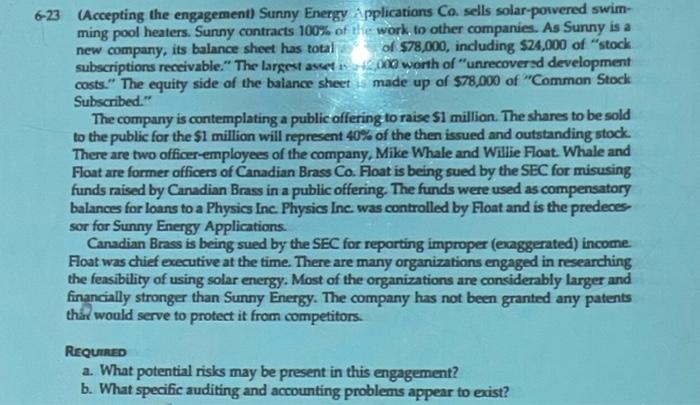

6-23 (Accepting the engagement) Sunny Energy A Pplications Co. sells solar-poivered swimming pool heaters. Sunny contracts 100% of the work, to other companies. As Sunny is a new company, its balance sheet has total. of $78,000, including 524,000 of "stock subscriptions reccivable." The largest awet in , 4,000 worth of "unrecoversd development costs." The equity side of the balance sheet is made up of $78,000 of "Common Stock Subscribed." The company is contemplating a public offering to raise 51 million. The shares to be sold to the public for the $1 million will represent 40% of the then issued and outstanding stock. There are two officer-employees of the company, Mike Whale and Willie Float. Whale and Float are former officers of Canadian Brass Co. Float is being sued by the SEC for misusing funds raised by Canadian Brass in a public offering. The funds were used as compensatory balances for loans to a Physics Inc. Physics Inc was controlled by Float and is the predeces: sor for Sunny Energy Applications. Canadian Brass is being sued by the SEC for reporting improper (eraggerated) income. Float was chief executive at the time. There are many organizations engaged in researching the feasibility of using solar energy. Most of the organizations are considerably larger and financially stronger than Sunny Energy. The company has not been granted any patents thair would serve to protect it from competitors. Requnne0 a. What potential risks may be present in this engagement? b. What specific auditing and accounting problems appear to exist? 6-23 (Accepting the engagement) Sunny Energy A Pplications Co. sells solar-poivered swimming pool heaters. Sunny contracts 100% of the work, to other companies. As Sunny is a new company, its balance sheet has total. of $78,000, including 524,000 of "stock subscriptions reccivable." The largest awet in , 4,000 worth of "unrecoversd development costs." The equity side of the balance sheet is made up of $78,000 of "Common Stock Subscribed." The company is contemplating a public offering to raise 51 million. The shares to be sold to the public for the $1 million will represent 40% of the then issued and outstanding stock. There are two officer-employees of the company, Mike Whale and Willie Float. Whale and Float are former officers of Canadian Brass Co. Float is being sued by the SEC for misusing funds raised by Canadian Brass in a public offering. The funds were used as compensatory balances for loans to a Physics Inc. Physics Inc was controlled by Float and is the predeces: sor for Sunny Energy Applications. Canadian Brass is being sued by the SEC for reporting improper (eraggerated) income. Float was chief executive at the time. There are many organizations engaged in researching the feasibility of using solar energy. Most of the organizations are considerably larger and financially stronger than Sunny Energy. The company has not been granted any patents thair would serve to protect it from competitors. Requnne0 a. What potential risks may be present in this engagement? b. What specific auditing and accounting problems appear to exist