6-3 please thankyou

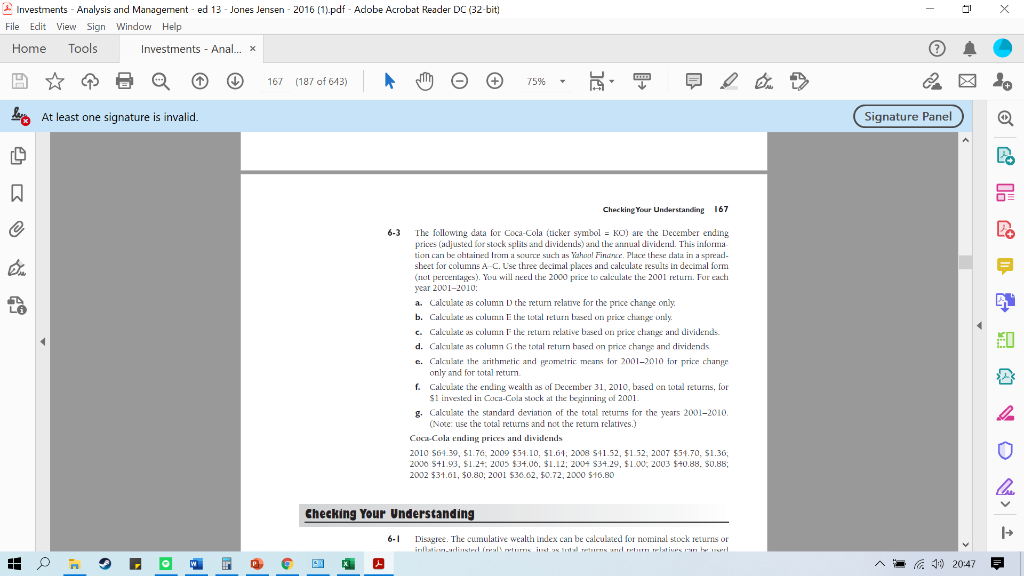

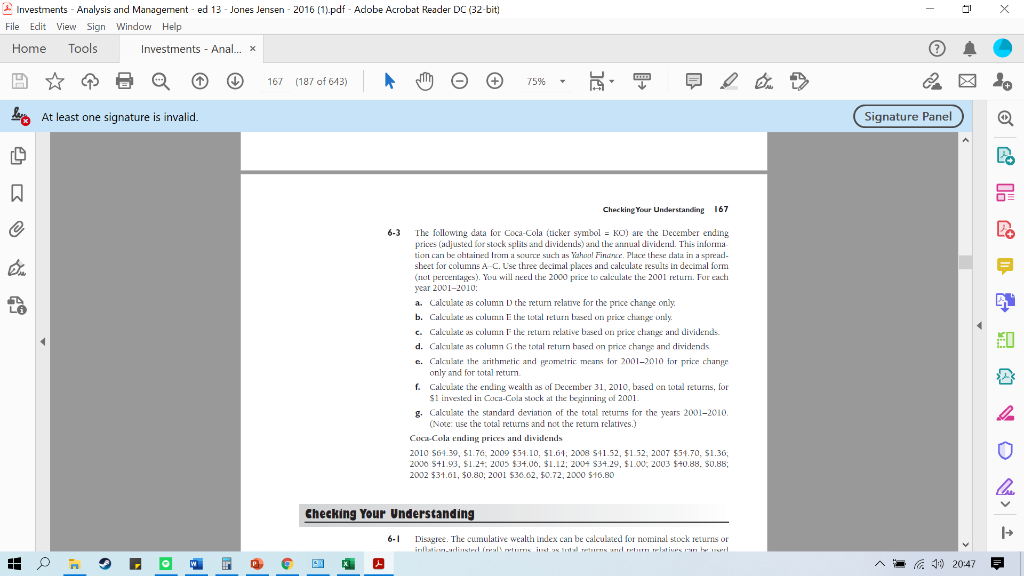

Investments - Analysis and Management -ed 13-Jones Jensen - 2016 (1).pdf - Adobe Acrobat Reader DC (32-bit) File Edit View Sign Window Help Home Tools Investments - Anal... X 167 (187 of 643) 75% hering At least one signature is invalid. Signature Panel Checking Your Understanding 167 6-3 LA 0 The following data for Coca-Cola (ticker symbol = KO) are the December ending prices (adjusted for stock splits and dividends) and the annual dividend. This informa tion can be obtained from a source such as Yahusal Finance. Place these data in a spread- sheet for columns A-C. Use three decimal places and calculate results in decimal form (nel percentages). You will need the 2000 price to calculate the 2001 return. For eacti year 2001-2010: a. Calculate as column D the retum relative for the price change only. b. Calculate as columna E the total return sel on price change only. c. Calculate as column the return relative based on price change and dividends. d. Calculate as column G the total return based on price charge and dividends c. Calculate the arithmetic and geometric means for 2001-2010 for price chany only and for total retum f. Calculate the ending wealth as of December 31, 2010, based on total retums, for $1 invested in Coca-Cola stock at the beginning of 2001. 8. Calculate the standard deviation of the total returns for the years 2001-2010 (Note: use the total returns and not the retum relatives.) Coca-Cola ending prices and dividends 2010 564.39, 51.76, 2009 $54.10, $1.64, 2008 541.52, $1.52, 2007 $54.70, 51.36 2000 S41.93, $1.24, 2005 $34.00, $1.12; 2004 $34.29, $1.00, 2003 $40.88. $0.88; 2002 $31.61, $0.80; 2001 $36.62, 50.72, 2000 $16.80 Checking Your Understanding 6-1 Disagree. The cumulative wealth index can be calculated for nominal stock returns or inline realment al return and return relative w P x a 30 20:47 = Investments - Analysis and Management -ed 13-Jones Jensen - 2016 (1).pdf - Adobe Acrobat Reader DC (32-bit) File Edit View Sign Window Help Home Tools Investments - Anal... X 167 (187 of 643) 75% hering At least one signature is invalid. Signature Panel Checking Your Understanding 167 6-3 LA 0 The following data for Coca-Cola (ticker symbol = KO) are the December ending prices (adjusted for stock splits and dividends) and the annual dividend. This informa tion can be obtained from a source such as Yahusal Finance. Place these data in a spread- sheet for columns A-C. Use three decimal places and calculate results in decimal form (nel percentages). You will need the 2000 price to calculate the 2001 return. For eacti year 2001-2010: a. Calculate as column D the retum relative for the price change only. b. Calculate as columna E the total return sel on price change only. c. Calculate as column the return relative based on price change and dividends. d. Calculate as column G the total return based on price charge and dividends c. Calculate the arithmetic and geometric means for 2001-2010 for price chany only and for total retum f. Calculate the ending wealth as of December 31, 2010, based on total retums, for $1 invested in Coca-Cola stock at the beginning of 2001. 8. Calculate the standard deviation of the total returns for the years 2001-2010 (Note: use the total returns and not the retum relatives.) Coca-Cola ending prices and dividends 2010 564.39, 51.76, 2009 $54.10, $1.64, 2008 541.52, $1.52, 2007 $54.70, 51.36 2000 S41.93, $1.24, 2005 $34.00, $1.12; 2004 $34.29, $1.00, 2003 $40.88. $0.88; 2002 $31.61, $0.80; 2001 $36.62, 50.72, 2000 $16.80 Checking Your Understanding 6-1 Disagree. The cumulative wealth index can be calculated for nominal stock returns or inline realment al return and return relative w P x a 30 20:47 =