You are a financial adviser advising the owner of a multi-national business who is considering which of two countries is the most tax-efficient in

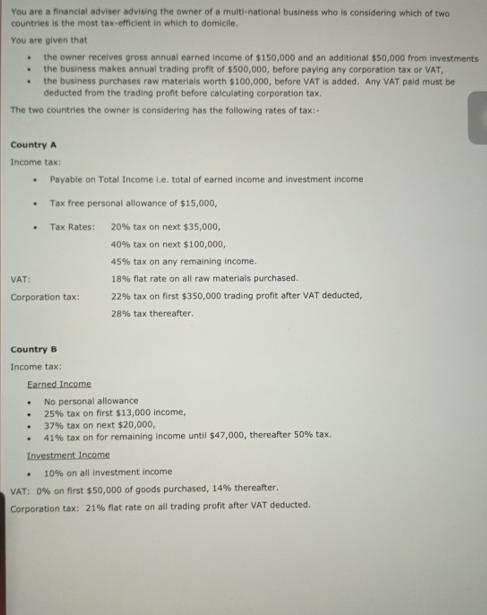

You are a financial adviser advising the owner of a multi-national business who is considering which of two countries is the most tax-efficient in which to domicile. You are given that the owner receives gross annual earned income of $150,000 and an additional $50,000 from investments the business makes annual trading profit of $500,000, before paying any corporation tax or VAT, the business purchases raw materials worth $100,000, before VAT is added. Any VAT paid must be deducted from the trading profit before calculating corporation tax. The two countries the owner is considering has the following rates of tax:+ Country A Income tax: VAT: . . Corporation tax: Country B Income tax: Earned Income . . Payable on Total Income Le. total of earned income and investment income Tax free personal allowance of $15,000, Tax Rates: 20% tax on next $35,000, 40% tax on next $100,000, No personal allowance 25% tax on first $13,000 income, 37% tax on next $20,000, 41% tax on for remaining income until $47,000, thereafter 50% tax. Investment Income . . . 45% tax on any remaining income. 18% flat rate on all raw materials purchased. 22% tax on first $350,000 trading profit after VAT deducted, 28% tax thereafter, 10% on all investment income VAT: 0% on first $50,000 of goods purchased, 14% thereafter. Corporation tax: 21% flat rate on all trading profit after VAT deducted. You are to prepare a report giving appropriate information about the two countries and your recommendation. Your report should include: a) Income tax, corporation tax, VAT and total tax liabilities; b) the effective tax liability as a percentage of the total of earned income, investment income and profit; c) a recommendation of around 100 words, with reasons and with reference to the data, as to which country is the better country. You must show all working at each stage and set your work out clearly.

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Question Country A Gross Annual Income 150000 Investment Income 50000 Business Income 368040 Total Income 568040 Computation of Business Income Annual ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started