 per year. Variable and fixed selling and administrative expenses are 50 20 per bulb sold and $210,000, respectively. Because its light bulbs are currently popular with environmentally conscious customers, GES can sell the bulbs for $9.80 each. GES is deciding among various concepts of capacity for calculating the cost of each unit produced. Its choices are as follows: Click the icon to view the capacity information) Data Table - X ped manufacturing cost per unit | Theoretical capacity Practical capacity Normal capacity Master-budget capacity mg = manufacturing, admin = administration) 800,000 bulbs 400,000 bulbs toriable cost per unit 290,000 bulbs (average expected output for the next three years) 200,000 bulbs expected production this year i Requirements Print Done Normal Master Budget $ 5 680 8 60 1. Calculate the inventoriable cost per unit using each level of capacity to compute fixed manufacturing cost per unit 2. Suppose GES actually produces 250 000 bulbs Calculate the production-volume variance using each level of capacity to compute the fixed manufacturing overhead allocation rate 3. Assume GES has no beginning inventory If this year's actual sales are 200,000 bulbs, calculate operating income for GES using each type of capacity to compute fixed manufacturing cost per unit. Choose from any list or enter any number in the input fields and the 4 pemaining Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started