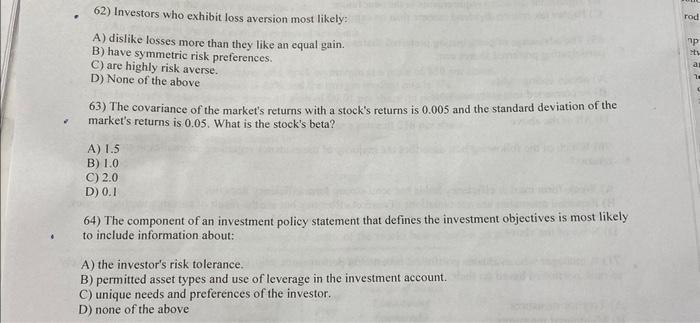

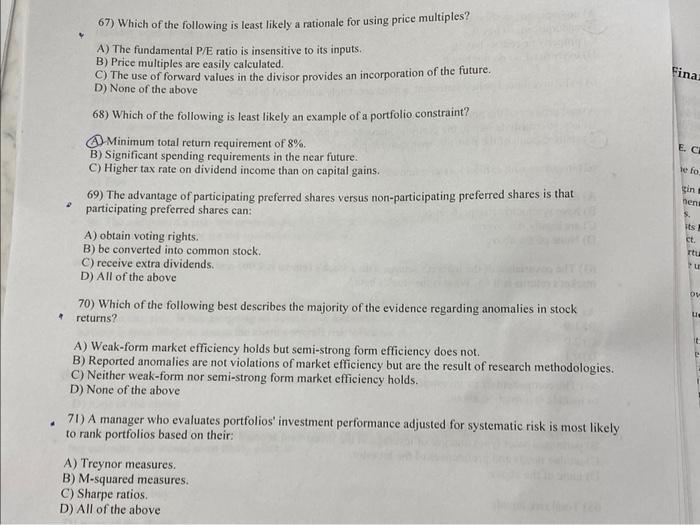

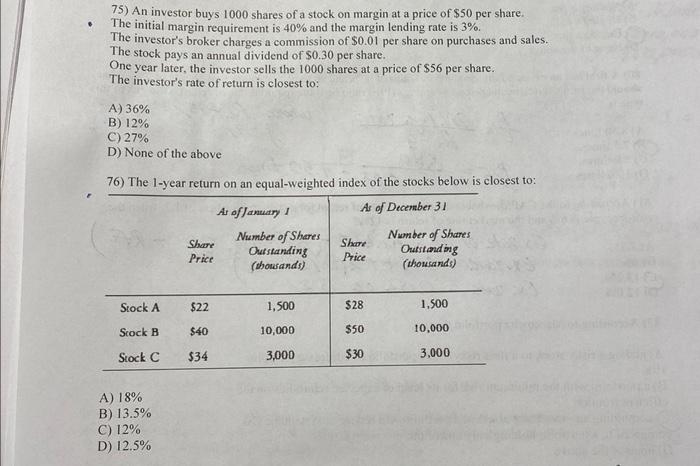

62) Investors who exhibit loss aversion most likely: A) dislike losses more than they like an equal gain. B) have symmetric risk preferences. C) are highly risk averse. D) None of the above 63) The covariance of the market's returns with a stock's returns is 0.005 and the standard deviation of the market's returns is 0.05 . What is the stock's beta? A) 1.5 B) 1.0 C) 2.0 D) 0.1 64) The component of an investment policy statement that defines the investment objectives is most likely to include information about: A) the investor's risk tolerance. B) permitted asset types and use of leverage in the investment account. C) unique needs and preferences of the investor. D) none of the above 67) Which of the following is least likely a rationale for using price multiples? A) The fundamental P/E ratio is insensitive to its inputs. B) Price multiples are easily calculated. C) The use of forward values in the divisor provides an incorporation of the future. D) None of the above 68) Which of the following is least likely an example of a portfolio constraint? (A) Minimum total return requirement of 8%. B) Significant spending requirements in the near future. C) Higher tax rate on dividend income than on capital gains. 69) The advantage of participating preferred shares versus non-participating preferred shares is that participating preferred shares can: A) obtain voting rights. B) be converted into common stock. C) receive extra dividends. D) All of the above 70) Which of the following best describes the majority of the evidence regarding anomalies in stock - returns? A) Weak-form market efficiency holds but semi-strong form efficiency does not. B) Reported anomalies are not violations of market efficiency but are the result of researeh methodologies. C) Neither weak-form nor semi-strong form market efficiency holds. D) None of the above 71) A manager who evaluates portfolios' investment performance adjusted for systematic risk is most likely to rank portfolios based on their: A) Treynor measures. B) M-squared measures. C) Sharpe ratios. D) All of the above 75) An investor buys 1000 shares of a stock on margin at a price of $50 per share. The initial margin requirement is 40% and the margin lending rate is 3%. The investor's broker charges a commission of $0.01 per share on purchases and sales. The stock pays an annual dividend of $0.30 per share. One year later, the investor sells the 1000 shares at a price of $56 per share. The investor's rate of return is closest to: A) 36% B) 12% C) 27% D) None of the above 76) The 1-year return on an equal-weighted index of the stocks below is closest to: A) 18% B) 13.5% C) 12% D) 12.5%