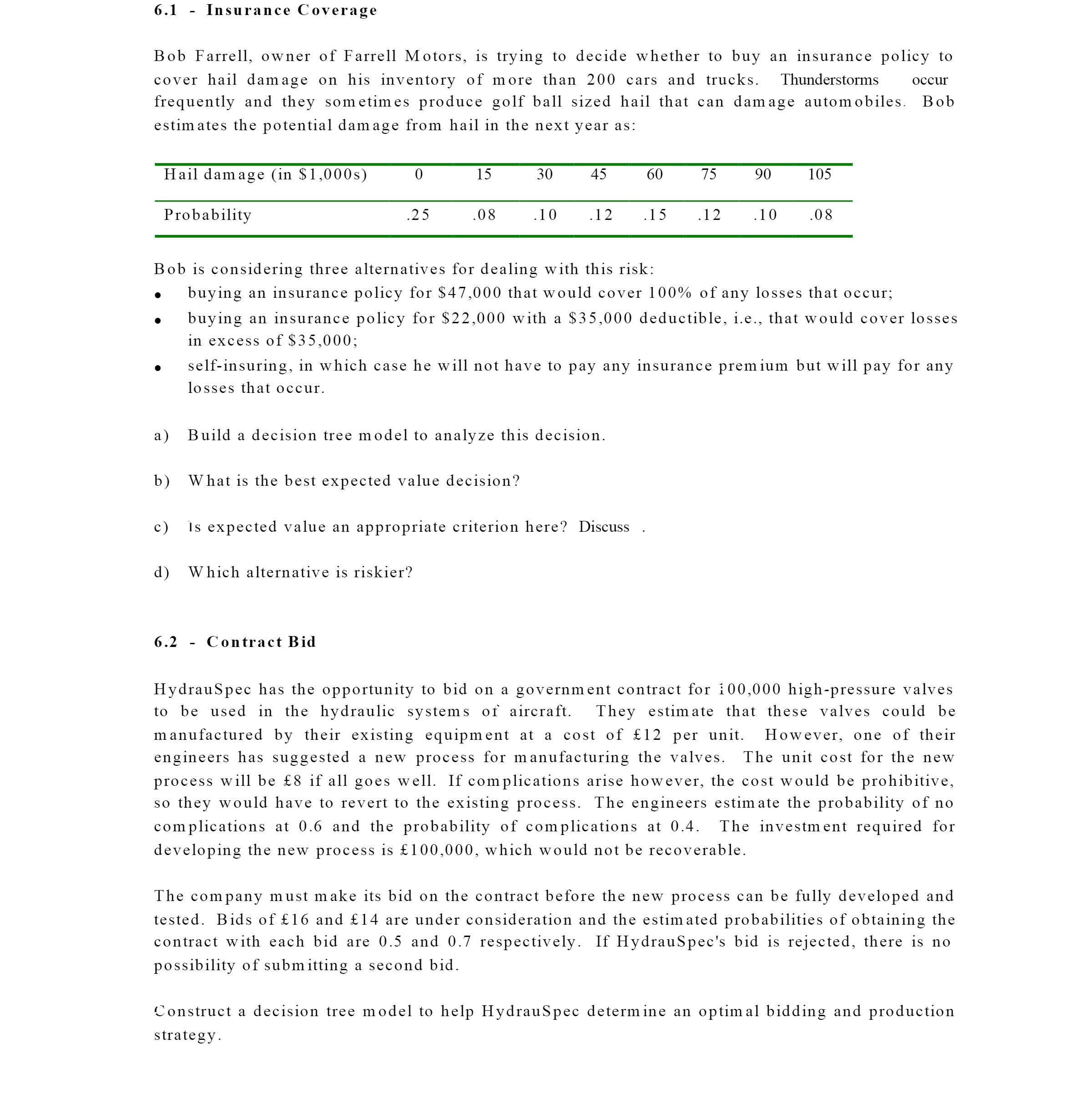

6.1 - Insurance Coverage Bob Farrell, owner of Farrell Motors, is trying to decide whether to buy an insurance policy to cover hail damage on his inventory of more than 200 cars and trucks. Thunderstorms occur frequently and they sometimes produce golf ball sized hail that can damage automobiles. Bob estimates the potential damage from hail in the next year as: Hail damage (in $1,0005) 0 15 30 45 60 75 90 105 Probability .25 .08 .10 .12 .15 .12 .10 .08 Bob is considering three alternatives for dealing with this risk: 0 buying an insurance policy for $47,000 that would cover 100% of any losses that occur; 0 buying an insurance policy for $22,000 with a $35,000 deductible, i.e., that would cover losses in excess of $35,000; 0 self-insuring, in which case he will not have to pay any insurance premium but will pay for any losses that occur. a) Build a decision tree model to analyze this decision. b) What is the best expected value decision? C) Is expected value an appropriate criterion here? Discuss . d) Which alternative is riskier? 6.2 Contract Bid HydrauSpec has the opportunity to bid on a government contract for 100,000 highpressure valves to be used in the hydraulic systems of aircraft. They estimate that these valves could be manufactured by their existing equipment at a cost of 12 per unit. However, one of their engineers has suggested a new process for manufacturing the valves. The unit cost for the new process will be 8 if all goes well. If complications arise however. the cost would be prohibitive. so they would have to revert to the existing process. The engineers estimate the probability of no complications at 0.6 and the probability of complications at 0.4. The investment required for developing the new process is 100,000, which would not be recoverable. The company must make its bid on the contract before the new process can be fully developed and tested. Bids of 16 and 14 are under consideration and the estimated probabilities of obtaining the contract with each bid are 0.5 and 0.7 respectively. If HydrauSpec's bid is rejected, there is no possibility of submitting a second bid. Construct a decision tree model to help HydrauSpec determine an optimal bidding and production strategy