Answered step by step

Verified Expert Solution

Question

1 Approved Answer

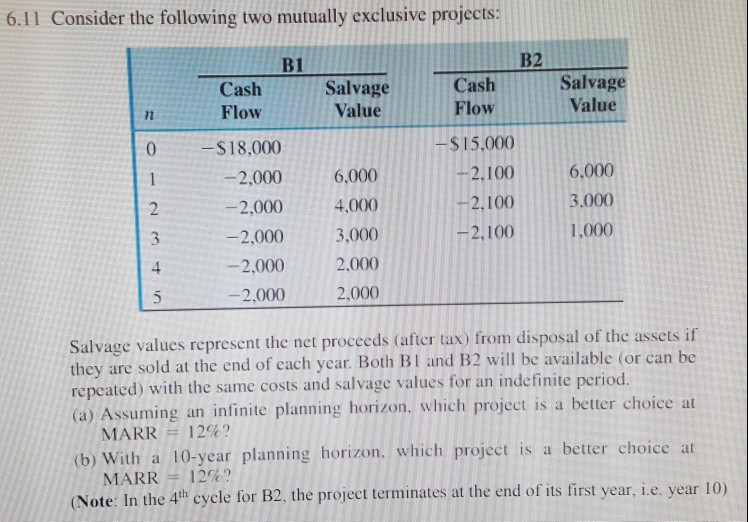

6.11 Consider the following two mutually exclusive projects B1 B2 Salvage Value Cash Flow Salvage Value Cash Flow tins 0 $18,000 -$15,000 2,000 6,000 2,0004,000

6.11 Consider the following two mutually exclusive projects B1 B2 Salvage Value Cash Flow Salvage Value Cash Flow tins 0 $18,000 -$15,000 2,000 6,000 2,0004,000 2,000 3,000 2,000 2.000 2,000 2,000 2.100 6.000 2.100 3.000 -2.100 1,000 4. Salvage values represent the net proceeds (after tax) from disposal of the assets if they are sold at the end of cach year. Both BI and B2 will be available (or can repeated) with the same costs and salvage values for an indefinite period. (a) Assuming an infinite planning horizon. which project is a better choice at MARR- 12% ? (b) With a 10-year planning horizon. which project is a better choice at MARR ,-12% ? e: In the 4th cycle for B2, the project terminates at the end of its first year, i.e. year 10)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started