Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- 6.3. It was crucial for our no arbitrage computations that there were only two possible values of the stock. Suppose that a stock

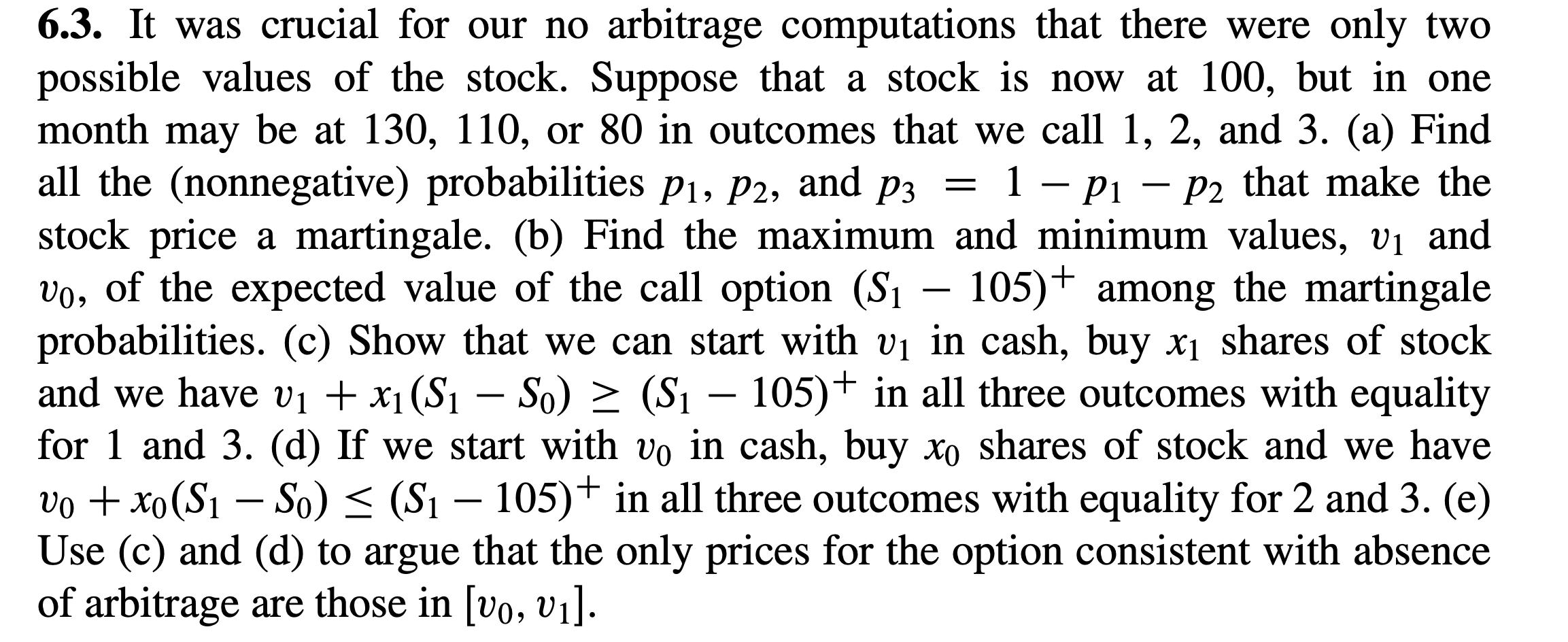

- 6.3. It was crucial for our no arbitrage computations that there were only two possible values of the stock. Suppose that a stock is now at 100, but in one month may be at 130, 110, or 80 in outcomes that we call 1, 2, and 3. (a) Find all the (nonnegative) probabilities P, P2, and p3 1 - P P that make the P1 P2 stock price a martingale. (b) Find the maximum and minimum values, v and vo, of the expected value of the call option (S - 105)+ among the martingale probabilities. (c) Show that we can start with v in cash, buy x shares of stock and we have v + x (S So) (S 105)+ in all three outcomes with equality for 1 and 3. (d) If we start with vo in cash, buy xo shares of stock and we have vo + xo(S1 So) (S 105) in all three outcomes with equality for 2 and 3. (e) Use (c) and (d) to argue that the only prices for the option consistent with absence of arbitrage are those in [vo, v]. =

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a We need to find probabilities p1 p2 and p3 such that the stock price is a martingale ie the expected value of the stock price at time 1 is equal to the current stock price 100 130p1 110p2 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started