Answered step by step

Verified Expert Solution

Question

1 Approved Answer

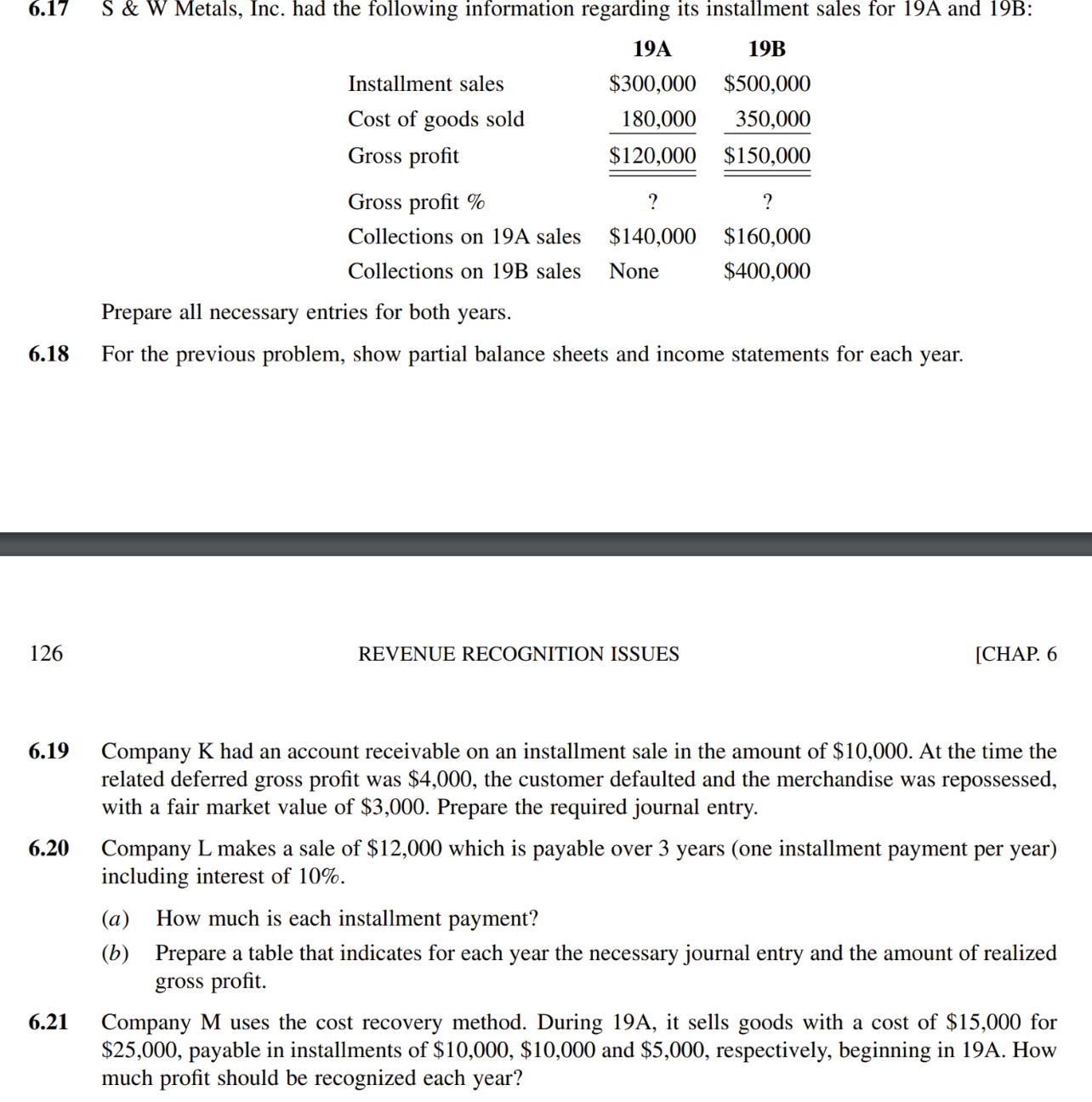

6.17 S&W Metals, Inc. had the following information regarding its installment sales for 19A and 19B: 6.18 126 Installment sales 19A 19B $300,000 $500,000

6.17 S&W Metals, Inc. had the following information regarding its installment sales for 19A and 19B: 6.18 126 Installment sales 19A 19B $300,000 $500,000 Cost of goods sold 180,000 350,000 $120,000 $150,000 Gross profit Gross profit % Collections on 19A sales ? ? $140,000 $160,000 Collections on 19B sales None $400,000 Prepare all necessary entries for both years. For the previous problem, show partial balance sheets and income statements for each REVENUE RECOGNITION ISSUES year. [CHAP. 6 6.19 6.20 6.21 Company K had an account receivable on an installment sale in the amount of $10,000. At the time the related deferred gross profit was $4,000, the customer defaulted and the merchandise was repossessed, with a fair market value of $3,000. Prepare the required journal entry. Company L makes a sale of $12,000 which is payable over 3 years (one installment payment per year) including interest of 10%. (a) How much is each installment payment? (b) Prepare a table that indicates for each year the necessary journal entry and the amount of realized gross profit. Company M uses the cost recovery method. During 19A, it sells goods with a cost of $15,000 for $25,000, payable in installments of $10,000, $10,000 and $5,000, respectively, beginning in 19A. How much profit should be recognized each year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

617 S W Metals Inc 19A Installment Sales Revenue 300000 Installment Receivable 300000 Cost of Goods ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e83edb4808_955109.pdf

180 KBs PDF File

663e83edb4808_955109.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started