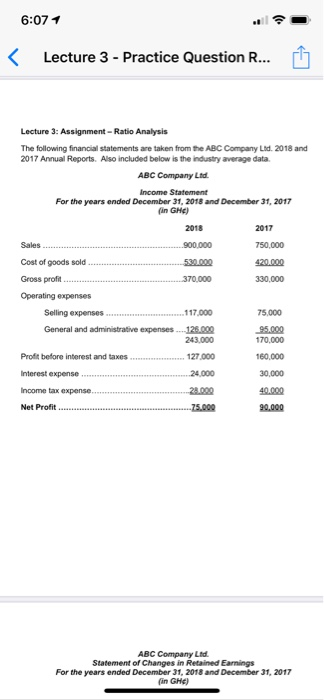

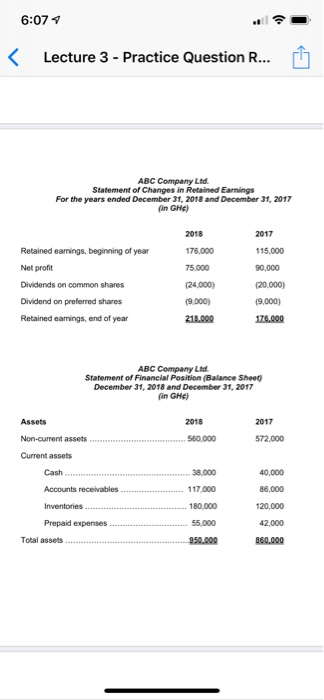

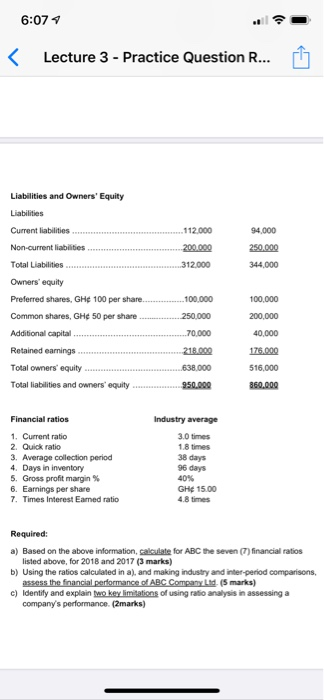

6:071 Lecture 3 - Practice Question R... 17 Lecture 3: Assignment - Ratio Analysis The following financial statements are taken from the ABC Company Ltd. 2018 and 2017 Annual Reports. Also included below is the industry average data. ABC Company Ltd Income Statement For the years ended December 31, 2018 and December 31, 2017 in GHC) 2017 750,000 420.000 330,000 2018 Sales 900.000 Cost of goods sold .. . .........................530.000 Gross profit ...370.000 Operating expenses Selling expenses..........................117.000 General and administrative expenses.125.000 243.000 Profit before interest and taxes................. ... 127.000 Interest expense... ...24.000 Income tax expense............. 22.000 Net Profit .-75.000 75,000 95.000 170,000 160.000 30,000 40.000 90,000 ABC Company Ltd Statement of Changes in Retained Earnings For the years ended December 31, 2018 and December 31, 2017 fin GHE) 6:07 Lecture 3 - Practice Question R... 17 ABC Company Ltd Statement of Changes in Retained Earnings For the years ended December 31, 2018 and December 31, 2017 in GH) 2018 2017 Retained earings, beginning of year Net profit Dividends on common shares Dividend on preferred shares Retained earnings, end of year 175.000 75.000 (24.000) (9.000) 215.000 115,000 90,000 (20.000) (9.000) 176.000 ABC Company Lid Statement of Financial Position Balance Sheet December 31, 2018 and December 31, 2017 (in GH) Assets 2018 2017 572.000 Non-current assets 560.000 Current assets Cash...... ...38.000 Accounts receivables ....................... 117,000 Inventories 180.000 Prepaid expenses............................ 55,000 950.000 40,000 86,000 120,000 42,000 860.000 Total assets 6:07 4 Lecture 3 - Practice Question R... 17 Liabilities and Owners' Equity Liabilities Current liabilities................. ..... ...112.000 Non-current liabilities.. 200.000 94.000 250.000 344,000 Total Liabilities ............................................312.000 Owners' equity Preferred shares, GH 100 per share...... ..100.000 Common shares, GH 50 per share....... 250,000 Additional capital ..70.000 Retained earnings ................. 218.000 Total Owners' equity... 638,000 Total liabilities and owners' equity .................950.000 100,000 200,000 40,000 176.000 516,000 360.000 Financial ratios Industry average 1. Current ratio 2. Quick ratio 3. Average collection period 4. Days in inventory 5. Gross profit margin% 6. Earnings per share 7. Times Interest Eamed ratio 3.0 times 18 times 38 days 96 days GHI 1500 4.8 times Required: a) Based on the above information, calculate for ABC the seven (7) financial ratios listed above, for 2018 and 2017 (3 marks) b) Using the ratios calculated in a), and making industry and interperiod comparisons, assess the financial performance of ABC Company Lid. (marks) c) Identify and explain two key limitations of using ratio analysis in assessing a company's performance (2marks)