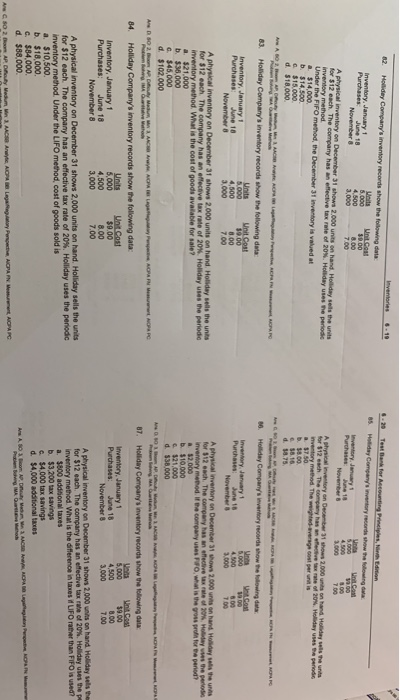

62 4. Holliday Company's inventory records show the following data Unit Cost vehidry January 1 Test Bank for Accounting Principles, M e tan Holiday Company's inventory records show the following A physical inventory on December 31 shows 2.000 units on hand Holiday set the units for $12 each. The company has an effective tax rate of 20 Holiday uses the periodic inventory method Under the FIFO method, the December 31 inventory is valued at A hic inventory on December 31shows 2.000 ton and wondersteun for $12 each the company has an a f 2014. Honday uses te Inventory method. The wighted average cost per A A CAPO 83 d. 318.000 AR C A APA Holiday Company's inventory records show the following data Unit Cost Inventory, January 1 Purchases June 18 November 3.000 10 Holiday Company's inventory records show the owing data COM Inventory January Purchases: June 18 November days the the period period? e A physical inventory on December 31 shows 2.000 units on hand Holiday sells the units for 512 each The company has an effective tax rate of 20. Holiday uses the periodic inventory method. What is the cost of goods available for sale? 21.000 b. $30,000 G 540,000 d. $102,000 A SOM CACHA ILYACHANGPARC A phy.cal inventary on December 31 wows 2.000 is on hand for 512 each. The company has an effective tax le 20 Hoy Inventory mode company uses FF, what is the group b. $10.000 $21,000 d. 536.000 07. Holiday Company's inventory records show the following data Unico Inventory, January 1 5.000 59.00 Purchases: June 18 4,500 8.00 November 3.000 $9.00 84 Holliday Company's inventory records show the following data Units Wat Cost Inventory, January 1 5.000 Purchases: June 18 4.500 November 8 3,000 7.00 A physical inventory on December 31 shows 2,000 units on handHolliday sells the units for $12 each. The company has an effective tax rate of 20%. Holliday uses the periodic Inventory method. Under the LIFO method, cost of goods sold is a $10,500. b. $18,000 G384.000. d $88.000 on APO Matum in ACA AICPA Legatory , AICPA FN A OPA PG A physical inventory on December 31 shows 2.000 is on hand Holidays the for $12 each. The company has an effective tax of 209 Holiday uses the pe inventory method. What is the difference in taxes UFO rather than FIFO is used a. $800 addtional taxes b. $3,200 tax savings 54.000 lax savings d. 54,000 additional tres A 50 m N. ACH ICPA BBL Pro CP Are c