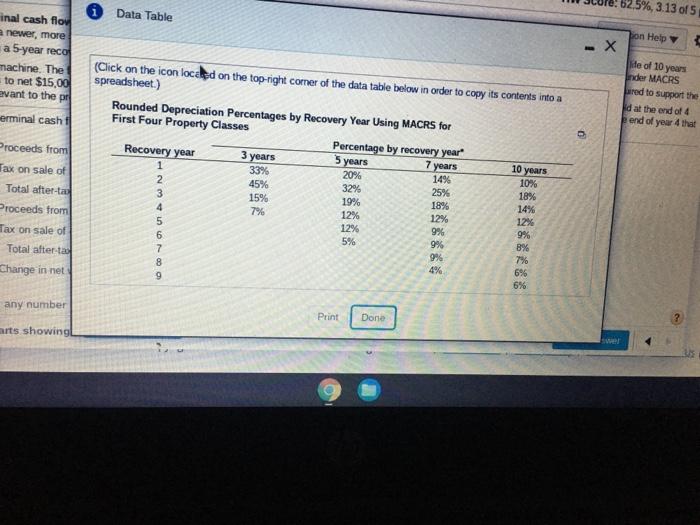

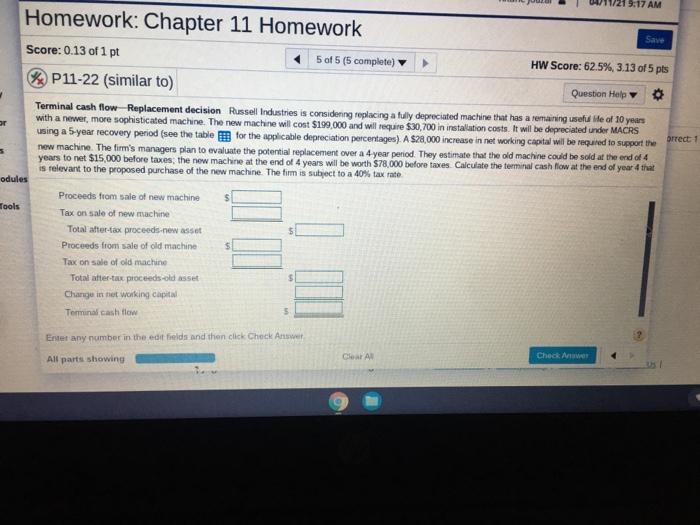

62.5%, 3.13 of 5 Data Table on Help inal cash flow a newer, more a 5-year reco machine. The to net $15,00 evant to the pe ide of 10 years Inder MACRS red to support the d at the end of 4 end of year 4 that erminal cash Proceeds from Tax on sale of Total after-tas Proceeds from Tax on sale of Total after tal Change in net (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 15% 19% 18% 14% 7% 12% 12% 12% 12% 9% 9% 5% 9% 8% 7% 8 6% 9 6% DAWN 4% any number Print Done Done arts showing Save Orrect 1 9:17 AM Homework: Chapter 11 Homework Score: 0.13 of 1 pt 5 of 5 (5 complete) HW Score: 62.5%, 3.13 of 5 pts P11-22 (similar to) Question Help Terminal cash flow Replacement decision Russell Industries is considering replacing a fully depreciated machine that has a remaining useful le of 10 years or with a newer, more sophisticated machine. The new machine will cost $199,000 and will require $30,700 in installation costs. It will be depreciated under MACRS using a 5-year recovery period (see the table for the applicable depreciation percentages). A $28,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a 4 year period. They estimate that the old machine could be sold at the end of 4 years to net $15,000 before taxes, the new machine at the end of 4 years will be worth $78,000 before taxes Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 40% tax rate odules Proceeds from sale of new machine $ Tools Tax on sale of new machine Total ster-tax proceeds new asset Proceeds from sale of old machine Tax on sale of old machine Totat atter-tax proceeds-old asset Charge int niet working capital Terminal cash flow 5 Enter any number in the edit fields and then click Check Answ All parts showing CA Check